April 15, 2016

Early this year oil prices plunged, the stock market followed suit, commodity prices fell, and the expansion appeared vulnerable. But in the past couple of months that scenario has turned on a dime. Crude oil prices have jumped 60%, the stock market has rebounded and is approaching a record high level, and commodity prices have turned upwards. What in the world is happening?

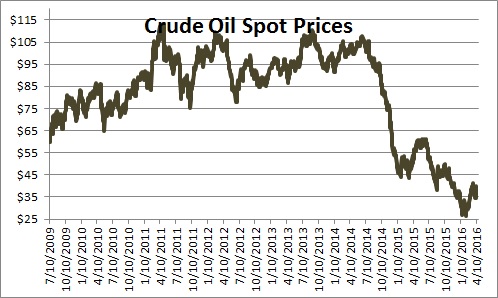

The most dramatic change was in the oil market. Crude oil prices appeared to stabilize in the fall of last year but resumed their slide in November. Prices fell from the mid-$40’s to a low of $26 by mid-February as the global supply and demand imbalance pushed prices inexorably lower. However, global production is about to shrink.

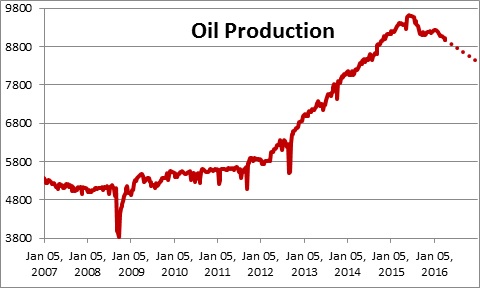

The Energy Department expects U.S. production to slip from its current pace of 9.0 million barrels per day to 8.4 million by yearend and to 8.0 million in 2017. At the same time oil ministers from OPEC nations and Russia could decide this weekend to cap production. As a result, oil prices have rebounded from a mid-February low of $26 per barrel to $42.

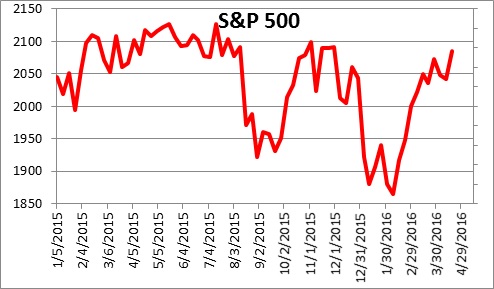

Changes in crude oil prices have perversely impacted the stock market. On balance lower oil prices stimulate economic activity in the U.S. as consumers, manufacturing firms that use oil, and transportation companies all benefit. But the markets have chosen to focus on the negative impact on companies in the oil sector and possible adverse consequences for financial firms exposed to energy. The drop in oil prices caused the S&P 500 to fall 11% between November and mid-February, but rebound by an equivalent amount between mid-February and mid-April as oil prices surged. The index is now within 2% of the record high level set in July of last year.

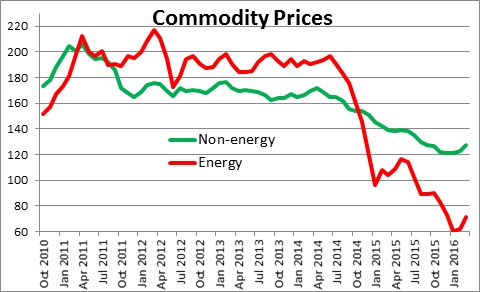

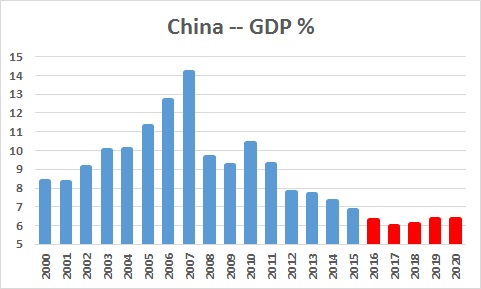

Meanwhile, commodity prices have been declining steadily for 18 months. The drop has been led by falling crude oil prices but accentuated by declines in virtually every type of commodity — copper, lead, zinc, aluminum, gold and silver, meats, seafood and poultry. The drop is attributable to the combination of both the global oil glut and slower growth in China which has reduced the demand for raw materials. But perceptions have recently shifted. The global supply of oil is finally expected to decline and growth in China has shown tentative signs of stabilizing. As a result, commodity prices have turned upwards.

While swings in oil prices, stock markets, and commodities have been dramatic (and sometimes unnerving) the impact on economic activity appears to have been muted. First quarter GDP growth (the first estimate of which will be released on April 28) should be about 1.0% after registering growth of 1.4% in the fourth quarter. But it is important to remember several things. First, the steady drop in oil prices has sharply reduced investment spending by firms in the oil patch as they curtail research and development spending and reduce purchases of oil drilling equipment. Second, the dramatic decline in the stock market early this year has made consumers and businesses a bit edgy and slightly less willing to spend. Finally, the steady increase in the value of the dollar has whacked growth in exports. Going forward these economic headwinds are likely to disappear.

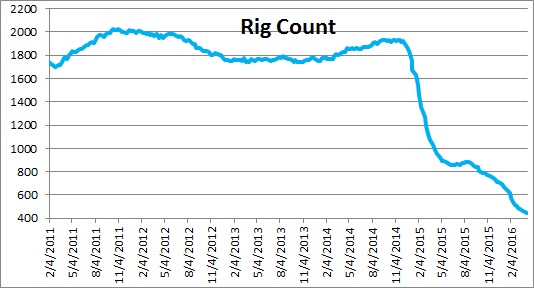

The 60% increase in crude oil prices between mid-February and mid-April suggests that the relentless drag on GDP growth from a 77% drop in the number of oil rigs in operation since September 2014 may be nearing an end. The rebound in oil prices should also reduce the potential negative impact on financial firms with exposure to oil. That combination of events has lifted the stock market higher to a near record level which will allow both consumers and corporate America to breathe a collective sigh of relief and, hopefully, stimulate their willingness to spend.

First quarter GDP growth for China turned out to be 6.7% — the same as 2015. The sharp slowdown in GDP growth in China has decimated the economies of emerging countries – particularly emerging nations in Asia. Any hint that GDP growth in China might be stabilizing after its long slide has lifted commodity prices which should, in turn, ease the plight of those countries.

So while the adverse movement in oil prices, commodities, and stock markets may have trimmed GDP growth in the first quarter, reversing those movements should bolster growth in the second quarter and beyond. We expect GDP growth in the first quarter to be about 1.0% followed by growth in the subsequent three quarters of about 2.5%.

For the Fed the modest growth reported in the fourth and first quarters combined with a still below target rate for inflation will leave the Fed on hold at its meeting later this month. But if economic indicators for the second quarter confirm a faster pace of economic activity, and if inflation forecasts are pushed higher by the rebound in oil and commodity prices, a second Fed rate hike still seems likely for June. While markets have fluctuated wildly in recent months, changes in the underlying pace of economic activity have been quite modest.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me