January 31, 2025

Fourth quarter GDP growth was 2.3% slightly below the consensus forecast of 2.6%. Growth for the quarter was led by consumer spending which jumped 4.2%. The only reason GDP growth was not more rapid was because the slow pace of inventory accumulation subtracted 0.9% from GDP growth. Consumer spending remained robust at the end of the quarter as personal consumption expenditures jumped 0.7% in December. With no hint of any slackening in the pace of consumer spending we expect first quarter GDP to climb at a 3.2% rate and gain 3.0% for the year as a whole. The question is whether such rapid GDP growth will prove to be inflationary.

We do not think that will be the case. We believe that the economy’s potential GDP growth has climbed from 2.0% to 3.0%, which means that projected 3.0% growth for 2025 will not be inflationary. Further, we believe that the inflation rate will be held in check by unit labor costs (labor costs adjusted for the change in productivity) which are rising 2.2%. That is reasonably consistent with a 2.0% inflation rate. In addition, housing prices should be unchanged in 2025 which means that growth in the “shelter” component of GDP will continue to slow. As a result, we are looking for the core CPI to slip from 3.3% currently to 2.9% by the end of this year which should be sufficient to allow the Fed to cut rates a couple of times in 2025. Tariffs could boost prices for some goods, but recent strength in the dollar means imported goods will be cheaper which should offset at least some of the price increases caused by tariffs. From where we sit the GDP and inflation combo continues to look favorable for the year as a whole.

Fourth quarter GDP growth came in at 2.3% which means that growth for 2024 was 2.5%. Some economists suggest that the economy slowed slightly in the fourth quarter. We do not buy that. The only reason GDP growth was 2.3% was because inventory accumulation slowed considerably and subtracted 0.9% from growth. Final sales which eliminates the change in inventories grew 3.2%. Inventories are very volatile from quarter to quarter and a faster pace of inventory accumulation should be expected in the first quarter. For that reason we anticipate first quarter GDP growth or 3.2%. The widely followed Atlanta Fed GDP NOW model is expecting first quarter growth of 2.9%.

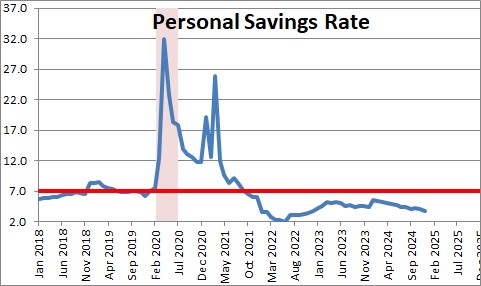

For the year as a whole real disposable income (income that is left after inflation and taxes) rose 2.4%. Spending rose 3.1%. As a result, the savings rate has fallen to 3.8% which is roughly one-half of its historical 7.0% pace. Given that the current pace of consumer spending exceeds the growth in income, many economists suggest that consumer spending must slow in the months ahead. But be careful. The savings rate has been at its current level for the past three years. Consumers seem comfortable saving less of their paychecks than they did previously. There are two reasons for this.

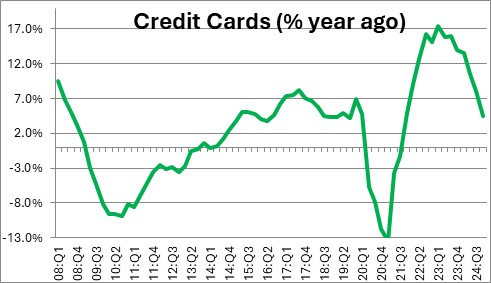

First, consumers initially relied on credit cards to supplement their pace of spending. Credit card growth peaked at 17% in the first quarter of last yea but it has slowed dramatically since to about 5.0%,

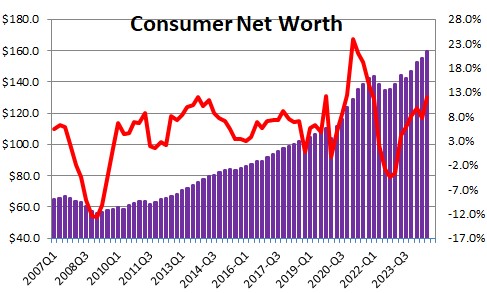

Second, consumers are apparently tapping some of their newfound wealth. The combination of rising stock prices and a dramatic increase in the value of their home has boosted consumer net worth by 12.0% in the past year to a record high level. While a sharp drop in the stock market could trigger a cutback in consumer spending, for now we expect consumers to continue their solid pace of spending.

The Fed and the Congressional Budget Office believe that potential GDP growth is about 2.0%. The idea that the economy could grow 3.0% in 2025 suggests that the inflation rate should accelerate. But, as we have indicated on numerous occasions, we believe that sustained faster growth in productivity has boosted the economy’s potential growth rate to about 3.0%. If so, 2025 GDP growth of 3.0% should not boost the inflation rate.

Between higher tariffs, the deportation of illegal immigrants, and expected changes in tax rates, there is a lot that could alter this seemingly favorable economic scenario later this year. But for now we remain optimistic.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me