February 13, 2015

The consensus view is that GDP growth in Europe is slowing down. There is also a concern that falling price levels in Europe could trigger an unwanted slide into deflation. While that is clearly a disturbing scenario, it is not going to happen.

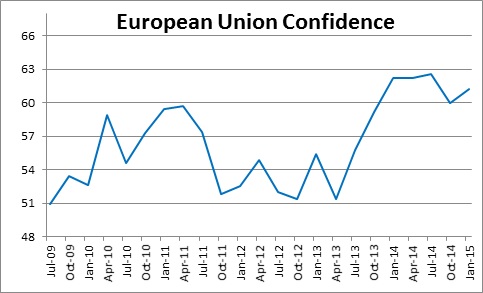

The Young Presidents’ Organization has 22,000 members in more than 125 countries. Each quarter the YPO does a worldwide confidence survey the results of which are available for a variety of regions. What do YPO members in Europe think?

The latest survey was taken in early January. Perhaps surprisingly confidence amongst YPO members in E.U. countries actually increased slightly in the first quarter from 60.0 to 61.2 which is close to its highest level thus far in the business cycle. Thus, a group of CEO’s living in Europe do not see the dire problems being touted in the press. Why?

First of all, GDP growth in Europe is not expected to slow this year. A few weeks ago the IMF downgraded its projected growth rate for Europe by 0.2% from 1.4% to 1.2%. That was the headline. Nobody bothered to point out that GDP growth in 2014 was 0.8%. Thus, even after a downward revision GDP growth in Europe is expected to quicken this year. It is important to remember that Europe will soon receive stimulus from a variety of sources.

First, the euro has weakened considerably. There is a perception that GDP growth in the U.S. will be robust this year while growth in Europe should be sluggish. At the same time the Federal Reserve is poised to raise rates while the European Central Bank is seeking to push rates lower. That is a recipe for a weaker Euro. In April of last year it cost $1.38 to buy one Euro; today is costs $1.14. That is a decline of 17% which will make European goods cheaper for Americans to buy (which should bolster European exports) and U.S. goods more expensive for Europeans to purchase (which will reduce imports.)

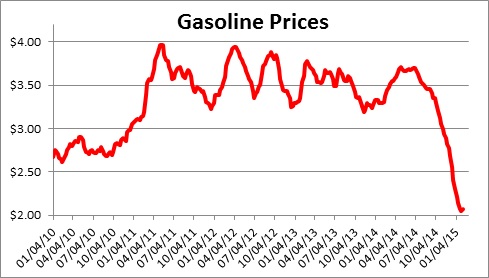

Second, there is the decline in oil prices. Europe will benefit from the drop in oil prices in exactly the same way that U.S. consumers do. It now costs European consumers about one-half as much to fill the tank with gas as it did in the middle of last year. The money saved can be spent on other goods and services.

Finally, fearing the possible onset of deflation the European Central Bank has adopted a quantitative easing strategy similar to what the Federal Reserve has done in the U.S. When the Fed first embarked on that strategy in late 2008 mortgage rates were 5.5%. They subsequently declined to 3.5%. If bond purchases in Europe can lower long term interest rates that, too, should enhance GDP growth this year.

We believe the ECB’s far of deflation is unwarranted. Headline inflation in Europe has slowed from 1.3% in 2013 to 0.4% as oil prices have declined. But the European Commission thinks that the core rate will remain steady. It came in at 0.9% in 2014 and it is projected to be 1.0% in 2015 and 0.9% in 2016. Europe is not about to slip into a deflationary death spiral. But justified or not, bond buying by the ECB should lower long-term interest rates in Europe and further bolster GDP growth.

Perhaps YPO members in Europe are not so irrational after all. There are some solid underpinnings for their relatively optimistic view. Even more interesting is a comparison of confidence levels for YPO members in Europe versus their counterparts in the U.S. Confidence in the U.S. rose in the January because U.S. GDP growth is expected to accelerate to 3.3% in 2015. As a result, the survey reading for the U.S. matched the high for the cycle at 65.0. Confidence amongst YPO members in Europe was not too far behind at 61.2. Not too shabby for a region which is generally regarded as a basket case.

Surveys are surveys and either or both groups of survey respondents could be wrong. But when a group of corporate leaders in Europe can look at their own businesses and at the stimulative factors described above and not be too worried, then perhaps the degree of pessimism about the region is greatly exaggerated.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen,

The Europe economy sounds good. The facts always undercut the media hype headlines. Thank you for the facts.

How is the Greek economy coming? I do not hear much about that. Is that economy going to create some problems for Europe?

Thanks for your interpretation of what is going on here and world wide. I really appreciate it.

…Darrel