August 2, 2024

The Fed’s announcement that it intends to cut the funds rate in September was widely expected (although we thought the Fed would wait until December). However, the employment report for July revealed considerable labor market weakness — employment, the unemployment rate, and hourly earnings — which makes the Fed’s announcement seem entirely appropriate. The markets are expecting three rate cuts between now and yearend which would reduce the funds rate from 5.3% currently to 4.6%. We agree.

What will be the pace of the rate cuts going forward? How low will the funds rate go? The answer lies in the combination of GDP growth and inflation. We are convinced that the economy will slow significantly in the final two quarters of this year. The inflation rate should continue to slow gradually throughout 2025. If that is the economic backdrop the Fed is justified in gradually lowering interest rates.

We currently expect GDP growth of 0.9% in the third quarter and 1.6% growth in the fourth quarter. That sounds worrisome, but is not even close to the recession scenario now seeping into the markets. However, the Fed needs to take action to ensure that the economy does not inadvertently fall over the edge into recession. But also recent productivity growth suggests that the economy could be growing far more quickly without triggering an uptick in inflation. Consider the following:

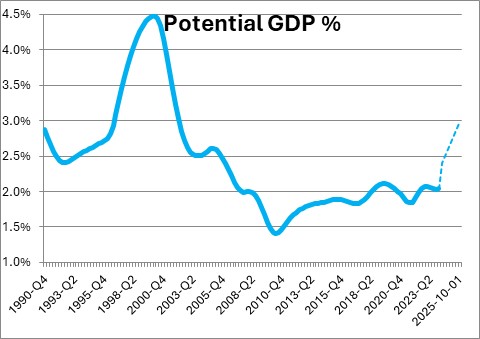

Productivity growth is surging. As a result, the economy may now be able to grow at a non-inflationary 3.0% pace. In so, our projected 1.0-1.5% growth is clearly anemic.

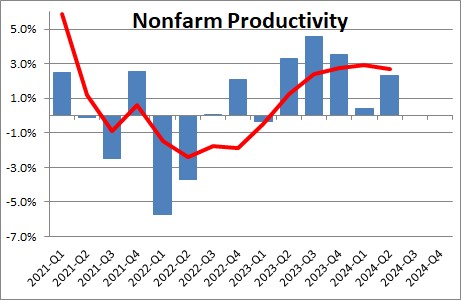

Productivity rose 2.3% in the second quarter and has climbed 2.7% in the past year. In estimating the economy’s potential growth rate (its economic speed limit) economists add two numbers, the growth rate in the labor force plus the growth rate of productivity. Currently, economists expect growth in the labor force of 0.8% and 1.0% growth in productivity, which gives an estimated potential growth rate of 1.8%. But productivity growth has accelerated in the past year for very good reasons. The labor market was very tight. Firms could not get enough workers to satisfy the still robust demand for their goods and services. As a result, business leaders spent money on technology in an effort to make their existing workers more efficient and thereby increase output. In other words, their action was done to boost productivity growth. Now AI is providing additional stimulus to productivity. If we get 0.8% growth in the labor force and productivity picks up to 2.2%, potential growth would become 3.0%. If second half GDP growth is likely to be 1.0-1.5%, why not cut rates to allow the economy to grow faster? A 3.0% pace would presumably still be noninflationary. For this to happen productivity must continue to grow rapidly. We think it will.

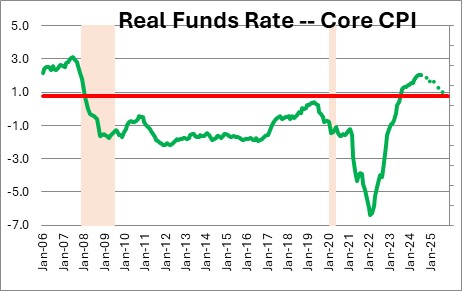

How quickly will the Fed ease? The answer depends upon the behavior of the funds rate relative to the inflation rate or, the so-called “real” funds rate. Currently, the funds rate is 5.3%. The core CPI (excluding food and energy) is 2.3%. Thus, the “real” funds rate is +2.0%. That is the highest real funds rate since 2007. The Fed thinks the funds rate is “neutral” when the funds rate is 0.8% above the inflation rate or, given a 2.0% inflation target, it estimates a neutral funds rate at 2.8%. If the economy slows in the second half of this year and inflation continues to shrink, the Fed may be able to ease steadily through the end of 2025. We expect that by December 2025 the funds rate will have dropped to 3.5%. With the inflation rate subsiding to 2.6%, the real funds rate at that time would be +0.9% which is essentially identical to the Fed’s estimate of a neutral “real” funds rate.

The expectation that the Fed will begin a series of rate cuts by September should quickly boost consumer confidence. Mortgage rates should drop from 6.8% currently to 5.75% by the end of the year which should re-ignite the housing sector. If lower interest rates are on the way it is unlikely that employers will choose to lay off any significant number of workers for fear that the economy could rebound quickly – as it did in 2020 and 2021. With consumer confidence having dropped for a combination of economic and political reasons, consumers relying on their credit cards to maintain their lifestyle, and business leaders becoming cautious about hiring, it is clear that the current pace of 2.5-3.0% GDP growth could not be sustained and that slower growth would be forthcoming. It has arrived. That paves the way for the long-awaited series of rate cuts by the Fed.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me