August 11, 2023

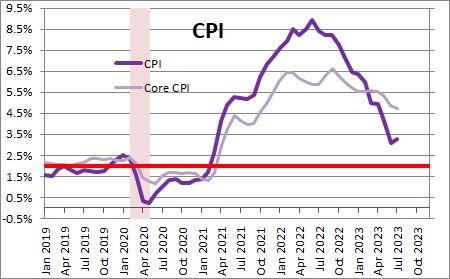

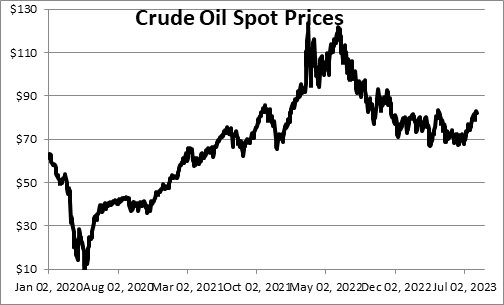

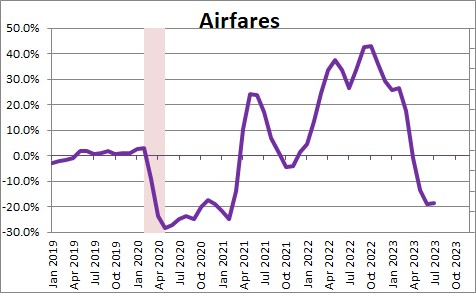

In the wake of the July CPI data there is a growing perception that inflation is steadily subsiding and that the Fed will not need to increase the funds rate further. We are not so sure. Several factors seem important. First, will the economy slow from its current 2.0% pace? Second, how quickly will the core inflation rate subside? And third, how patient will the Fed be in allowing the inflation rate to decline gradually on its own? Or will it feel it must raise the funds rate further to shrink the core inflation rate more quickly? There has been an impressive reduction in the core inflation rate in the past year, but the pace is likely to slow in the months ahead. One reason for that is the dramatic increase in crude oil and natural gas prices which has not yet filtered into the CPI. But it will. Rising energy prices impact more than the energy component of the CPI. They also raise the cost of jet fuel which will push up airfares, and they boost the cost of diesel fuel which will increase the cost of shipping anything by truck – which includes almost every commodity. The Fed may feel a need to encourage a faster drop in the inflation rate by raising the funds rate a couple more notches.

Both the overall CPI and the core CPI rose 0.2% in July. As a result, the core CPI has now risen 4.7% in the past year. It peaked at 6.9% in July of last year so it has declined fairly rapidly even though it remains far above the Fed’s 2.0% inflation target. But the trend is still downwards. For what it is worth, we expect the core CPI to dip to the 4.0% mark by yearend. But the August CPI data may not be as friendly.

What concerns us is the recent increase in energy prices. For example, the price of crude oil has risen from $70 per barrel in early July to $83 currently. That is an 18% increase which is eventually going to filter into the CPI. One could argue that that run-up in the price of crude oil will only raise the energy component of the index which is excluded when calculating the core rate of inflation. Not quite. As crude prices rise they boost the cost of jet fuel and diesel.

Falling airfares in the past year undoubtedly reflect a sharp drop in the cost of jet fuel. Rising jet fuel prices in the next couple of months will almost certainly force airlines to boost ticket prices.

More importantly, the higher cost of diesel fuel will substantially boost operating costs for truckers. That increase in transportation costs will be passed along to retail customers so the price of everything that moves by truck will be higher — from furniture to cars to food and apparel. For what it is worth, we expect the CPI to increase 0.6% in August and the core CPI to increase 0.4%.

But there are two other factors to consider. In June the Fed expected GDP growth this year to be 1.0%. Right now we know that GDP rose 2.0% in the first quarter, 2.4% in the second quarter, and in the third quarter growth is closing in on 2.0%. We believe that GDP growth this year will be 2.0%. That is far more rapid than the 1.0% growth rate the Fed had in mind. Similarly, the Fed expected the core personal consumption expenditures deflator to slow to 2.6% in 2023. Right now we expect both the core CPI and the core personal consumption expenditures to increase 4.0% in 2023. The inflation rate, by any measure, is not slowing nearly as quickly as what the Fed had in mind.

If the economy is rising at a far more rapid rate than what the Fed expected in June, and the inflation rate is not slowing nearly as quickly as it thought, what does it do in September? At this point it is not entirely clear. It may choose to pass, but even if it does we would still expect additional rate hikes in the months beyond.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Follow Me