April 18, 2025

One can justify almost any forecast of the economic environment between now and yearend from recession with a big increase in the unemployment rate and a dramatic pickup in the inflation rate, to moderate growth with a slight pickup in inflation and a gentle nudge upwards in the inflation rate. But those forecasts to a large extent are dependent upon one’s expectation about tariffs – how high will they be, how long will they last, and how will other countries respond. The problem is that none of us have any idea what Trump is likely to do next. We can hope for the best and that the already imposed and threatened tariffs are bargaining chips that eventually create a more level playing field for trade between countries. But if that does not happen the far more pessimistic forecasts could be more accurate. Our sense is that right now consumers have bought into the worst-case scenario.

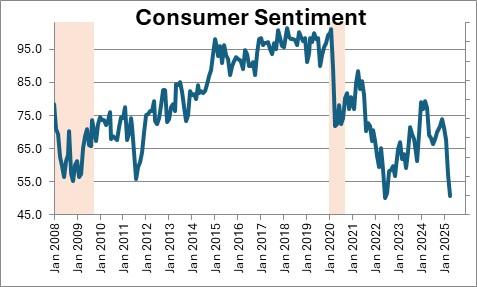

The University of Michigan’s series on consumer sentiment has plunged in recent months and is now lower than the low point in the 2008-2009 recession. But that was the longest and deepest recession since the Great Depression in the 1930’s and has been billed as The Great Recession. In that particular period GDP declined sharply for three consecutive quarters. The unemployment rate rose to 10.0%. Is that what we think is going to happen this time? Possible. But to get there one has to assume a worst case scenario for tariffs. In our opinion, the fear is overdone.

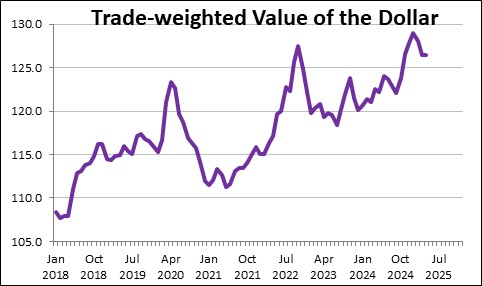

Economists who espouse a particularly dire economic environment get considerable attention in the press. Fear sells papers and attracts viewers. The press manages to find the dark side of every economic indicator that is released or every market movement. For example, a recent front page article in the Wall street Journal highlighted the fact that the dollar has dropped significantly since the beginning of the year. That is true, but it seems to paint a rather misleading picture. The article never pointed out that the dollar rose sharply in the final two months of last year and is currently exactly where it was in November. That does not strike us as a particularly troublesome change and certainly not indicative of a wholesale shift in foreigners willingness to invest in the United States. Further, the dollar registered far more significant declines in 2020 and 2022 and nobody talked about significant problems with the dollar during those periods of time. In today’s world the general view is that tariffs are a huge problem and will sink the dollar. People see what they want to see.

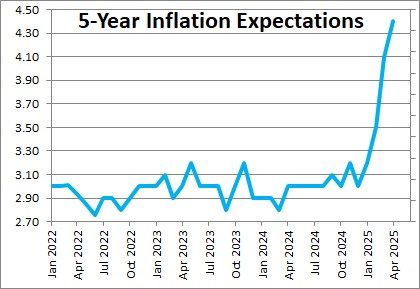

On the inflation front the press talks about dramatic increases in inflation expectations. But the data cited typically come from a survey. For example, the University of Michigan’s survey of 5-year inflation expectations has climbed from 3.0% at the end of last year to 4.4%. That is a scary. But consumers expectations of almost anything, whether that is GDP growth or inflation, are based to a large degree on what they read in the press. What consumer do you know who is sitting around trying to calculate GDP growth or the inflation rate?

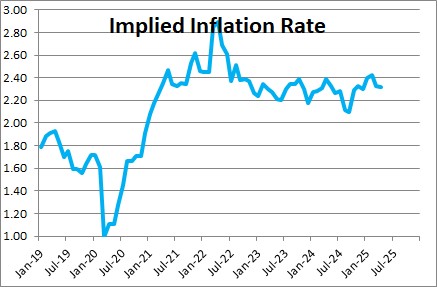

A more accurate barometer of inflation expectations can be formed by the difference between the nominal rate on the Treasury’s 10-year note and its inflation-adjusted equivalent. The difference between the two represents the market’s implied inflation rate over the next decade and is the conclusion of thousands of investors in the U.S. Treasury market. It is currently 2.3% and it has been at roughly that same level since the beginning of 2023. So who should you believe? The opinion of a bunch of probably ill-informed consumers? Or the expectation of thousands of investors in the U.S. Treasury market?

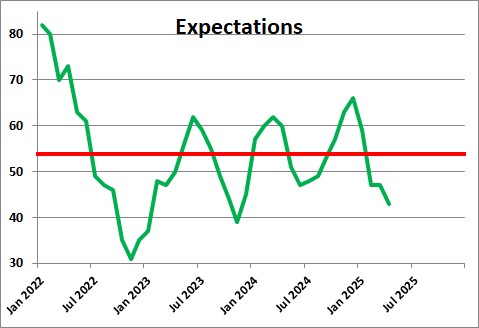

Then there is the survey of homebuilder confidence, in particular the expectations component of the overall index. It has fallen 23 points or 35% since the end of the year. That, too, seems scary. But this series is highly volatile and has fluctuated widely between 40-60 for the past couple of years. Its average has been 53 during that period of time. In December builders were as enthusiastic as they have been since mid-2022. Now they have swung in the other direction. Who knows where they might be next month.

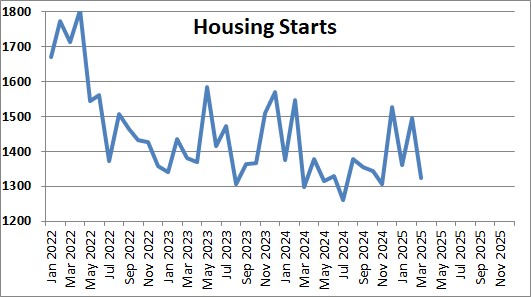

What builders are actually doing can be seen from the data on housing starts. On a monthly basis starts are very volatile which makes any month’s change hard to interpret. In the past four months starts have moved up or down by 10% or more in each month. However, it is clear that starts have slowed from roughly 1,750 thousand in early 2022 to 1,400 thousand today. Given the dramatic increase in mortgage rates from 3.0% to 6.7% that makes sense. But it is also clear that starts today are roughly where they have been for the past two years and the economy continued to chug along nicely in that period of time.

In conclusion, it is clear that tariffs will both slow GDP growth and boost inflation. The question is one of degree and that, in turn, depends upon the assumptions about tariffs described earlier. But making one’s assessment of what is likely to happen in the months ahead using data derived from surveys which are volatile and determined to a large extent by what people read in the media, can lead to inaccurate conclusions.

It is clearly an uncertain environment and considerable volatility should be expected, but try to avoid jumping onto the worst case scenario until we have a better idea of what Trump is actually going to do.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me