November 6, 2015

The Fed has (almost) guaranteed that short-term interest rates will begin to climb in December. It has also told us that it intends to raise rates very slowly thereafter. But no one has yet talked about how high rates might ultimately have to climb.

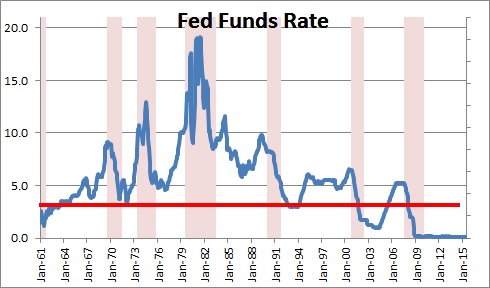

With the funds rate at 0.0% it is clear that the Fed is trying its best to stimulate the pace of economic activity. If the funds rate were at 10.0% it would be equally clear that the Fed was trying to slow it down. Surely there must be some level of interest rates between 0% and 10% where its policy would be “neutral”. How can we figure out what that so-called “neutral” rate might be?

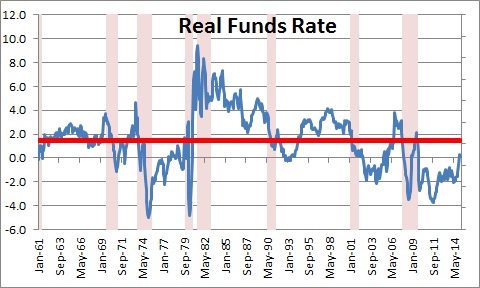

Most economists use the relationship between the funds rate and the inflation rate or the “real” funds rate. As shown below, it varies widely depending upon the Fed’s policy stance at the time. Over the course of the past 50 years – in good times and bad — the real funds rate has averaged about 1.5%. If the Fed wants its policy to be neutral it should think about a funds rate that is 1.5% higher than the inflation rate. Given that the Fed has a 2.0% inflation target, then a “neutral” funds rate be should be a 1.5% real rate, plus 2.0% inflation, or about 3.5%.

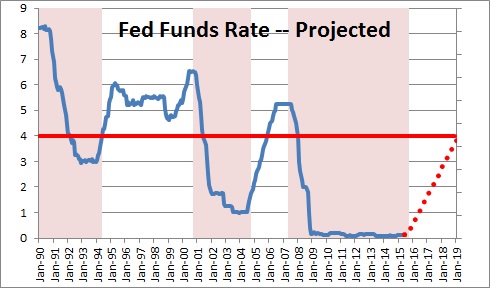

At its September FOMC meeting Fed officials told us that they expect the funds rate to be 0.4% at the end of this year, 1.4% by the end of next year, 2.6% at the end of 2017, and 3.4% by the end of 2018. The Fed also indicated that it believes that over the longer term the funds rate should be about 3.5%. The discussion above is essentially how they came up with that number. In the Fed’s mind monetary policy will continue to be accommodative until the end of 2018. It will take three years to shift from a wildly stimulative policy stance to one that is “neutral”.

The next thing you need to know is that the U.S. economy has never gone into recession until the Fed has pushed the funds rate above that so-called neutral rate. That is because in those situations the Fed is actively trying to slow down the pace of economic activity in an effort to head off an increase in inflation. Every downturn in the U.S. economy has had the heavy footprint of the Fed all over it. The Fed is certainly not trying to produce a recession. But it has two goals. First, it is charged with keeping the economy expanding at a pace consistent with full employment. Second, it supposed to keep inflation at about 2.0%. When inflation climbs above target, the Fed is forced to take action to slow the pace of economic activity by raising rates which will, hopefully, keep inflation in check. Unfortunately, as it gradually raises interest rates there comes a point when consumers and business people suddenly realize that rates have reached a punishingly high level, they sharply curtail their pace of spending, and the economy falls over the edge into recession. While the Fed may be the designated cause of the recession, it is just doing its job.

As we see it, if Fed policy does not reach the 3.5% neutral rate until the end of 2018 and the U.S. economy has never fallen into recession until the Fed has pushed the funds rate above that neutral level, then we conclude that the earliest possible date for a recession in the United States would be 2019. While we are not forecasting a recession in that year, for the first time interest rates will have risen to a level where they could begin to bite and we should start paying attention. A recession may not be too far distant.

While the Fed gets a lot of grief about how slowly the economy has been expanding in recent years, it is worth noting that if the expansion lasts until July 2019 (which we expect) it will go down in the history books as the longest expansion on record. The Fed deserves a little more credit.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me