April 12, 2019

The IMF recently reduced its 2019 global GDP growth forecast by 0.2% to 3.3% after slicing it 0.2% in October. Its forecasts receive widespread attention because the IMF has the resources and the skills to examine closely the economies of virtually every country around the globe. As always, the growth outlook varies depending upon exactly where one chooses to look.

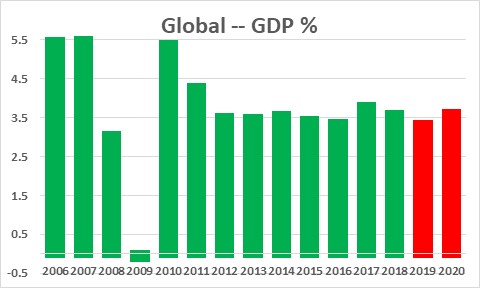

The IMF forecast highlighted the fact that global economic activity is expected be the slowest since the recession. While that is technically true, the chart below shows that the projected 3.3% growth rate this year is only marginally slower than in any of the previous seven years, so do not be too alarmed.

The IMF expects the U.S. economy to climb 2.3% this year, a growth rate broadly in line with the expectation of many other economists. For what it is worth, we believe the economy is rebounding sharply from the fourth and first quarter slump caused in large part by the 20% drop in stock prices compounded by the protracted government shutdown. Business and consumer confidence have largely shrugged off the impact of these two events. The stock market is closing in on a new record high level. The labor market is charging ahead with jobs growth of 190 thousand per month which will keep consumer income rising and consumer spending steady at a 2.5% pace. And the decline in mortgage rates from 5.0% late last year to 4.0% is giving renewed vigor to the housing sector. As a result of all this, we anticipate U.S. GDP growth of 2.6% in 2019 versus the IMF’s forecast of 2.3%.

Outside of the U.S., the economic environment is disquieting.

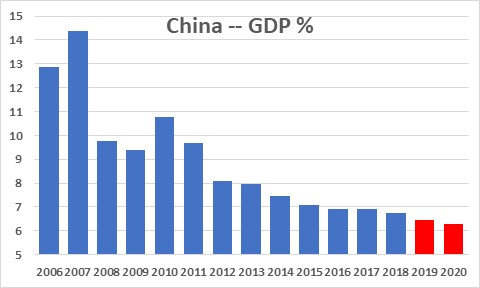

The IMF expects growth in China, to slip to 6.3% in 2019. However, the IMF expects GDP growth in China to drift steadily lower to 5.5% by 2024. This steady growth erosion largely reflects the negative impact on growth of an aging population.

The IMF’s forecast for Europe for 2019 has been chopped by 0.6% in the past six months to 1.3% which is noticeably slower than average growth of 2.0% in the previous five years. The IMF cited a variety of reasons for the anticipated slowdown ranging from escalating tariffs imposed by the U.S., concerns about a no-deal Brexit, a worsening fiscal outlook for some countries, and street protests in France which have disrupted retail sales and undermined consumer and business confidence. Clearly, these are all important factors for determining GDP growth for Europe. But keep in mind that exports are 13% of the U.S. economy, and trade with Europe is 12% of that. Thus, the anticipated growth slowdown in Europe will retard U.S. GDP growth this year by perhaps 0.1%.

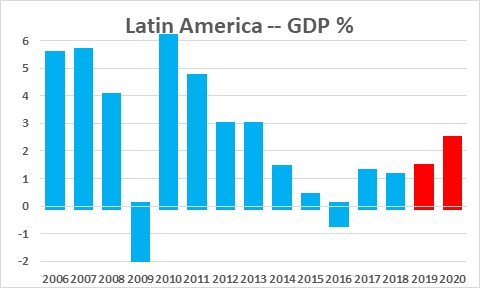

The IMF has reduced its forecast for Latin America by 0.8% in the past six months to 1.4%. However, its projected growth rate is roughly in line with growth in the previous five years which means that Latin America’s woes have been ongoing. The growth reduction this year was led by Mexico which is being hit by a sharp curtailment of growth in exports caused by the combination of increased tariffs imposed by Trump, threatened border closures, and the fate of the new U.S./Mexico/Canada trade agreement.

The rocky political climate in Brazil and the arrest of former President Michel Temer have pulled down consumer confidence in that country to a 6-month low.

And, in Venezuela the political standoff between President Maduro and Juan Guaido has plunged the economy into chaos. The U.S. imposed sanctions on the Venezuelan economy are taking a toll as the country’s oil exports to the U.S. fell to zero in March. That has severely constrained the inflow of hard currency needed to pay for imports. Widespread and recurring power outages are curtailing production in all sectors of the economy. Meanwhile, residents are trying to cope with a projected 10,000,000% inflation rate.

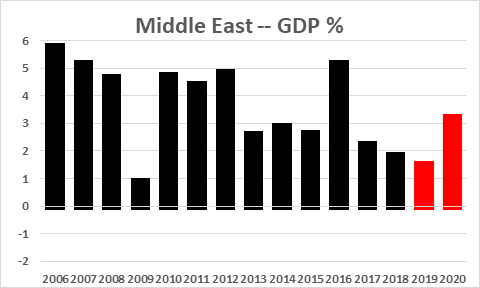

Finally, in the Middle East and North Africa growth is expected to slow to 1.5% in 2019 as oil production in the region is falling rapidly.

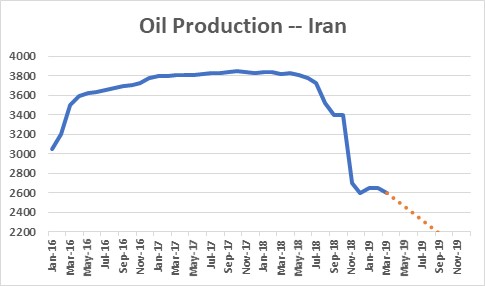

Oil production in Iran, for example, has been hit sharply by the impact of the U.S. imposed sanctions. Its oil production have fallen from 3.4 million barrels per day in September to 2.6 million currently. The U.S. wants to eliminate Iranian oil exports. At the same time Saudi Arabia has voluntarily cut production in an effort to boost oil prices which have rebounded to $65 per barrel.

The point of all this is that the U.S. economic backdrop seems relatively benign and even more friendly if our 2.6% GDP projected growth rate for the year is accurate. But elsewhere around the globe from Europe, to China, to Latin America, and the Middle East growth will be constrained in 2019. While there are always economic uncertainties, those potential problems will almost certainly put a lid on global growth this year. However, the outlook could improve considerably if trade agreements can be reached between the U.S. and China, or between the U.S. and Europe, or immigration policies between the U.S. and Mexico can be stabilized. Under no set of circumstances should we be thinking about a recession in the U.S. or anywhere else any time for the foreseeable future.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Follow Me