September 12, 2014

Fed Chair Janet Yellen believes that the labor market remains soft and that the Fed should not raise rates until everyone who wants a job has one. We agree that the labor market is not yet at full employment but it will be by the spring of next year. We suggest that ample job opportunities exist, but employers are having a hard time finding workers with the necessary skills for employment. To a large extent the remaining unemployed workers either do not have the skills required for the jobs they seek, have expectations that are out of line with reality, and/or lack an incentive to work because they can earn almost as much from unemployment benefits. Low interest rates are not going to solve these problems.

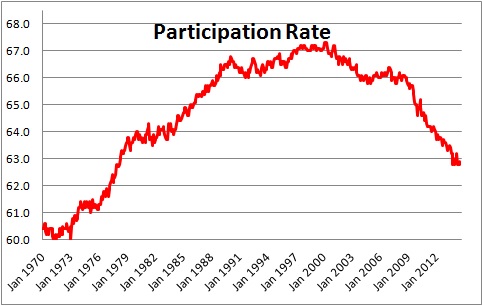

As evidence of labor market weakness Yellen frequently cites the steady decline in the participation rate which is the percent of our population that either has a job or is actively seeking employment. Her contention is that the rapid drop in recent years reflects workers who have become so discouraged about the prospect of finding a job that they have simply given up looking for employment. We do not accept her argument.

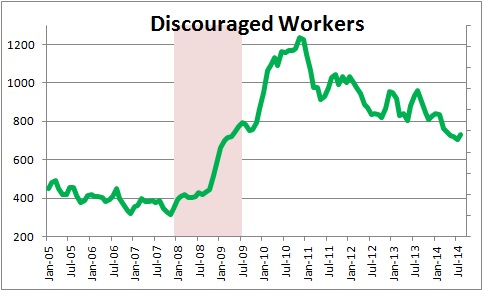

First of all, the number of discouraged workers is declining, not rising. If the unemployment rate is falling rapidly and is beginning to approach what has historically been regarded as a full employment level, why would anyone suddenly give up looking for a job? That defies logic.

We suggest that perhaps two-thirds of the recent decline in the participation rate has been caused by baby boomers who are retiring and thereby leaving the labor force. This means that the decline is largely attributable to demographics rather than an indicator of labor market weakness. Given that the baby boomers were born between 1946 and 1964, they should retire between 2011 and 2039. That roughly coincides with the time when the participation rate began to drop. When the baby boomers entered the labor force in the 1970’s and 1980’s, the participation rate rose sharply. Doesn’t it make sense that when they retire the participation rate should fall just as rapidly?

If the participation rate is falling for a legitimate reason, i.e., demographics, then the decline in the unemployment rate is not some statistical aberration that can be easily dismissed which is what Ms. Yellen is inclined to do. At 6.1% the current unemployment rate accurately portrays a labor market that is approaching full employment.

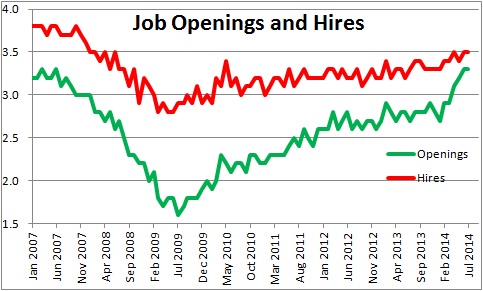

Yellen also seems to believe that there are a large number of unemployed workers who not only have the skills required for the job but are also willing to work. Again, we are not so sure. The reality is that there are plenty of job openings out there. Take a look at the chart below. Job openings have been rising rapidly but hires have been rising more slowly.

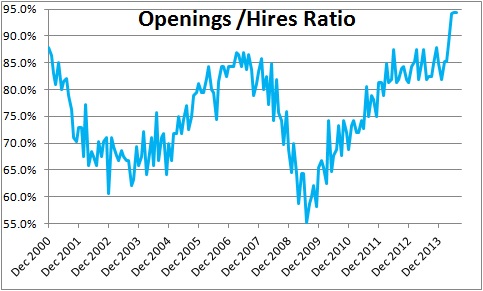

Indeed, the ratio of openings to hires has never been higher time since the inception of this series in 2000. Thus, there are plenty of jobs out there, but employers are having a hard time filling them. Why is that?

We suggest that the bulk of problem is that the currently unemployed and underemployed workers simply do not have the skill set required for employment. If they did, why aren’t they being hired? If they have the right skills, why haven’t discouraged workers begun to seek employment given so many jobs available? Why haven’t long-term unemployed workers been able to snag some of those jobs? Perhaps they have not bothered to go back to school to acquire the skills that are necessary. Why haven’t some current part time workers who claim they want full time employment stepped into those full time positions?

It is also likely that some currently unemployed workers find the combination of unemployment and/or welfare benefits sufficiently attractive that there is little incentive to take a full time job. They are therefore unwilling to accept some of the available positions.

Others may have unrealistic expectations about compensation. Perhaps they were laid off from a high paying job and are unwilling to settle for a lower paying position. Or perhaps they are a recent college grad and believe they can command a much higher salary than is possible. Once again, they are unwilling to accept the jobs that are available.

As the pool of available workers continues to shrink and employers have increasing difficulty finding the skilled workers that they need, they will undoubtedly hire some currently unemployed or underemployed workers and train them in house. But others may choose to work existing employees longer hours rather than hire someone new. Still others may choose to implement changes in technology that will enable them to boost output without increasing the size of their work force.

At this point no one knows exactly how much slack actually exists in the labor market. But if the Fed believes that the labor market is weaker than it actually is and delays raising short term interest rates as a result, it risks falling behind which means that ultimately it will have to play catch up by raising rates quickly at some point down the road. We believe that the labor market is strong enough that the Fed should start raising rates soon and proceed slowly rather than risk a more rapid pace later.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me