July 26, 2024

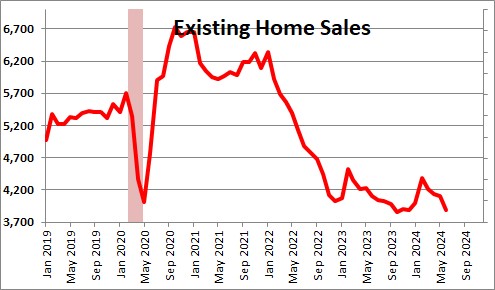

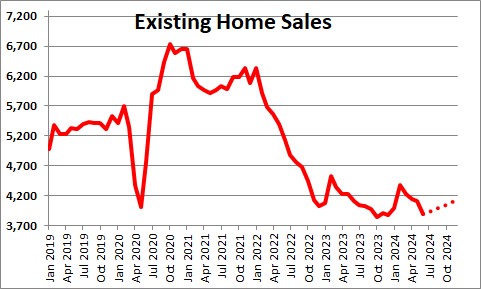

Existing home sales plunged 5.4% in June to 3,890 thousand which is the fourth consecutive decline in sales. Its current level is in line with the low points reached in both the 2008-09 and 2020 recessions. A dramatic increase in home prices and doubling of the 30-year mortgage rate in the past four years has hammered housing affordability. Many potential buyers have been priced out of the market. Because housing is so interest rate sensitive it is typically one of the first sectors of the economy to dip into recession. Could the current housing weakness be a precursor of things to come? We doubt it. Three factors determine housing affordability – home prices, mortgage rates, and consumer income. As we see it, all three factors are pointing towards a rebound in housing in the second half of this year and 2025.

Existing home sales fell 5.4% in June to 3,890 thousand which was considerably lower than expected.

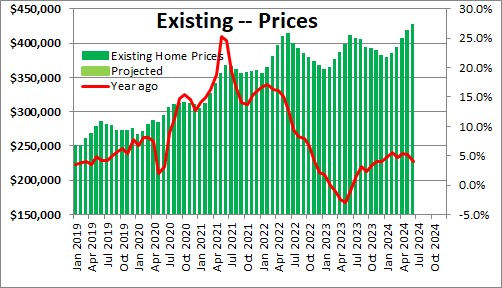

Why are sales so weak? Several reasons. First, existing home prices have risen from $270,400 in February 2020 — the month just prior to the onset of the 2020 recession – to a record high level of $426,900 in June 2024 — an increase of 58% in four years.

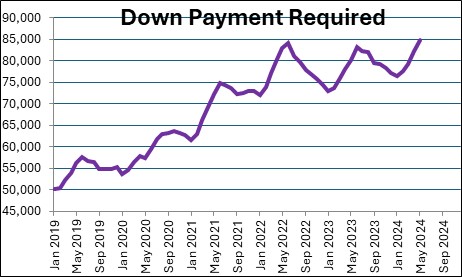

If a lender requires a 20% down payment, that means that the down payment on a median-priced home has climbed from $54,000 to $85,000.

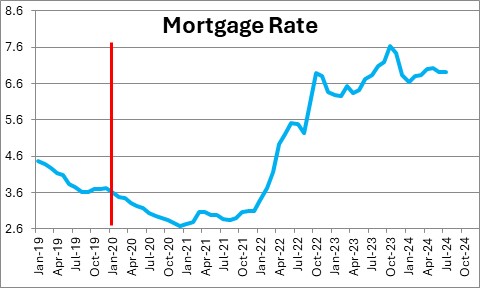

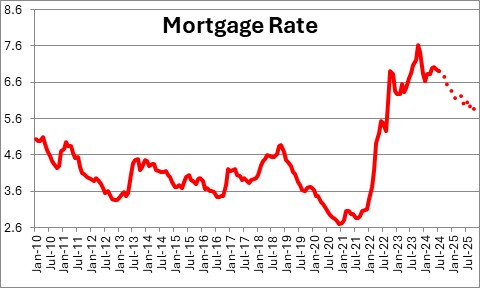

At the same time mortgage rates have nearly doubled from 3.5% to 6.8%.

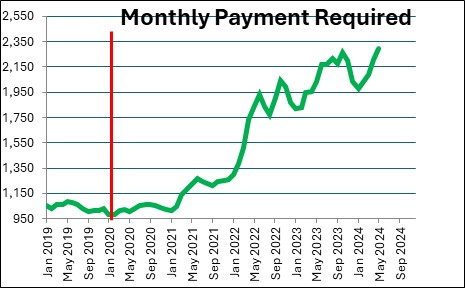

The combo of surging home prices and a doubling of the 30-year mortgage rate means that the monthly payment on a median-priced home has risen from $1,000 to $2,200.

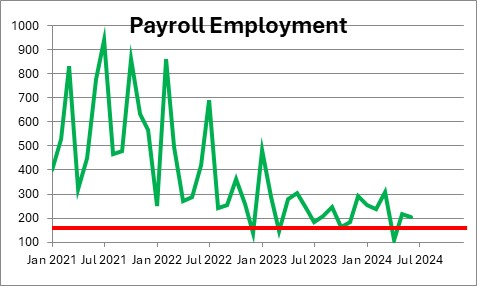

Despite steady increases in both payroll employment and wages, income growth has not kept pace. Family income in the past four years has climbed from $82,900 to $102,400 – an increase of 24%.

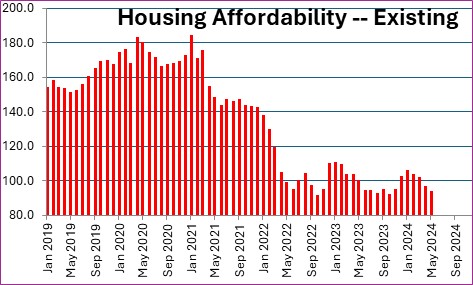

Housing affordability is based on the three factors noted above – home prices, mortgage rates, and family income. In February 2020 – just prior to the recession the housing affordability index was 174 which means that a median income earning family had 74% more income than required to purchase a median-priced home. It has since dropped to 93. That same median income earning family now has 7% less income than required to purchase a median-priced home. In four years home ownership has become unaffordable for many.

This sounds ominous. Could it be an early indication that a recession is looming? No. We believe that the housing sector has hit bottom and will rebound between now and yearend and accelerate in 2025.

The two biggest negative factors at the moment are home prices and mortgage rates. But both are likely to decline in the months ahead.

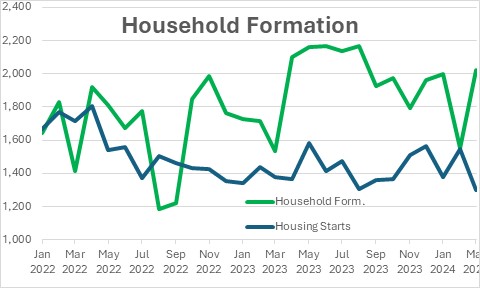

One of the reasons home prices have been rising so rapidly is that there is simply not enough housing available to satisfy the demand. The number of households being formed each month has been steadily rising, at least partially attributable to increased immigration. At the moment roughly 2.0 million households are being formed each month. Housing starts are 1.4 million. Demand exceeds supply.

However, in each of the past three years the June level of prices was the highest for the year. Home prices declined steadily thereafter. They should do the same thing in 2024.

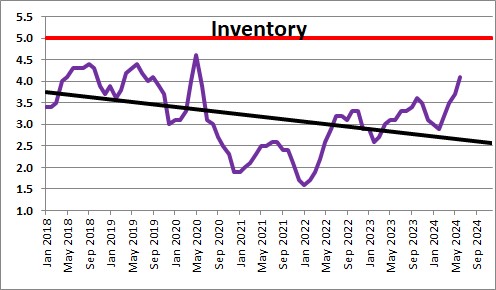

At the same time more homeowners are putting their homes on the market. The supply of available homes reached 4.1 months in June. While still below the desired 5.0 months, that is the largest number of homes available in four years. The additional supply should help to reduce prices between now and yearend.

Mortgage rates are currently 6.8%. But with inflation gradually slowing and the Fed likely to begin a protracted period of rate reduction by yearend, mortgage rates should steadily decline to perhaps 6.6% by the end of this year and 5.8% by the end of 2025. Some of the current softness in sales could reflect potential buyers waiting for mortgage rates to drop later this year.

The final piece of the home affordability index is consumer income. Income is largely determined by the combination of payroll employment and wages. Monthly job gains have slowed and are currently averaging 175 thousand per month. Wages are climbing at a 4.5% rate. Thus, consumer income is likely to grow at a moderate pace in the months ahead.

If home prices decline, mortgage rates drop, and consumer income rises then housing affordability should climb in the second half of this year. The median income earning family today has 7% less income that is necessary to purchase a median-priced home. By yearend that same family should have 8% more income than required. This enhanced affordability should result in a quickening in home sales from 3,890 thousand currently to 4,150 thousand by yearend. With further reductions in mortgage rates and additional growth in income, sales should steadily accelerate in 2025.

The slowdown in home sales has been dramatic but, in our opinion, the market has hit bottom and the outlook should brighten considerably in the months ahead.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me