August 6, 2021

Every quarter we are surprised by a steady robust pace of GDP growth and the resilience of the stock market. How can that happen? Clearly, a series of stimulus checks combined with ultra-easy Fed policy deserve much of the credit. But let’s not forget the contribution from the tech sector. Without a vaccine none of this would be happening. But also, technology has allowed us to work from home when we were locked out of the office, conduct business meetings when we could not meet in person, buy things we needed when stores were closed. It has also helped restaurants develop take-out and delivery services when in-restaurant dining was prohibited. While initially businesses may have been forced to accept this new technology, good things have happened as a result. Productivity growth has accelerated, corporate earnings growth has quickened, and the stock market has soared. Best yet, technological developments hold the promise of faster growth in our standard of living.

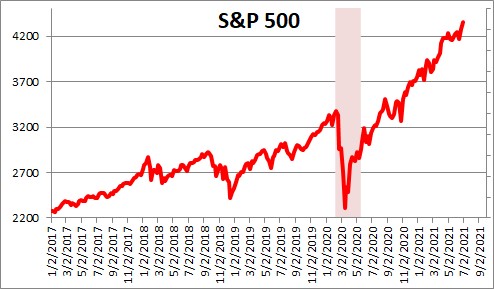

Last year’s quarantine-induced recession was the worst in our history. GDP declined 31% in the second quarter of last year. Twenty-two million workers lost their jobs. But 11 days after the quarantine was imposed Congress passed a $2.5 trillion fiscal stimulus package. Meanwhile, the Fed purchased $2.0 trillion of securities to provide additional liquidity. Additional stimulus followed. As a result, the deepest recession in U.S. history ended two months later. By August – five months after hitting bottom – the stock market recovered everything that it lost during the recession. By way of contrast, it took five years for the stock market to achieve that feat following the 2008-09 recession. Clearly, a timely and aggressive combination of monetary and fiscal policy turned things around.

It goes to show that if our leaders are willing to spend enough money they can quickly get the economy back onto an upward trajectory. But money alone cannot achieve a sustained recovery. For that to happen we needed a vaccine. In its absence Americans would have still been unwilling to get on an airplane, stay in a hotel, go to a restaurant, or attend a sporting event. It is important to understand that a vaccine typically take ten years to develop. But thanks to Operation Warp Speed that cycle was compressed to a single year. OWS was a public/private partnership funded by $10.0 billion from the initial fiscal stimulus package. Eight pharmaceutical companies were selected to divide equally the $10.0 billion and do everything in their power to produce 300 million safe and effective doses of the vaccine by the end of January 2021. The government agencies involved included, amongst others, the CDC, HHS, the FDA, NIH, and the Department of Defense. Their job? Get out of the way. Clear the path for Big Pharma by removing any bureaucratic obstacles. And guess what? It worked! Kudos to our federal government and the biomedical research industry for making that happen. Without it the stimulus led recovery would have eventually stalled.

While the vaccine development was almost certainly the most important contribution from the tech sector in the past 16 months, there were others. As we began working from home we needed high-speed internet access. We also needed security to protect our home computers from hacking and ransomware.

In the midst of the quarantine businesses needed a way to communicate with their employees and customers. Along came Zoom and others to fill that need.

Consumers could not purchase needed goods and services from local stores which were closed. Sales at on-line retail giant Amazon took off. But retail chains like Walmart and Target did an impressive job of convincing their customers to buy goods on-line and pick them up at the store. During the recession Amazon hired 175,000 workers, Walmart hired 100,000.

Restaurants had to close their doors to in-restaurant dining, but Grubhub and UberEats helped them find ways to deliver meals to their customers. The revenue stream was greatly diminished, but for most restaurants there was enough money coming in to keep the lights on and the doors open.

During the pandemic you could not visit your local doctor in his or her office. As a result, tele-health got a boost. You no longer had to sit in the waiting room for an hour with a roomful of other sick patients to see your doctor. Now you could do all this from the comfort of your own home.

A lot of these services were available prior to the recession but the pandemic expedited their development and acceptance.

During the pandemic businesses had to completely re-think their business models under very stressful circumstances. Those who were willing to embrace new technology survived. Many others did not. It may be too early to reach too many conclusions about this pandemic-caused experiment, but a couple of things jump out at us.

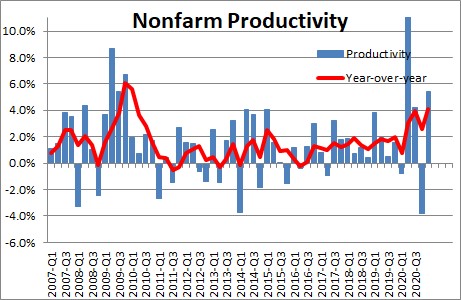

First, productivity growth has accelerated. In the 10-years leading up to last year’s recession productivity growth averaged 1.0% per year. In the five quarters since then productivity growth has accelerated to 3.1%. Businesses were able to provide more goods and services with fewer workers than ever before.

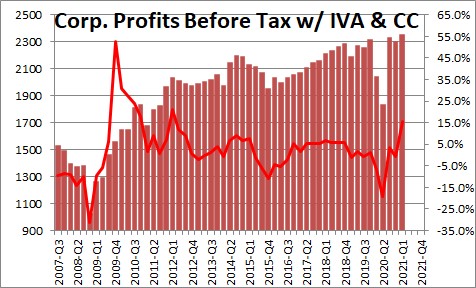

Similarly, corporate earnings growth in the 10 years prior to the recession averaged 7.0% per year. In the subsequent five quarters earnings have climbed at a 9.5% pace. This earnings growth has propelled the stock market to a record high level. It is hard to make a case that the work-from-home adjustments made during the past 16 months have harmed corporate profitability.

Now business leaders today are grappling with what to do next. Many are saying that the vacation is over and now is the time to get workers back into the office. But given the discussion above, perhaps working from home might be a viable alternative. The long held notion that camaraderie in the office around the water cooler or around a co-worker’s desk encourages new ideas is being challenged by new ways of communication. Working from home may not be the ideal solution for every firm in every industry, but employees seem to like it and the company’s performance does not appear to have suffered.

One final thought. Suppose that in this new high tech world productivity growth accelerates for a protracted period of time. If so, our potential growth rate — a proxy for growth in our standard of living — will climb. Today there is a widespread belief that the economy’s potential growth rate is 1.8%, consisting of 0.8% growth in the labor force combined with 1.0% growth in productivity. Going forward growth in the labor force may slow to perhaps 0.4% as the baby boomers retire. But what if productivity growth climbs to 2.0? Then, the economy’s potential growth rate – the sum of those two growth rates — is 2.4% rather than 1.8%. That is a 33% increase in the growth rate of our standard of living. If the tech industry can continue to find ways to boost business productivity we will all be better off.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me