January 26, 2024

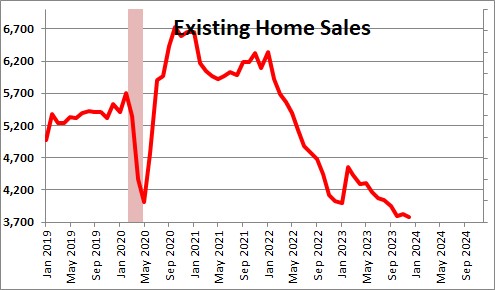

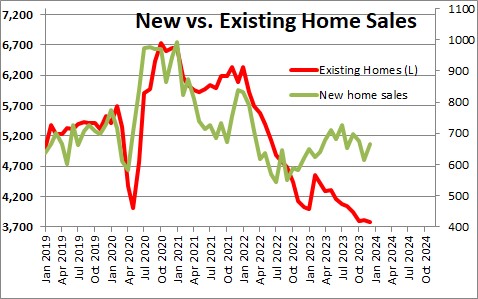

The housing sector consists of both new and existing home sales. At the moment, existing sales have plunged to a record low level while new home sales have turned upwards. Why the difference? More importantly, what is the outlook for the housing market in 2024? Our sense is that the combination of falling mortgage rates, a drop in home prices, and steady income gains will fuel a significant increase in housing affordability as the year progresses. The increase in affordability will, in turn, boost both new and existing home sales. The rebound in housing will keep the economy on a steady growth path in the first half of this year, and stimulate growth in the second half as the Fed begins a protracted period of declining interest rates.

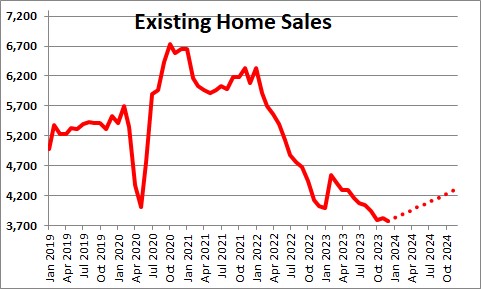

The difference between the path for existing home sales and that of new homes seems to be centered on the availability of homes for sale in each market. At the moment, existing home sales are at a near record low level. Without a doubt steadily rising mortgage rates throughout 2023 combined with equally steady increases in home prices took a toll. But there is yet another factor at work which is contributing to the anemic pace of sales – supply.

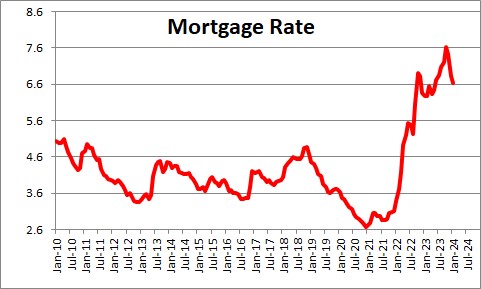

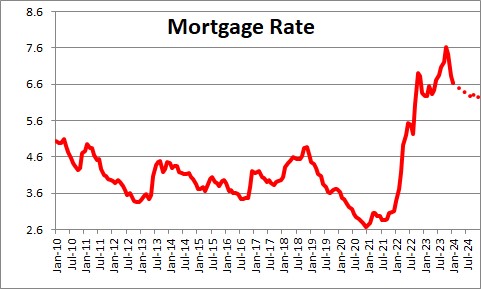

As mortgage rates climbed from 3.0% at the end of 2021 to 7.6%, home owners were reluctant to put their homes on the market. If they sold their current home they would need to buy another place to live. But if they planned to take out a mortgage on the next home, they would effectively be trading a 3.0-3.5% mortgage rate for a 7.6% rate. Not many people are inclined to make that swap.

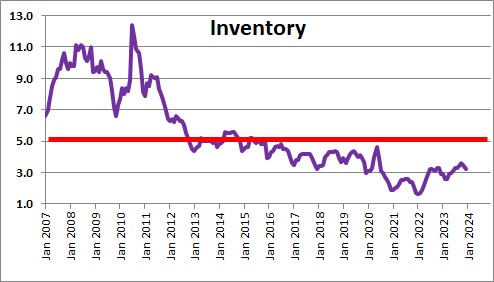

As a result, the supply of homes on the market plunged to a record low level of 2.0 months. The National Association of Realtors suggests that a 5.0-month supply is the point at which demand and supply are roughly in balance. Realtors cannot sell a home that is not on the market. The NAR has said that with more normal supply, home sales could easily be 1,000 higher than they are currently. That is, 4,700 thousand rather than 3,700 thousand. Still weak but not nearly as anemic as the current data suggest.

Unable to find an existing home that met their needs, potential home buyers turned to builders where at 8.2 months the supply of new homes was far more plentiful. As a result, new home sales in recent months have turned upwards while existing sales remain in a slump. Typically the two markets move in the same direction. This divergence between the two is unprecedented.

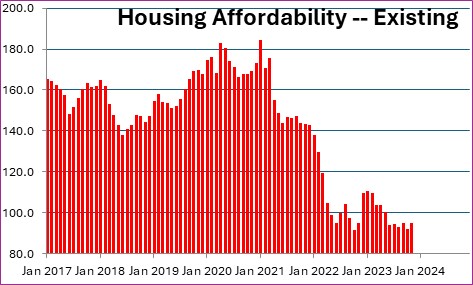

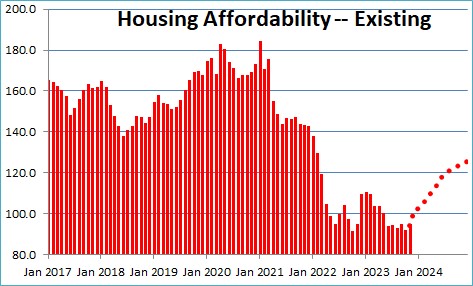

So what happens next? The answer to that question depends in large part on housing affordability. Currently the housing affordability index stands at 94 which means that a median-income-earning family has 6% less income than required to purchase a median-priced home. That stands in sharp contrast to 40-60% more income than necessary prior to the increase in mortgage rates. But housing affordability is poised to surge in the months ahead.

Affordability depends upon three factors – mortgage rates, home prices, and consumer income.

Mortgage rates peaked at 7.6% a few months ago. Inflation has steadily slowed and the markets have concluded that the Fed will soon begin to lower the fed funds rate from 5.5% currently to 2.5% over the course of the next couple of years. As a result, mortgage rates, which have already declined to 6.6%, should fall to 6.25% by the end of this year. That will help.

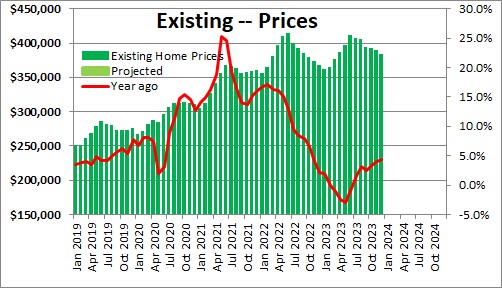

Second, home prices have begun to decline. Existing home prices have fallen 6.5% in the past six months. That is a rapid rate of descent – 13.0% at an annual rate. As rates drop more potential sellers should be willing to put their homes on the market and, as the supply of available homes increases, prices should continue to decline at a modest pace. That, too, should help boost affordability.

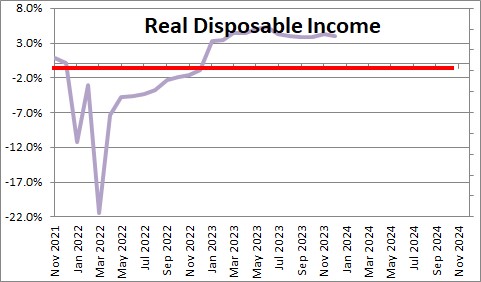

Finally, consumer income will continue to climb. Jobs growth remains constant at around 160 thousand per month. Wages have been rising steadily at a 6.5% rate. Those two pieces ensure that real disposable income will climb at about a 3.0% pace in the months ahead.

The combination of lower mortgage rates, falling home prices, and steadily rising income implies that housing affordability is going to surge in the months ahead. Rather than having 6% less income than required to purchase a median-priced house, potential buyers will have 25% more income than required to purchase that same median-priced house by the end of this year.

With significantly enhanced affordability characterized by smaller down payments and lower monthly payments, both new and existing home sales should rise 10% or so as the year progresses. While not a dramatic rebound, it stands in sharp contrast to the steady declines registered throughout most of last year.

Given the surprisingly robust 3.3% increase in GDP growth in the fourth quarter, economists quickly concluded that growth cannot be sustained at that pace and anticipate a sharp slowdown as the year progresses. But they have had a similar expectation for a year and the economy continues to chug along. Now, reinforced by falling interest rates in the second half of this year as the Fed begins to ease, we suggest that they are still underestimating the strength and resilience of the U.S. economy.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me