February 24, 22012

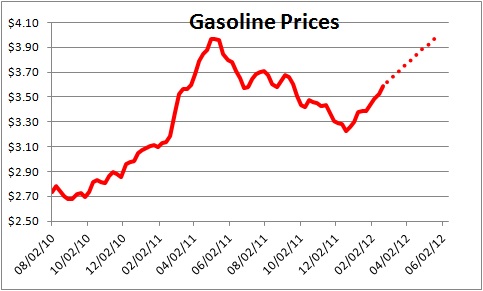

Gasoline prices have risen sharply in the first two months of the year and seem destined to once again reach $4.00 per gallon. How much of a negative impact might this have on the economy? Will it boost inflation? Will the Fed care?

After reaching a low point of $3.21 per gallon in mid-December the price of gasoline has climbed 11% to $3.59 as the result of saber-rattling between Iran and Israel. Judging by the jump in gasoline futures, pump prices seem destined to reach $4.00 per gallon.

Last Year

Civil unrest throughout North Africa and the Mideast caused gasoline prices to spike in the first five months of 2011. At the same time the economy slowed sharply. But how much of that economic slowdown was attributable to higher gas prices? Probably not a lot.

In the first quarter of 2011 GDP edged upwards by just 0.4%, but that pace of expansion was reduced 1.2% by a sharp drop in government spending — 0.8% from reduced defense spending and 0.4% from a drop in state and local government expenditures. Neither of those declines had anything to do with higher oil prices.

The modest 1.3% rate of expansion in the second quarter 2011 was partially attributable to parts shortages following the tsunami in Japan. We know, for example, that automobile sales subtracted 0.7% from GDP growth in that quarter. Once again, that drop had nothing to do with rising oil prices.

While GDP growth in the first half of 2011 averaged 1.0%, most of the slowdown was attributable to factors other than rising oil prices. Indeed, in the absence of the drop in government spending and the tsunami, first half growth would have been about 2.0%. Higher gas prices undoubtedly curtailed consumer spending to some extent, but its impact appears to have been limited.

The Economy – 2012

For this reason we do not expect the likely rise in gasoline prices to $4.00 per gallon to have any major negative impact on GDP growth in 2012.

The stock market declined last summer, but well after gasoline prices peaked in mid-May. The stock market drop occurred in July and August and was caused by the contentious debate in Congress about the debt limit and the possibility that the Treasury might actually default on its debt. Its drop had nothing to do with oil prices. Today the stock market today is at its highest level since May 2008 and seems poised to move higher in response to a record level of corporate earnings.

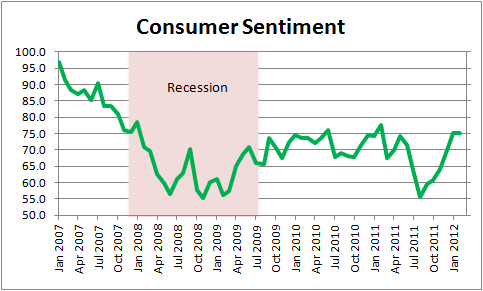

Consumer sentiment was crushed by the decline in stock prices last year, but it has rebounded and is currently being supported by a 0.8% drop in the unemployment rate in the past five months, a considerably faster pace of job creation, and the rebound in housing. Note that consumer sentiment has remained lofty despite the recent rise in gasoline prices in the first two months of this year.

In short, rising oil prices do not appear to have had a significant negative impact on GDP growth in 2011, so a similar-sized increase in 2012 should have limited impact primarily because today’s economy is on a far more solid footing than it was a year ago.

Inflation

The increase in oil prices captures all the headlines and is very visible because it costs so much to fill the tank with gas. But a couple of points are worth noting.

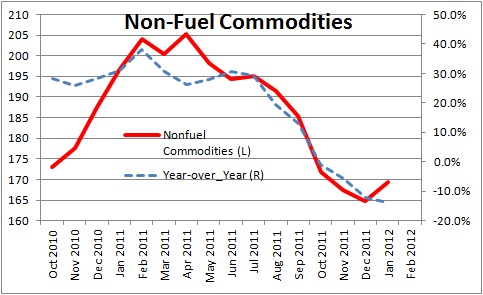

First, within the energy component of the CPI gasoline prices may be rising, but natural gas prices have been falling rapidly and are now 40% lower than they were at this time last year. Thus, some of the sting of higher gasoline prices will be offset by lower natural gas prices. Similarly, prices of non-fuel commodities have also been declining and are currently 15% lower than in January of last year.

Perhaps the most important factor that will keep inflation In check during 2012 is the labor market which still has considerable slack with the unemployment rate at 8.3%. Competition between unemployed workers for the available jobs should keep the pressure off of wages. That is crucial because wages represent about two-thirds of a firm’s total costs. If wages remain in check there is no reason for firms to raise prices.

Will the Fed Care?

The Federal Reserve has explicitly stated that it has a 2.0% inflation target. If gasoline prices rise the energy component of inflation will at least temporarily push inflation above the Fed’s desired path. But because energy prices are so volatile, this should not bother the Fed. Gasoline prices invariably rise in the first half of the year in anticipation of the summer driving season, but then reverse course and decline sharply in the second half of the year. The behavior of gasoline prices last year was a classic example of this pattern. As long as the acceleration in inflation is confined to the energy component, the Fed will remain watchful but not be overly concerned. Remember, their focus is almost exclusively on the so-called “core” rate of inflation, i.e., the CPI excluding food and energy.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me