March 16, 2018

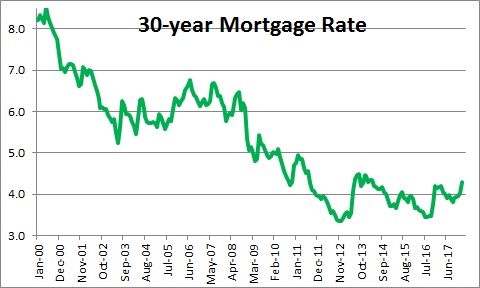

Mortgage rates have risen 0.5% in the first three months of this year from 4.0% to 4.5%. Home prices are beginning to climb more quickly. Buyers, sellers, and realtors are getting nervous. However, it is important to remember that solid employment growth is boosting consumer income as well. As a result, housing remains affordable and should remain so for the foreseeable future.

With respect to mortgage rates, at the end of last year they were comfortable at the 4.0% mark. In less than three months they have climbed to 4.5%. That is a big increase in a short period of time. But it is important to note a couple of things. First, by any historical standard a 4.5% 30-year mortgage rate is still very low. Second, the early year run up in rates was triggered by a fear that the economy was overheating, inflation was beginning to climb, and the Fed would raise rates more quickly than expected. That assessment has now changed.

Earlier this year strong economic data led many economists to anticipate first quarter GDP growth of 3.5-4.0%. At the same time the core-CPI rose 0.3% in January which was biggest monthly increase in more than one year. The conclusion was that the economy was overheating, inflation was on the rise, and the Fed would accelerate its pace of tightening. Mortgage rates rose.

But subsequent data have been less robust. First quarter GDP growth expectations have slipped to 2.0-2.5%, and the core-CPI for February rose 0.2% which was more in line with other recent months. The early year fear of rapidly rising interest rates has quieted down. Mortgage rates have leveled off.

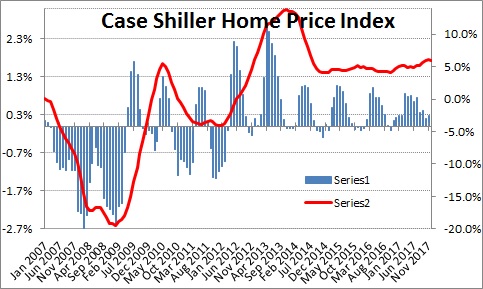

However, home prices have begun to rise more quickly. A year or so ago home prices were rising by about 4.5%. Today they are climbing at a 6.0% pace.

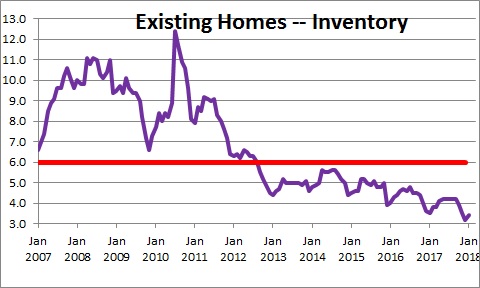

This upswing in home prices reflects the extreme shortage of homes available for sale. There is currently a 3.4-month supply of homes on the market. The National Association of Realtors suggests that demand and supply are roughly in balance when there is 6.0-month supply. Thus, demand exceeds supply and — not surprisingly – faster growth in home prices reflects that imbalance.

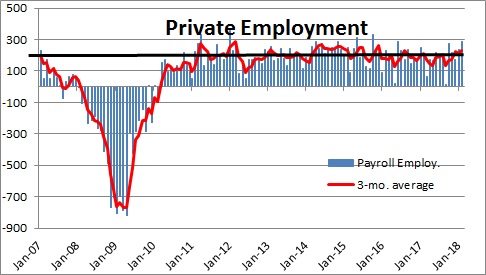

This combination of rising home prices and higher mortgage rates has understandably made some people nervous. But there is a third part of the housing affordability equation that is overlooked and that is consumer income. It is on the rise as well. Employment gains have been consistently robust and seem to be gathering momentum. For example, payroll employment rose 182 thousand per month last year. In the past six months that has averaged 205 thousand, and in the last three months it has climbed to an even steamier 242 thousand. Employment gains generate the income that allows consumers to spend.

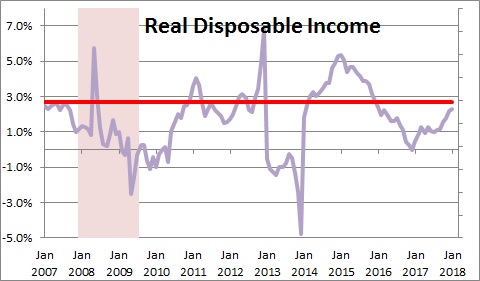

Primarily because of these job gains, real disposable income – which is what is left after paying taxes and adjusting for inflation – has climbed 2.3% which is close to its long-term average of 2.7%.

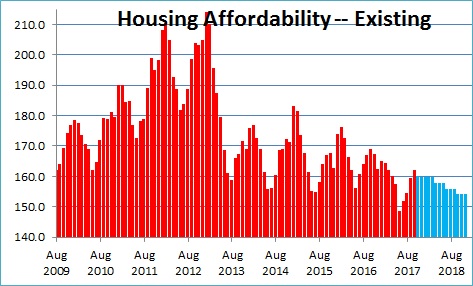

So, is income rising quickly enough to counter the increases in both mortgage rates and home prices? Not quite. The National Association of Realtors has a series on housing affordability that encompasses all three of these variables. Right now, consumers have 60% more income than is necessary to purchase a median-priced home. This series peaked in January 2013 when mortgage rates were at a record low level of 3.47%. At that time consumers had 113% more income than necessary to purchase a median-priced house. As mortgage rates have risen, housing is less affordable today that it was five years ago. In contrast, prior to the recession – at the peak of the housing bubble – consumers had just 15% more income than needed. Thus, housing today remains affordable.

While mortgage rates and home prices are important in determining housing affordability, so is consumer income growth and this is the piece that people tend to miss. If we continue to generate 200 thousand jobs a month, inflation rises moderately, and the Fed continues to pursue a go-slow approach to raising interest rates, the housing market will do just fine. This is not to say that everybody will be able to afford to purchase a home. They will not. Those on the lower end of the income scale and those with lots of student debt may find home ownership more challenging. But, in general, the housing market will remain affordable throughout 2018.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me