February 3, 2012

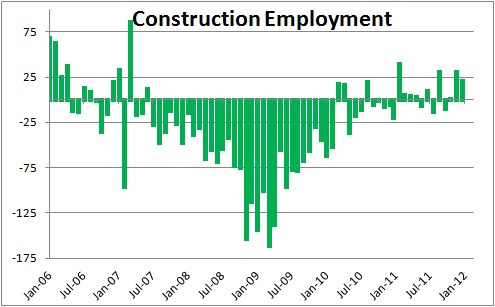

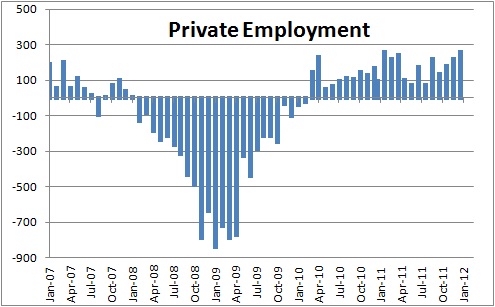

The January employment report was robust in every way, and it is not the first such report. It is hard to dismiss an unemployment rate that has fallen 0.8% in the past five months. It is hard to dismiss private sector job gains in the past three months that have averaged 218 thousand. It is hard to dismiss significant employment gains in the long-suffering construction sector that has begun to turn upwards after losing more than two million jobs in the past six years.

There can be little doubt that an unusually mild winter is contributing to the upswing, and for that reason one should not extrapolate the recent strength and carry it forward into the months ahead. The economy never moves in a straight line, and almost certainly winter weather will return at some point between now and mid-March. When it does the data will soften and people will once again become nervous. But what economists try to do is sort through the monthly wiggles and focus on the trend. That trend is not only upwards, but it is gathering steam with each passing month.

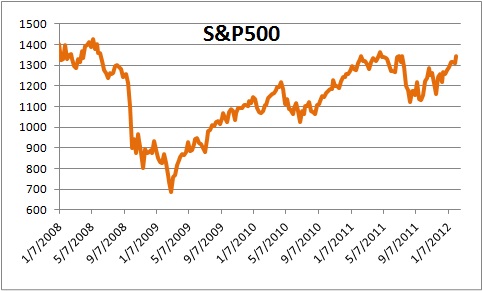

Look at the stock market. The S&P has now regained all of the ground that it lost last summer and is essentially at its highest level since mid-2008. That is not happening because we have had a couple months of good weather.

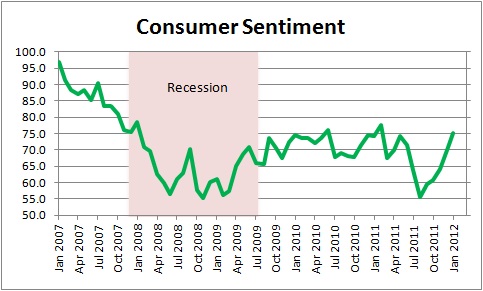

As the stock market recovers consumers gain confidence which, in turn, makes them more willing to spend.

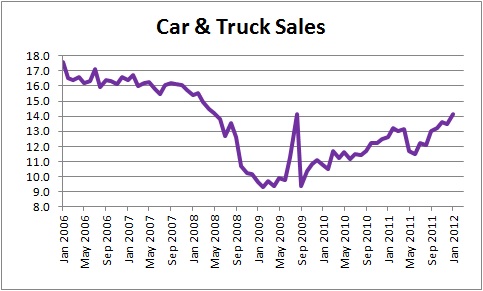

We do not yet know much about the likely pace of consumer spending in the first quarter, but we do know that car sales surged in January. The pace quickened from 13.5 million units in December to 14.1 million which is now the fastest pace of sales since the middle of 2008. It has even surpassed the temporary boost to sales caused by the “cash-for-clunkers” program in the middle of 2009. Consumers do not jump in to purchase big ticket items unless they are reasonably confident that the economy is on the mend.

Some economists may dismiss the recent turnaround in construction employment as being weather-induced. Clearly, weather may well be a factor that contributed to that apparent recent strength in the industry. But keep in mind that the December and January gains in employment were widespread and not associated exclusively with weather-dependent sectors. Factory jobs have quickened. Wholesale trade, professional and business services – like accounting, and employment services, health care, leisure and hospitality jobs have all been gathering momentum.

Furthermore, the pace of hiring has been steadily improving since September. We are not talking about some temporary, two-month, weather-induced fake out.

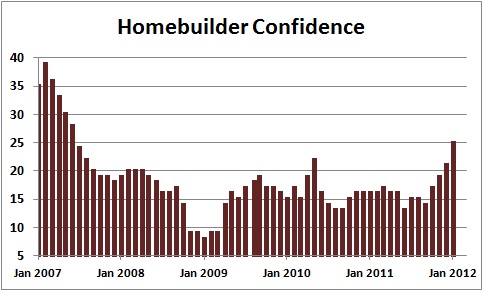

With respect to housing and the construction sector, virtually every housing/construction related indicator has been signaling for months that the turnaround was underway. In housing the pace of sales of previously-occupied homes has picked up. That faster pace of sales has reduced the inventory of unsold home to a near-record low level. Sensing this shortage of available housing, homebuilder confidence has jumped to its highest level in five years.

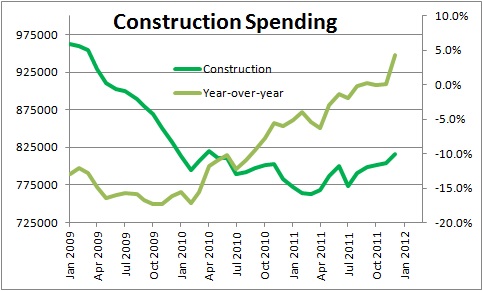

Construction spending in general, not just housing, has been on the upswing. Such spending has risen in eight of last nine months since hitting bottom in March. While part of the pickup is housing-related, the gain has been concentrated in the non-residential sector. What are they building? Stores and offices, schools, airports, factories, and power plants have all registered double-digit gains over the course of the past year.

Because the recession was so deep for so long and was so painful, consumers and business people have been reluctant to believe that the economy might actually be emerging from its slump. Until recently each tidbit of good news was dismissed as a temporary phenomenon. But eventually the upward momentum becomes so pervasive that it can no longer be denied. That time appears to be at hand.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me