March 18, 2022

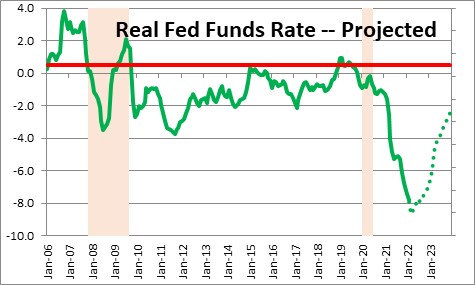

The press described last week’s Fed’s tightening initiative as the most aggressive in years – which is true. But the Fed has dug itself into such a deep hole that the actions it outlined will not be nearly enough to shrink inflation to the 2.0% mark. That is because between now and the end of 2023 the Fed does not intend to boost the funds rate above the inflation rate. Negative real rates will not significantly slow GDP growth, they will not raise the unemployment rate, and they will not slow the rate of inflation. The Fed needs to get serious.

The Fed believes that a “neutral” funds rate is 2.5%, a level which neither stimulates nor retards the pace of economic activity. That makes sense if the inflation rate is around its 2.0% target. A 2.5% funds combined with 2.0% inflation implies a “real” funds rate of 0.5% –which is about what it has averaged in the past 20 years. In other words, the Fed believes that for the funds rate to be “neutral” it must be slightly higher than the rate of inflation.

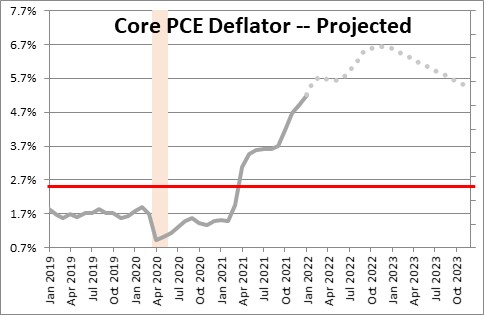

When the inflation rate is higher – or lower – than 2.0%, the “neutral” rate can change. For example, if the inflation rate is 1.0%, one could argue that a neutral funds rate is 0.5% higher than that or 1.5%. But when, like now, the core personal consumer expenditures deflator inflation is 5.5%, then the neutral funds rate is perhaps 6.0%. A funds rate of 1.75% at the end of the year is not even remotely close to what is required to slow down the economy and bring the inflation rate back down towards 2.0%.

It is difficult for us to see how the core PCE deflator can slow from 5.6% currently to 4.1% by the end of the year (which is what the Fed expects).

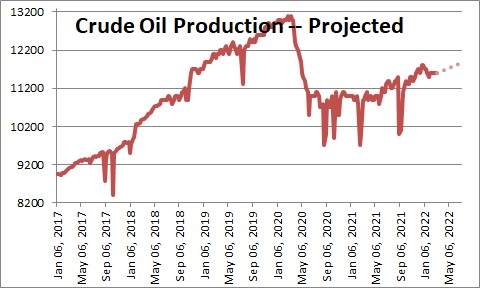

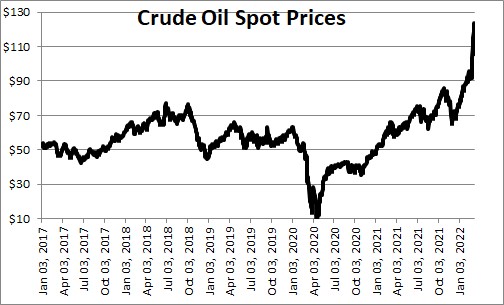

A decline in oil prices? Not likely. The Biden Administration continues its war on the producers of fossil fuel and wants the country to rely on wind and solar energy. In the face of a steady diet of regulatory constraints from Washington, oil production today is 11.6 million barrels per day versus 13.1 million prior to the 2020 recession. That is why oil prices were climbing long before the war began. When Biden took office crude oil prices were $50 per barrel. At the end of last year they were $75 per barrel. Today they are $103. The EIA does not expect production to pick up to the pre-recession level of 13.0 million barrels per day until sometime in 2023.

The war between Ukraine and Russia that has caused oil prices to climb recently is not going to end any time soon. Even if the fighting stops, the sanctions will not end. The U.S. will continue to shun imports of Russian oil and Europe intends to gradually reduce its reliance on Russian oil and gas. Russia is the world’s second largest oil producer and its production accounts for 13% of global output. If its supply into the global market is curtailed, oil prices are not going to decline.

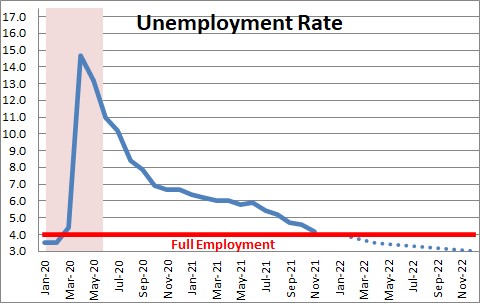

Reduced wages pressures? Not a chance. The unemployment rate today is 3.8% which is not only below the Fed’s estimate of the full employment level of 4.0%, it is headed lower. The Fed expects it to reach 3.5% by the end of this year. The labor market is the tightest it has been in 50 years.

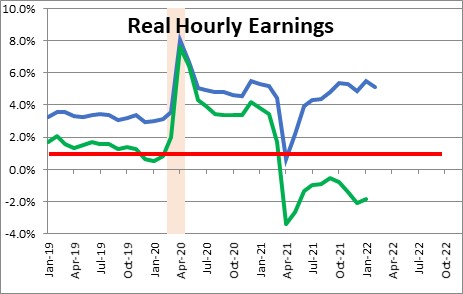

To find the workers they need firms have been offering significantly higher wages as well as a variety of non-wage benefits such as health insurance, child care assistance, and an ability to work from home. In the past year wages have risen 5.1%. But inflation has risen even faster so real wages have declined 1.8%. Workers are getting fatter paychecks, but their purchasing power is less than what it was a year ago. Workers are in the driver’s seat and are justifiably pressing their employers for higher wages. That wage pressure will not go away until the unemployment rate begins to rise. Nobody expects that to happen any time soon. This is important because wages represent about two-thirds of a firm’s overall cost and, thus far, they have been easily able to pass those higher costs along to their customers.

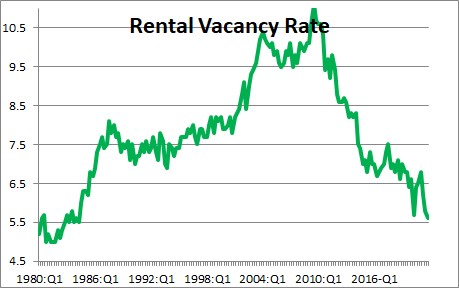

Lower rents? No way. There is a considerable shortage of both single-family homes and apartment units. The vacancy rate for rental units is the lowest it has been since the early 1980’s. When demand exceeds supply, prices rise.

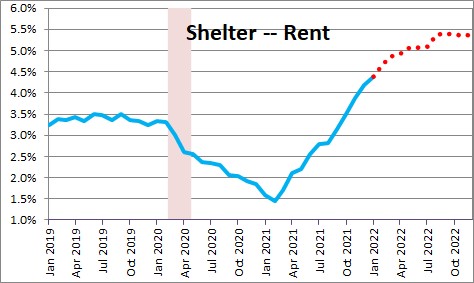

The shelter component of the CPI has been accelerating for a year. Its year-over-year increase is currently 4.8%. We expect it to climb to 5.5% as year progresses. The upward pressure on rents does not end until such time as builders significantly boost the pace of production. But builders cannot find enough construction workers. They are experiencing shortages of necessary building materials. The upward pressure on rents is not going to end any time soon.

The Fed thinks that the core PCE will rise 4.1% in 2022. For that to happen it needs to see inflation begin to subside immediately. As described above, that is not going to happen. We happen to expect the core PCE to increase 6.7% for the year. If the funds rate rises to 1.7% the real rate at yearend will be -5.0%.

The economy us at full employment. GDP will reach its potential growth path in the second quarter which means there will be no remaining slack in the economy. The unemployment rate is 3.8% — and falling. The Fed expects GDP to increase 2.8% growth this year which is faster than its potential growth of 1.8%. If there is no slack in the economy and GDP continues to expand at a rate in excess of potential, inflation is not going to slow. If we are right and GDP grows 3.5% for the year the situation will be worse. The Fed has begun to move in the right direction, but it is likely to fall far short of what is required. At some point the Fed will have to get serious and when it does, rates will move sharply higher Once the Fed quickens the pace the odds are that it will go too far and dump the economy into recession. The only good news that a recession is not in the cards any time soon..

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me