April 23, 2021

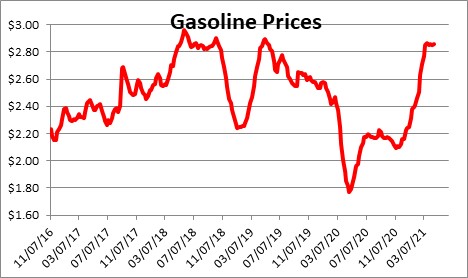

The Fed claims that we are seeing a temporary runup in inflation which will eventually dissipate and settle in at a pace slightly above its 2.0% target. Perhaps. But our fear is that we could see a sustained increase in inflation in excess of what the Fed envisions. Right now the housing sector is on fire with double-digit gains in house prices and they are accelerating. Builders cannot find an adequate number of skilled workers. The food and beverage industry is trying to scale up production but owners cannot find enough cooks and servers. Firms are bidding up wages in an effort to attract an adequate number of workers. Gas prices have climbed to almost $3.00 per gallon. Commodity prices are surging. Supply shortages are evident throughout the manufacturing and service sectors at the same time that consumers are inundated with cash. That is not a recipe for some temporary blip in the inflation rate. It seems to us that the inflation risk is all on the high side.

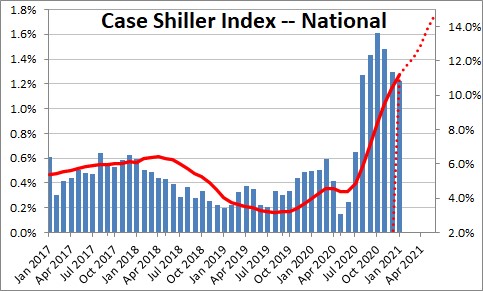

Home prices are surging. In the past year prices have risen 11.2%. But in the past six months they have accelerated to 17.0%. Why? Because the demand for housing has skyrocketed. Fueled by fat stimulus checks consumers have money to spend. Mortgage rates remain extremely low at 3.1%. With many people now able to work from home, renters are fleeing the big cities for cheaper alternatives in more affordable suburbs.

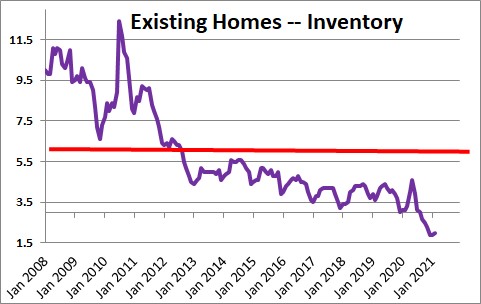

As home sales have accelerated the supply of homes available for sale is not even close to what is needed. At a minuscule 2.1 months the supply of homes is about one-third of what is required to bring supply and demand into balance. Further, the typical home sits on the market for just 18 days — the shortest period of time ever between listing and sale.

This housing imbalance will continue until such time as builders are able to significantly step up the pace of production. They are trying, but every builder is challenged to find enough bodies. Their costs have escalated as surging lumber prices have tacked on an additional $26,000 to the price of a new home. Local building restrictions have curtailed the supply of lots available to builders in an effort to moderate the rate of growth in those suburban communities. Supply is unlikely to catch up with demand any time soon.

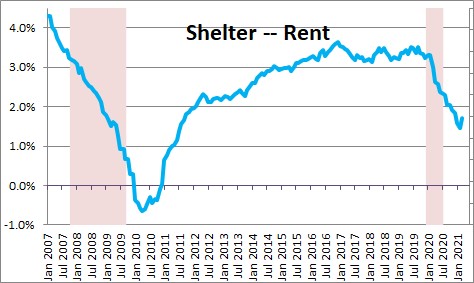

Potential home buyers will eventually recalculate the tradeoff between buying a home versus renting and conclude that homes have gotten too expensive and decide to rent instead. At that point, rents will begin to climb which is a big deal because the “shelter” component represents one-third of the entire CPI. Currently, shelter prices have moderated because of rent forgiveness for renters who lost their jobs during the pandemic. But at some point rent forgiveness will end. When it does a large portion of the CPI will begin to accelerate.

Gas prices have now climbed to almost $3.00 per gallon. Prior to the recession gas prices were $2.50. Thus, prices are now higher than they were prior to the recession. Given that the recovery is gathering momentum, not just in the U.S. but around the world., which way do you think gasoline prices are going from here?

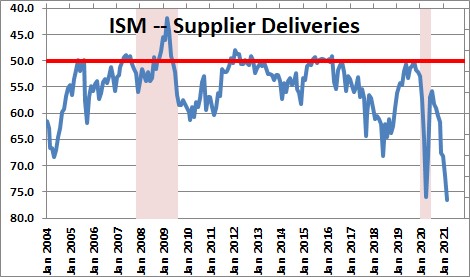

Government restrictions last year shut down the economy and supply chains were disrupted. Firms cannot simply flip a switch and restore the flow of necessary inputs. The supplier delivery component of the Institute of Supply Managers monthly survey indicates clearly that the flow of materials from suppliers has been significantly curtailed. Every firm is struggling to find a solution.

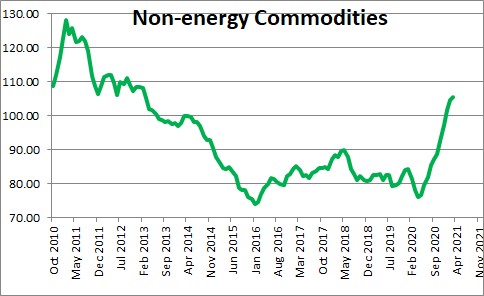

Once these firms re-establish their supply chains, they will still be faced with higher prices of virtually everything. Oil prices have risen. Prices of non-energy commodities has been surging as well and are now at their highest prices in the past eight years. The price increases are broad-based with copper, lead, aluminum, zinc, steel and lumber leading the way.

The government shut down the economy in the spring of last year. It then flooded consumers with cash in the form of a series of stimulus checks. Demand has surged, but supply chain disruptions have emerged. Firms are scrambling to find enough workers and materials to boost production. You might think that with the unemployment rate at 6.0% firms would easily be able to find enough bodies to hire. They can’t. Job openings are back to where they were prior to the pandemic but hiring is lagging. With $300 of Federal unemployment benefits continuing through September 6 in addition to state benefits, many unemployed workers seem content to remain on the sidelines and live off government provided benefits until they expire.

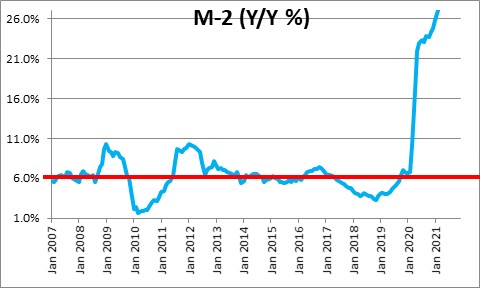

Powell may think that this increase in inflation is temporary; we are unconvinced. The reality is that 27% growth in the money supply is unprecedented. We saw 15% money growth back in the late 1970’s at which time the inflation rate was also about 15% . Powell says that we have to unlearn that connection between growth in the money supply and the inflation rate. We are not yet prepared to do so. Time will tell which view is correct but everything we can see suggests that the risk is on the side of an increase in the inflation rate in excess of the 2.0-2.5% pace the Fed deems acceptable.

Stephen Slifer

NumberNomics

Charleston, S.C.

Great update Steve and timely. I read yesterday that YTD container shipping costs from China have doubled plus ongoing 25% China tariffs. Kent bicycle, bike supplier to Walmart, is anticipating retail price hikes of $60.00 on a $190.00 bike, this Xmas over last year.

YTD materials prices for Lumber have risen 35%, Steel Futures 40%, Iron Ore 7% and Copper 15%. None of this seems temporary to me. It’s my understanding that manufactures and retailers are absorbing these increases for now but that can’t continue.

I’m trying to learn how to invest to protect against inflation. The following is attributed to Warren Buffett; Be fearful when others are greedy and greedy when others are fearful.

Well pointed out Bill. I subscribe to exactly what Mr. Slifer said here, this wave is going to wipe out many.

But how can we protect assets & cash from this impending inflation though? Please advise!

Steve –

Despite the numbers you present, in the last month 10 and 30 year Treasury rates have decreased from an already low threshhold. How is it possible that these rates

will remain low in the face of what is soon to be rapidly increasing inflation? Mr. Powell is obviously a very smart man who has access to the best research in the world. Why is he so sanguine about this? What is the linkage between inflation and long Treasury rates?

Hi Bill,

I get the idea that prices can rebound following the price drop during the recession. But it makes no sense to me that the level of prices should end up significantly higher than where they started — which is what we seem to be seeing in home prices, oil, other commodity prices. If labor shortages in construction, restaurants and bars results in higher wages that also seems like it is going to get passed on.

The question then is, how quickly does the Fed respond? My guess is they drag their feet even if inflation does climb fairly quickly.

Best.

Steve

Hi Max,

Thanks for your comments. While I think higher inflation is coming and that ultimately the Fed will have to tighten, please understand that we are talking about something that is still down the road a long ways. For the balance of this year and into 2022 the economy is going to grow quickly given all the stimulus money and the end of COVID, and we all feel great again and spend all that accumulated savings. Also, note that I am an economist and not some sort of financial advisor, but it would seem to me like this is far too soon to get into a defensive mode. Stock prices still seem to have lots of room to run.

Best.

Steve

Hi Frank,

You are right that long rates have dropped a bit in the past couple of weeks. If inflation really does climb and we actually begin to see it occur (rather than just a pickup in inflationary expectations), that is when you may get the next pop in long rates. The market is already expecting inflation to average about 2.5% over the next 10 years, so you will have to see something that tells them that inflation is going to be higher than expected.

The next question in my mind is, if the Fed really does see faster inflation, how quickly will the Fed respond to it? My guess is that they will drag their feet, and with an election coming in November of next year, I suspect that they will be unlikely to tighten after midyear. 2023 still seems like the soonest they might act.

I am a big lover of the Fed. I spent the first 10 years of my career at the Board in Washington. Greatest respect for the economists there. I always want to know what they think. But lately the Fed’s forecasts have been way off the mark. In June of last year they expected the unemployment rate at yearend to be 9.6%. By September the economy grew far more quickly than they expected and they trimmed the forecast of the yearend unemployment rate to 7.6%. By December the economy continued to grow rapidly and they finally got the unemployment rate down to 6.7% which is where it ended the year. Somehow the Fed was way off the mark so it makes me view their current forecast with several grains of salt. You say that Powell has access to the best information but, in this case, they were more wrong than just about anybody.

And I have always said that I thought Fed rate decisions were not impacted by politics. But with Chair Powell I am not so sure. In January he was talking about how the economy was in terrible shape. But yet Q3 GDP growth was 7.3%, Q4 growth was 6.6%. Forecasts for GDP growth for this year were for roughly 6.0% growth. The stock market was at a record high level. The unemployment rate had fallen faster than anybody expected. And yet according to Powell the economy is in danger? That makes absolutely no sense. My suspicion is that the man was making a case for the huge stimulus package that Biden wanted. Now that the package is passed he sounds far less pessimistic. Did he actually believe what he was saying? Or did politics dominate what he was saying? I vote for the latter.

Best.

Steve