October 31, 2014

Third quarter GDP growth of 3.4% was respectable. But economists quickly noted that over the past year growth has been a disappointing 2.3%. What they fail to understand is that the economy is not going to grow much more rapidly than that.

The only way the economy can grow at all is if firms hire more people, or the workers that they already have become more efficient. The labor force part of the equation expands as a result of growth in the population or by immigration. The productivity part rises only if employers provide their workers with new technology which enables them to produce the same amount of goods in less time. Thus, the pace of economic activity has a speed limit which is commonly called “potential GDP”. It is the sum of growth in the labor force and the growth rate of productivity.

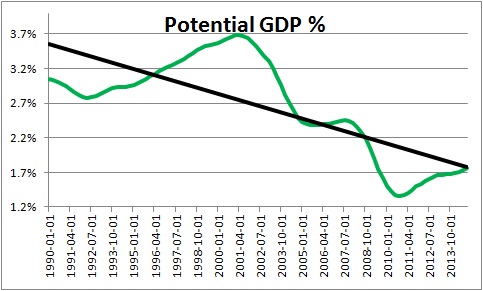

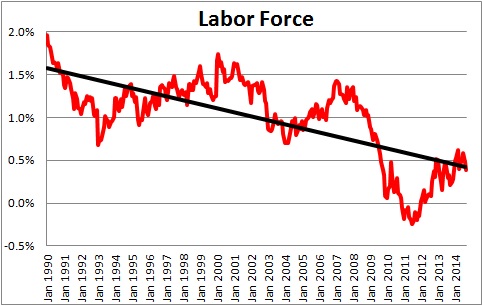

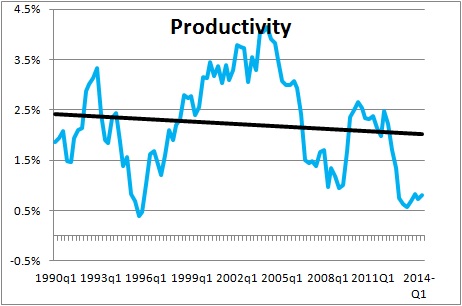

Throughout the 1990’s economists generally through that potential GDP was about 3.0% — 1% growth in the labor force and 2.0% growth in productivity. But potential growth is not constant over time. It can vary as growth in either its two components changes. Potential growth today is currently estimated to be growing about 1.8% – 0.4% growth in the labor force and 1.4% growth in productivity. What happened?

Throughout the 1990’s and early 2000’s the labor force climbed at about a 1.0% pace. But it slowed noticeably once the recession began in 2008 and is currently about 0.4%. Some economists contend that many workers became so discouraged about job prospects that they gave up looking for a job and dropped out of the labor force. The problem with that argument is that the number of discouraged workers has been steadily falling since the recession ended in June 2009. We contend that the bulk of the decline in the labor force reflects the baby boomers beginning to retire. They were born between 1946 and 1964. If they retire at age 65 they will retire (and drop out of the labor force) between 2011 and 2029. That roughly coincides with the timing of the sharp slowdown in the labor force.

Productivity growth accelerated in the mid-1990’s as firms adopted new technology – the internet in particular. But its growth has recently slowed to 0.8% because firms have been cautious about investing in the first five years of expansion given worries about both the durability and speed of the expansion.

Combining labor force growth of 0.4% and expected productivity growth of 1.4% we believe that potential growth today is 1.8%. In the 1990’s we expected GDP growth to average about 3.0% over the course of a business cycle. It cannot do that any longer. Over time it should average 1.8%.

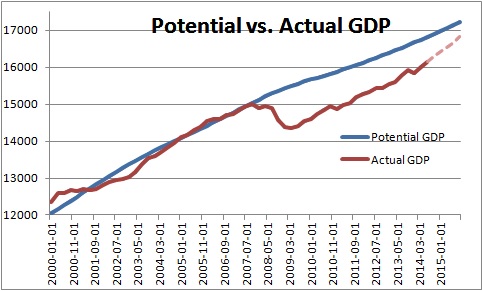

Actual GDP varies during the course of a business cycle. During a recession actual GDP declines. The unemployment rate rises and the factory utilization rate declines which means that the economy develops some slack. Actual GDP drops far below potential. When the recession ends the economy can grow quickly at first because of these idle resources. Eventually the slack disappears and the pace of economic activity slows to a pace more in line with potential.

In the current business cycle the recession was so severe that actual GDP fell far below potential as the unemployment rate soared to 10.0% (versus 5.5% at full employment) and the factory utilization rate slipped to 64% (versus 79% at full capacity). In the wake of this near-depression experience firms were reluctant to hire back all those workers they just laid off. Consumers were more interested in paying down debt than in spending. Thus, the economy is closing the gap between actual and potential GDP far very slowly than usual.

When potential GDP growth was 3.0% and the economy slipped into recession it was common to see growth rates of 4.0-4.5% for a few quarters once the recession ended as unemployed workers and idle plant capacity were re-employed. Thereafter growth would slow to 3.0%. But today with potential GDP growth just 1.8% we might see growth rates of 2.8-3.3% for a while. We should not expect to see several quarters when GDP growth surpasses 4.0%. The economy can no longer achieve that pace for any protracted period of time.

Until economists recognize that the economy’s speed limit has slowed, they will constantly be disappointed by GDP growth of 2.3%. We are not really disappointed at all. With 2.3% growth in the past year the economy continues to exceed it’s presumed 1.8% potential growth rate, the gap between the two gradually narrows This is the new normal.

Stephen Slifer

NumberNomics

Charleston, SC.

Follow Me