November 17, 2023

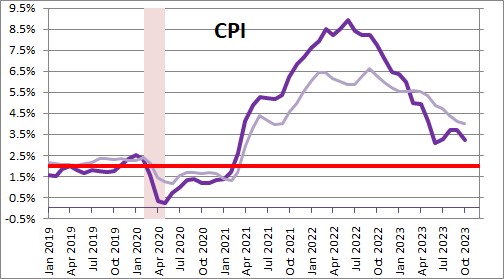

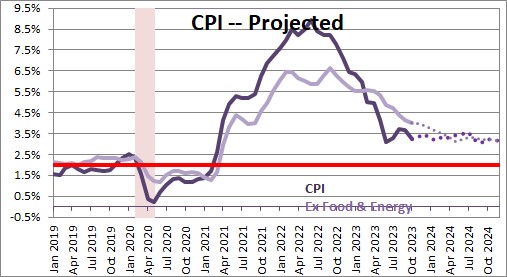

The CPI registered no change in October which is encouraging because the CPI has risen every month since May 2020. The 12-month increase in the CPI has plunged from a peak of 9.0% to the 3.2% mark. The core rate has dropped from 6.5% to 4.0%. While inflation remains high, it is moving steadily in the right direction. We expect inflation to slow further in 2024 as $4.0 trillion of surplus liquidity created by the Fed via its purchases of Treasury securities in 2020 and 2021 should be completely eliminated by the spring of next year. The overall CPI measure has fallen more quickly than the core rate in large part because of a dramatic drop in oil prices. Oil prices are always volatile. Why the big drop in 2023? And what impact might oil prices have on inflation in 2024?

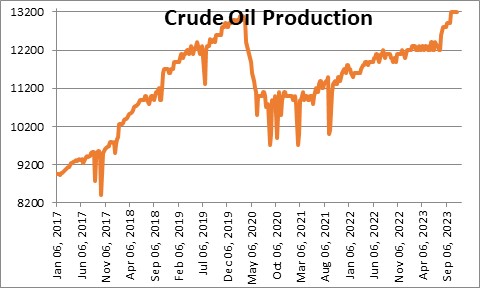

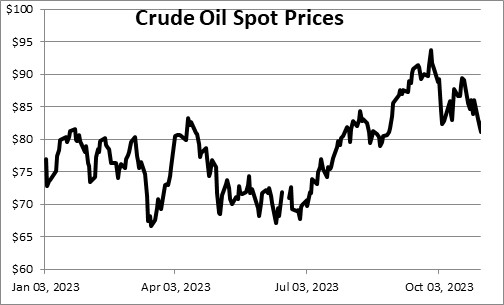

In the past couple of months crude oil prices have plunged from $93 a barrel at the end of September to $75. Much of that drop in prices reflects a dramatic increase in U.S. production which has jumped from 12.2 million barrels per day in June to 13.2 million barrels per day currently. In light of the Administration’s intention to restrict the production of fossil fuels in favor of more environmentally friendly energy sources like wind and solar, such a development is surprising.

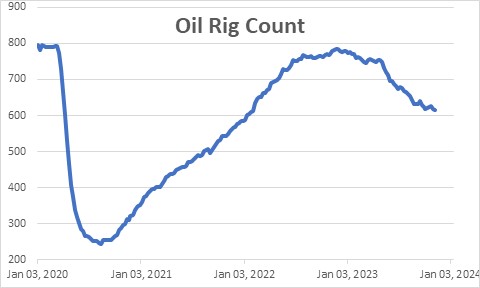

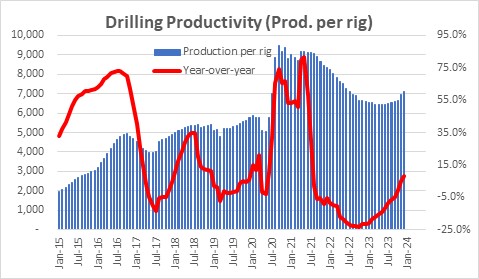

The output gain has not come about by an increase in drilling activity. In fact, the number of oil rigs in production has dropped from nearly 800 at the beginning of the year to 616 This means that the enhanced production has been triggered by technological changes like hydraulic fracturing that allow drillers to boost output per well in operation — i.e., increased productivity.

In fact, drilling productivity has increased about 8% in the past year.

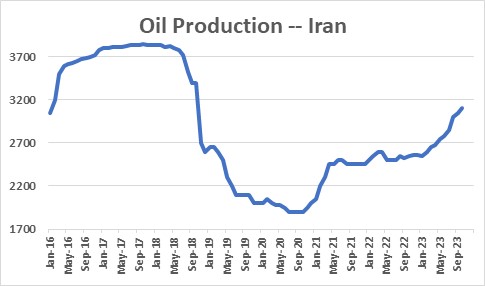

At the same time, Iranian oil production has jumped from 2.5 million barrels per day a year ago to 3.1 million currently. Iran has partially countered most of the U.S.-imposed sanctions by exporting more oil to China and Russia.

Between the U.S. and Iran, global oil production has climbed by 1.6 million barrels of oil daily. The U.S. lifted production from 12.2 to 13.2 million barrels of oil per day, and Iran boosted production from 2.5 to 3.1 million barrels per day. The additional supply has caused oil prices to plunge from $93 at the end of September to $75 currently.

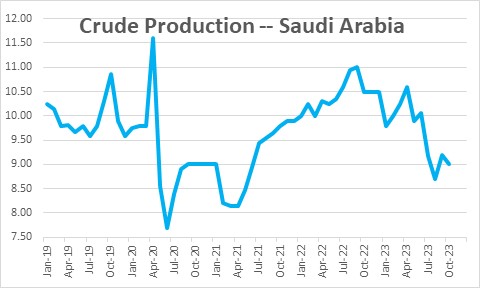

To counter this rather dramatic price drop Saudi Arabia has reduced its daily output from 10.5 mbpd at the end of last year to 9.0 million – almost matching the increased production from the U.S. and Iran.

So what does all this suggest going forward? In the U.S. the increased production is attributable to improved technology. That is not going to change. In fact the Energy Information Agency expects U.S. production to climb from 13.2 million barrels per day currently to 13.5 million by the end of next year. It also believes the reduced Saudi output will, over time, boost crude prices to $90 by the end of 2024,. Our sense is that in the upcoming year oil prices will likely trade in a range from $80-90. If so, oil prices will increase somewhat in 2024.

Oil prices, as always, are very volatile and typically not the major factor determining the inflation rate. Both the overall CPI and the core rate have been gradually shrinking for more than a year. But at 4.0% the core CPI is still double the Fed’s 2.0% target. Nevertheless, it is headed in the right direction and should continue to shrink in the months ahead.

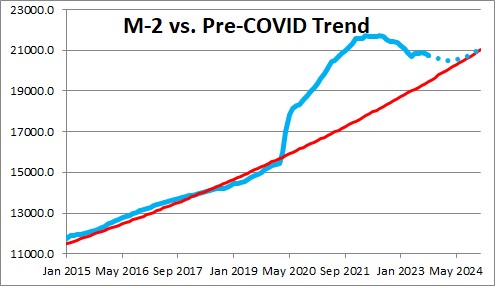

The reason we are so optimistic about the continuing slowdown in inflation is because the $4.0 trillion of surplus liquidity created by the Fed via its purchases of Treasury securities in 2020 and 2021 has shrunk to $1.3 trillion, and if the Fed continues to reduce the money supply at its current pace any remaining surplus liquidity should disappear by the early part of next year. That, in turn, should allow the inflation rate to continue its descent.

Against this background, the 5.5% funds rate is almost certainly at its peak. The Fed may actually shift into easing mode in the second half of next year. We expect the funds rate to fall from 5.5% currently to 4.75% by the end of 2024. As the inflation rate subsides the yield on the 10-year note is likely to drop from 4.5% today to perhaps 4.25% by the end of next year. That, in turn, should cause mortgage rates to fall from 7.4% currently to 6.25%. The slowdown in inflation may not reach the 2.0% target until 2025. And the funds rate may not drop to its equilibrium level of 2.5% until 2025. But the direction is clear. Slower inflation and lower rates are a recipe for both faster GDP growth by the second half of next year, and a buoyant stock market.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me