February 2, 2018

The stock and bond markets have finally begun to fear faster-than-expected GDP growth and worry that inflation might finally be on the rise. If that is the case, the Fed could raise the funds rate more quickly than is currently anticipated. But is it fear justified? We continue to believe the pickup in inflation will be modest.

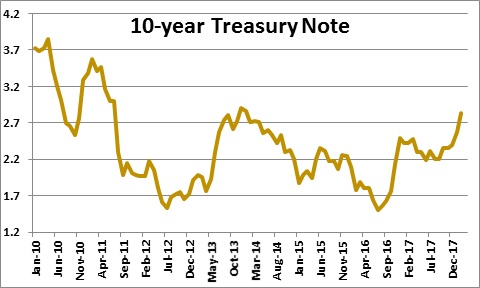

In the past couple of weeks, the fear of faster growth and higher inflation has caused the yield on the Treasury’s 10-year to climb from 2.4% in December to 2.8%.

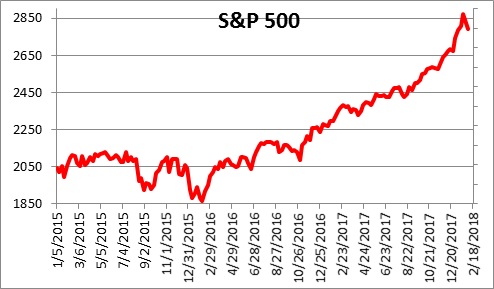

The rise in the 10-year yield caused the S&P to retreat by almost 3% in recent weeks. Is this the beginning of the long-awaited stock market correction? Maybe. But even if it is, we believe it will be of relatively short duration and magnitude and that the longer-term trend remains higher with the S&P reaching 3,000 by the end of the year.

Part of the market’s fear is from faster GDP growth. Fourth quarter came in at 2.6% which was less than had been expected, but it was held down by a miniscule increase in business inventories. Final sales growth, which excludes the inventory change, came in at a solid 3.2%. That captured the markets’ attention. Early estimates of first quarter GDP growth are around the 3.0% mark. That is clearly faster than we have seen for some time and partially justifies the markets’ fear.

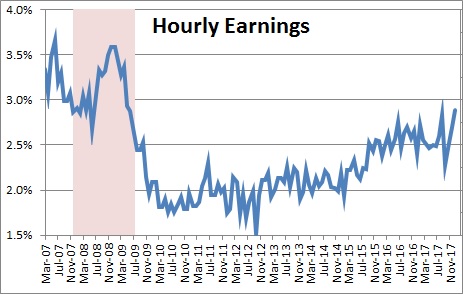

Faster GDP growth will generate upward pressure on both hourly earnings and worker compensation, which then boosts the inflation rate. While the direction is right, how much of a pickup should we expect? Our bet is that it will be relatively modest.

The January employment report indicated that average hourly earnings have risen 2.9% in the past year. The yearly increase seems to reflect a solid uptrend. This tidbit of information spooked the markets.

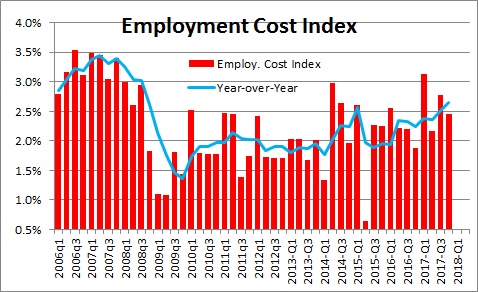

Hourly earnings are only a small part of worker compensation. Many workers are not paid hourly but receive an annual salary. Others may receive an annual bonus payment. And total worker compensation includes various types of benefits. The employment cost index combines all that additional information. It, too, is on the upswing with a year-over-year increase of 2.7%.

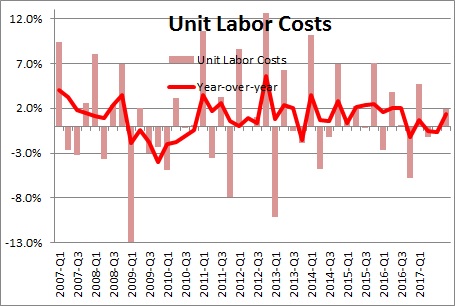

But there is a missing piece and we continue to stress it. Increases in labor costs can be offset by commensurate increases in productivity. We should focus specifically on what economists’ call “unit labor costs” which makes that adjustment. It will determine the extent to which high labor costs translate into higher inflation. Last year the Bureau of Labor Statistics reported that compensation increased 2.4%, but at the same time productivity growth quickened to 1.1%. As a result, unit labor costs – labor costs adjusted for the increase in productivity — rose 1.3%. But the Fed has a 2.0% inflation target. An adjusted 1.3% increase in labor costs is not putting upward pressure on inflation.

But that is history. What do unit labor costs look like in 2018? Given the tightness in the labor market we anticipate a 3.0% increase in worker compensation this year. With investment spending on the upswing we suggest that productivity will climb by 1.8%. If that is the case, unit labor costs are likely to increase 1.2% which is virtually identical to last year’s increase. Thus, the tightness in the labor market is still not putting upward pressure on the inflation rate. We would begin to worry if unit labor costs jumped to 2.5% or higher. We are not even close.

We believe that the core CPI will increase from 1.8% last year to 2.2% in 2018 which is roughly in line with the Fed’s 2.0% inflation target. If that forecast is correct, the Fed will not be alarmed and will have no reason to raise the funds rate more than the three times that it has previously indicated. And if inflation remains in check, the yield on the 10-year note by yearend should be about 3.0% — not much higher than it is currently.

Markets always tend to overreact. If our economic scenario is accurate the pickup in inflation will be modest and the stock and bond markets will eventually settle down.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me