October 26, 2018

Stock market volatility in recent weeks has increased dramatically as investors try to cope with multiple worries including rising interest rates, China, the election, and some surprising weakness in housing. Typically, stock market corrections are nothing more than the usual ebb and flow of stock prices and have little economic significance. But when the economy is headed into a tailspin, stocks invariably flash an early warning signal. That concern is accentuated when it is accompanied by weakness in an interest-rate-sensitive sector like housing. Home sales have been sliding since the end of last year. No wonder stock investors are nervous. This stocks/home sales combo also makes economists re-examine their crystal balls. After taking a closer look, we still conclude that the recent housing weakness is not a harbinger of things to come. Here’s why.

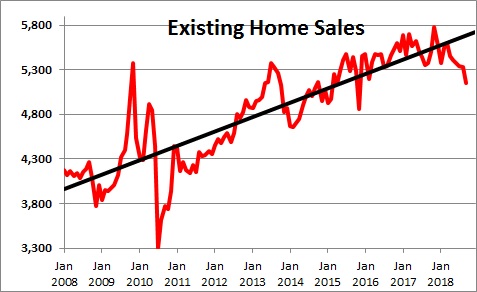

After sliding steadily since December of last year existing home sales registered a troubling 4.3% drop in September. The headlines were uniformly negative. “Housing is Another Brick in the Wall of Worry”, Housing Market is Faltering and Strong Economy Offers No Cure”, “Housing Sector May Be the Skunk at the Economic Picnic”. Cute headlines, but seriously misleading. In all those stories nobody pointed out that almost all the September decline was in the South. But something important happened in the South in September. Hurricane Florence devastated the northern part of the South Carolina coast. And the South will be weak again in October because Hurricane Michael crushed the Florida Panhandle. I can only imagine those headlines. So be prepared. The two hurricanes had a significant impact on sales in those two months, but it will prove to be temporary.

Even prior to the September data home sales have been steadily falling for months. So, what is going on? Is it a demand problem? Or is there some sort of supply constraint? We believe that for the most part it is the latter.

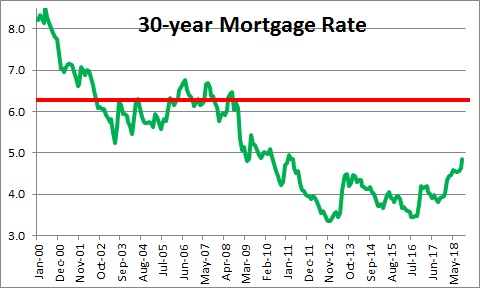

First, on the demand side. Could it be that rising mortgage rates and higher home prices have made housing unaffordable? Not really. It is true that mortgage rates have climbed from a low of 3.5% a couple of years ago to 4.9%. Clearly, mortgage rates are higher than they were. But over the past 25 years mortgage rates have averaged 6.25%. We believe that mortgage rates have not yet risen to the point where they might begin to significantly constrain demand.

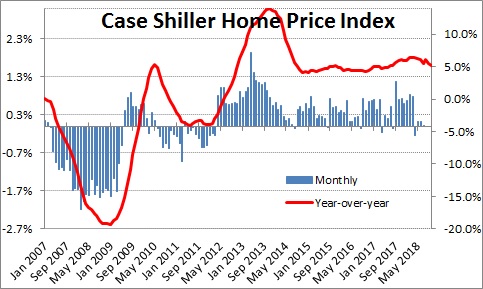

At the same time, home prices have been rising by about 5.0% annually for the past several years. Could this combo of higher mortgage rates and higher home prices push some buyers out of the market? Yes, but not many.

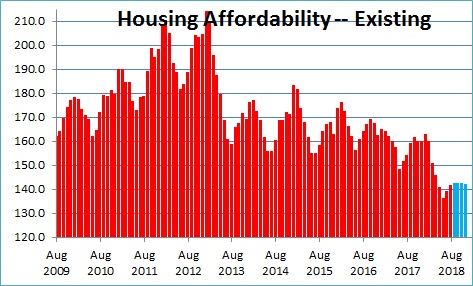

When people talk about housing affordability the discussion typically centers on mortgage rates and home prices. But there is a third variable in the equation – consumer income — and it has been rising steadily. The National Association of Realtors publishes a monthly series on housing affordability which encompasses all three variables. Currently, consumers have 40% more income than is required to purchase a median-priced house Five years ago consumers had 80-90% more income than required. Housing is clearly less affordable today than it was at that time, but is it unaffordable? No. In late 2007, just prior to the recession when the housing sector was hot, consumers had just 14% more income than was required; today they have 40% more income. Housing was relatively unaffordable in 2007. That is not the case today.

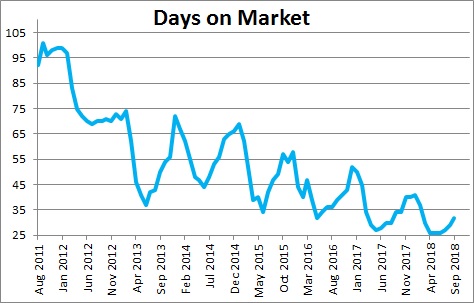

If potential home buyers were truly getting nervous we would expect homes offered for sale to sit on the market for a longer period of time. But that has not been happening. The average home is on the market for 32 days before it is sold. This series began in mid-2011. At that time, it took 90-100 days to sell a house. The 32-day average time between listing and sale today is one of the shortest we have seen. That seems to suggest that the demand for housing remains solid.

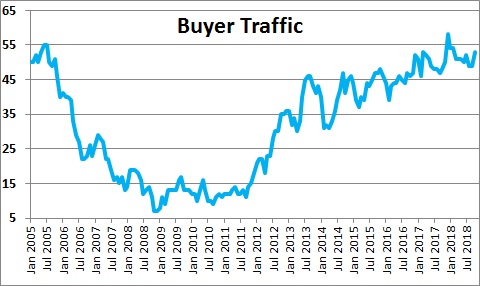

We would also have thought that if the housing market were weakening builders would be reporting less traffic through their model homes. That does not seem to be happening. Instead, traffic seems to be bouncing around from month to month at some of the highest levels we have seen in a decade.

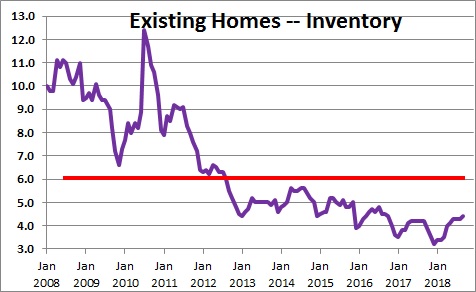

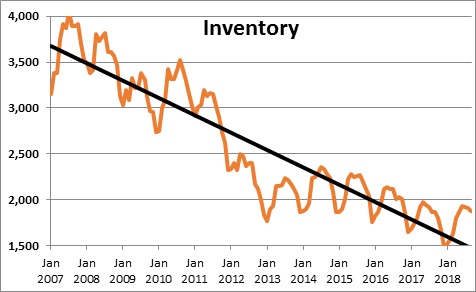

On the supply side, realtors are constantly complaining about a shortage of inventory. They cannot sell a house that is not on the market. Today there is a 4.3-month supply of homes available for sale. But realtors suggest that a 6.0-month supply is required for demand and supply to be in balance. We are not even close. There is clearly a significant shortage of homes available for sale. Demand exceeds supply.

It is interesting to note that the absolute number of homes available for sale has been steadily declining for more than a decade. If there were a 6.0-month supply of homes available today, the inventory level would be almost 700 thousand homes higher. If 700 thousand homeowners suddenly put their houses on the market, would the demand be adequate to sell them? We think so. Remember, a 6.0-month supply is regarded as the point at which demand and supply are in balance. If 700 thousand homes come on the market, existing home sales would surge to 5,850 thousand rather than the current level of 5,150 thousand and we would not be having this discussion about weakness in the housing market. That would be a record pace of sales.

At first blush the drop-off in home sales is impressive and appears to be troubling. But upon closer examination the slowdown largely reflects supply constraints rather than any softening of demand. For now, rest easy. The drop in housing is not as problematical as it seems.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me