February 21, 2024

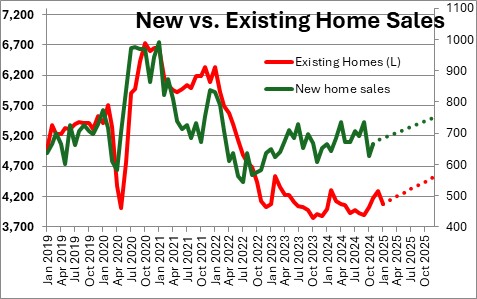

The housing market has been in a slump for the past two years as opposing forces tug in opposite directions. First time homebuyers are struggling with the combination of higher home prices and higher mortgage rates. The possibility of home ownership has largely disappeared for many younger, first time purchasers. Current homeowners, however, have benefitted from rapidly rising home prices which have built-up equity that can be used for an all-cash purchase or, at the very least, a very large down payment and reduced mortgage on their next home. On the supply side, builders are worried about tariffs which could significantly boost their cost of construction. If the Trump Administration follows through with the promised regulatory reform, consumer income continues to climb, mortgage rates fall, and home prices are steady or decline somewhat in 2025, housing affordability should increase which will stimulate both new and existing home sales and provide a boost to GDP growth for the year.

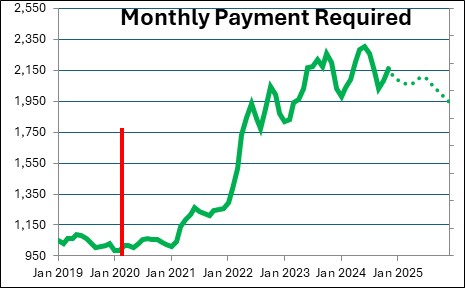

It is no surprise that first time homebuyers have been largely priced out of the market. In the five years since the recession the combination of higher home prices and elevated mortgage rates has caused the monthly payment required to purchase a median-priced home to double from $1,000 to $2,100,

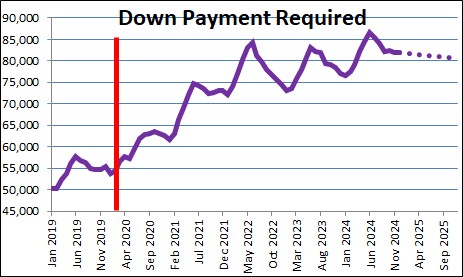

As home prices have risen the required down payment has jumped 50% from $55,000 to $82,000.

An annual study conducted by the National Association of Realtors found that the first-time homebuyer market share fell from 32% in 2023 to 24% in 2024. That is the lowest share since the NAR began collecting the data in 1981. The historic average is 40%.

At the same time, the average age for first-time buyers climbed from 35 years in 2023 to 38 years in 2024. That is also a record. The average age for first-time buyers hovered around 32 for 20 years prior to the recession.

To cope with this challenge, younger adults are choosing to save money by waiting a couple of years to make their first purchase, staying in their parents homes for a longer period of time, or moving back in with their parents after having previously ventured out on their own. First time homebuyers are struggling.

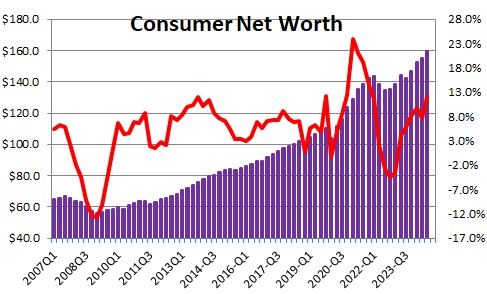

Existing homeowners have benefitted from the combination of rising stock prices and the dramatic increase in the value of their home. Consumer net worth has jumped 50% in the five years since the recession to a record high level.

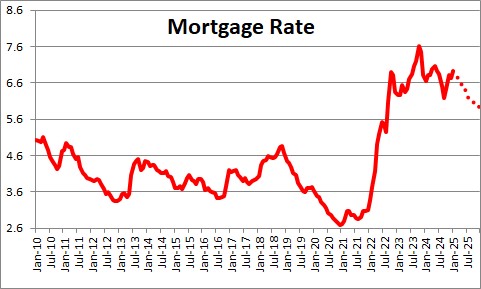

If current owners choose to sell they are able to tap their increased equity and either pay cash for their next home, or opt for a sizeable down payment to reduce the size of the new mortgage. But despite their attractive financial position, current owners have been reluctant to sell for two reasons. First, they will be trading in a 3.5% mortgage for one that is almost 7.0%. Second, they will have to move somewhere else and the extreme shortage of homes available for sale has drastically limited their options.

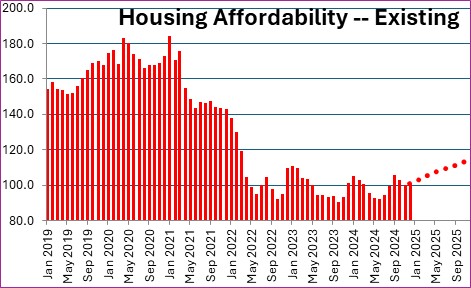

Looking ahead to the remaining months of 2025 housing affordability should improve. Affordability is based on three factors – consumer income, mortgage rates, and the price of the home.

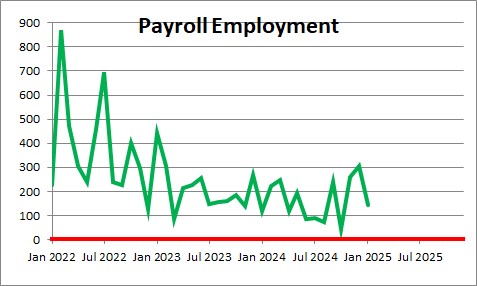

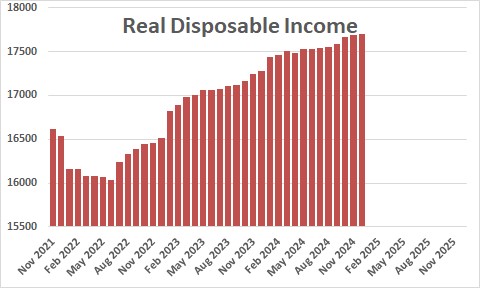

Consumer income is determined to a large extent by jobs growth. More people working translates into additional income. Jobs are increasing by 200 thousand per month and wages are rising by about 4.0%. As a result, real disposable income is growing by 2.4%. With most economists expecting GDP growth of 2.0% or so this year, jobs should continue to grow which means that consumer income will also continue to climb.

Mortgage rates are currently 6.9%. We expect the rate on a 30-year mortgage to fall to 6.2% by yearend because the “real” mortgage rate currently is about a percentage point higher than its long-term average.

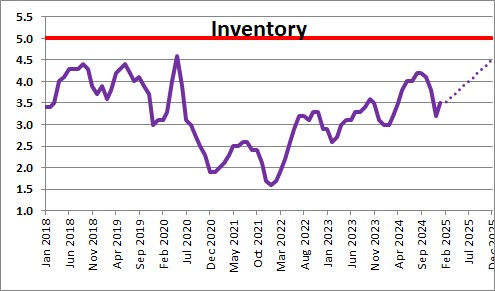

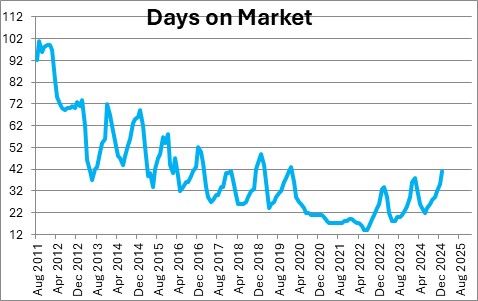

Finally, home prices should be fairly steady or even decline somewhat as the year progresses. On the one hand the demand for housing currently exceeds supply (as evidenced by the extreme shortage of homes available for sale). That should tend to push prices higher. But at 42 days in January the number of days it takes to sell a home has been edging its way higher (although it is still relatively short by any historical standard). If current owners sense that the market is weakening they may be willing accept a price somewhat below asking to close the deal. In 2024 the average home sold at 100% of the asking price. That is unlikely to continue in 2025.

If consumer income continues to climb, mortgage rates decline somewhat as the year progresses, and home prices are steady (or decline), housing affordability should increase. In December a potential home buyer had almost exactly the amount of income required to purchase a median-priced home. By the end of this year that same potential homebuyer should have about 15% more income than required. That should provide a lift to the housing market.

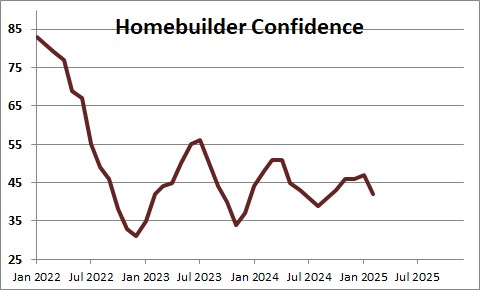

Home builders, meanwhile, are nervous about policy changes in Washington. They are hopeful that Trump will deliver on his promise to eliminate unnecessary and confusing regulations. That expectation steadily boosted confidence between August and January, but the announced tariffs — particularly those on Canada and Mexico — quickly dampened those high hopes. According to the National Association of Home Builders tariffs matter. The NAHB says that 32% of appliances and 30% of softwood lumber come from international trade. The proposed 25% tariff on goods coming from Canada and Mexico will, hopefully, be significantly reduced or eliminated by some new NAFTA trade agreement.

In short, we believe that a slight reduction in prices, a drop in mortgage rates, continued growth in consumer income and a pickup in the pace of construction by builders will boost new and existing home sales by 5-10% as the year progresses.

A faster pace of construction should cause the housing component of GDP to climb by 5.5% in 2025 and contribute to an expected 2.8% pace of GDP growth for the year.

Stephen Slifer

NumberNomics’

Charleston, S.C.

Follow Me