February 18, 2022

The world seems to be expecting war between Russia and Ukraine, and by the time you read this it may have begun. But the world has never encountered the kind of war that is likely to break out in Eastern Europe. There will undoubtedly be an air and ground attack. But there will almost certainly be a cyber component as Russia tries to disable the ability of Ukraine to coordinate its defenses, interrupt its supply chains, run its government, and produce power. The U.S. and NATO will respond, but exactly what that looks like remains unclear. Having said that, it is important to remember that going into this period of heightened uncertainty the economy is in good shape. Interest rates are rising but they are starting from an extremely low level and even by yearend real interest rates will remain negative, Businesses are hiring as quickly as they can and the demand for workers continues to far exceed supply. Consumers are still spending vigorously. Their net worth is at a record high level. The ratio of consumer debt to income is near a record low level. Corporate earnings have climbed 20% in the past year and are at a record high level. As a result, war in Europe may slow things down somewhat, but the economy is in no danger of falling into recession as a result.

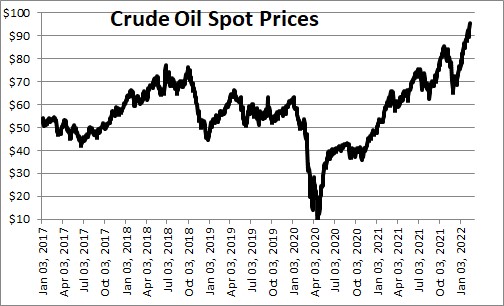

So what might happen in the event of war? One piece that seems fairly certain is that it will almost certainly disrupt the supply of oil and natural gas as Russia responds to whatever sanctions the U .S. and NATO impose which will push prices above the $100 per barrel mark.

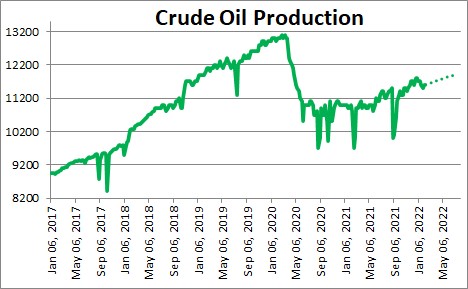

U.S. oil producers could significantly step up production. At 11.6 million barrels per day, oil production has not yet returned to the 13.0 million pace that existed prior to the recession. A large part of oil producers unwillingness to step up production is caused by the Biden administration’s obsession with green initiatives and its expressed intention to curtail the production of fossil fuel. Don’t count on oil producers to significantly boost production.

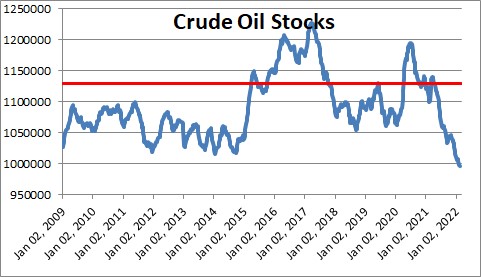

Without a significant bump-up in production it will be hard for the U.S. to respond to increased demand for oil from Europe because crude oil inventories are currently at their lowest level since 2007. Any increase in demand will push prices higher.

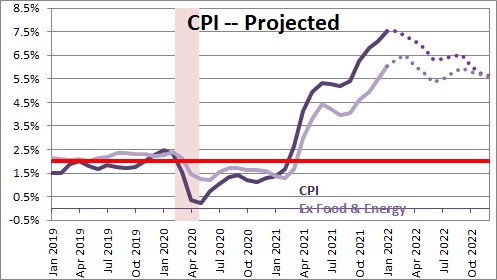

Rising oil prices will boost the inflation rate further. We currently expect both the overall CPI and the core rate to increase 5.6% this year. It is likely to climb even faster in the event of war.

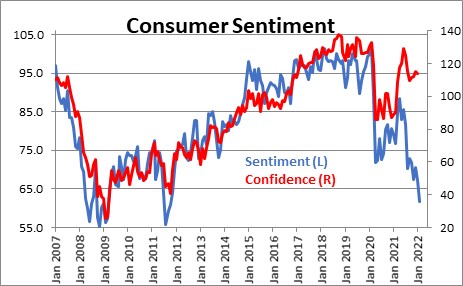

Consumer confidence has declined, but the extent of the drop is unclear. The University of Michigan measure of consumer sentiment has plunged to a level last seen during the 2008 recession. That makes little sense. In contrast, the Conference Board measure of consumer confidence has fallen only slightly. Consumer spending patterns suggest that, for now, the Conference Board series is a more accurate barometer of the current situation. War in eastern Europe will almost certainly make consumers more nervous.

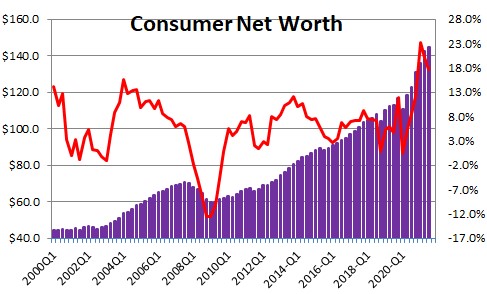

But how much will a decline in confidence reduce consumer spending? Widespread labor shortages exist. Thus, employers are likely to hire workers as rapidly as they can. Those same labor shortages will fuel even more rapid wage gains. As a result, nominal income will continue to climb. But faster inflation will offset most or all of workers bigger paychecks which means that real disposable income is likely to shrink. But stock market gains and rising house prices have boosted consumer net worth by 18% in the past year to a record high level. At the same time consumer debt in relation to income is near a record low level. These factors will cushion the blow from falling real disposable income. War will slow consumer spending, but by less than one might expect.

The stock market jitters will probably get worse. While the S&P 500 index feels like it has already fallen by 20%, the reality is that – despite considerable volatility – it has declined a moderate 9%. War will likely cause it to decline further, but it has already discounted a great deal of that possibility.

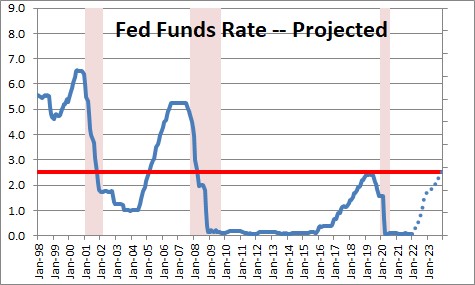

How will the Fed respond to this? Already high and perhaps even faster inflation would ordinarily cause it to raise rates rapidly and shrink its balance sheet. But war changes the odds. We currently expect seven rate hikes this year which would boost the funds rate to 1.75% by yearend and higher still in 2023. However, increased uncertainty in the event of war should curtail the Fed’s enthusiasm for rate hikes. They will still raise rates, but more slowly than we and most other economists expect at the moment.

The point of all this is that war in eastern Europe will cloud the economic outlook on many fronts. But it is also important to remember that the economy is in very good shape going into this less certain environment. Interest rates are rising but they are starting from an extremely low level and even by yearend real short- and long-term interest rates will remain negative and thereby stimulate the pace of economic activity. Businesses are hiring as quickly as they can and the demand for workers far exceeds supply. Consumers are still spending vigorously. Their net worth is at a record high level. The ratio of consumer debt to income is near a record low level. Corporate earnings have climbed 20% in the past year and are at a record high level. War in Europe may dent growth in 2022, but it is unlikely to push stock prices too much lower than they already are and it is not going to trigger a recession.

Stephen Slifer

NumberNomics

Charleston, S.C.

Great invite! Great job!!steve!!