September 22, 2023

This past week the Federal Reserve left the funds rate unchanged at 5.5%, which is exactly what was expected. While the Fed may not have raised the funds rate, the bond market took matters into its own hands and significantly raised every other interest rate across the entire maturity spectrum. The stock market also got hammered in the wake of the Fed’s decision. What happened? The primary culprit seems to have been triggered by the Fed’s so-called “Summary of Economic Projections”. The Fed now sees slightly more rapid GDP growth next year and a slightly higher unemployment rate. As a result it will have less room to cut the Fed funds rate in 2024. In June the Fed suggested that it might be able to reduce the funds rate from a peak of 5.75% late this year with four 0.25% rate cuts in 2024 bringing it to 4.75% by yearend Now it suggests that only two 0.25% rate cuts to 5.25% are likely. This was not the scenario market participants had come to expect. Meanwhile, the United Auto Workers Union has escalated its strike against all of the “Big Three” automobile manufacturers. At the end of September, after a three-year hiatus, student loan borrowers will have to resume monthly payments on their debt. Also, without budget legislation getting passed in Washington by September 30 there is the likelihood of a government shutdown beginning on October 1. If that occurs some of the important economic data for September such as the employment report and the CPI will be delayed. Markets do not like uncertainty and the near-term economic environment seems filled with it.

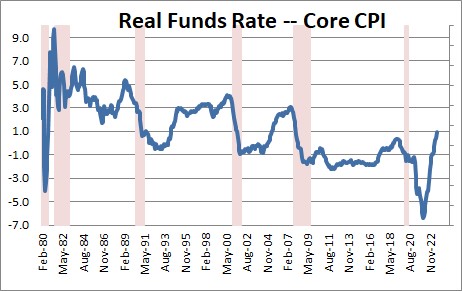

First, with respect to interest rates, the way to judge whether the Fed funds rate is appropriate is to examine the funds rate in real terms. Today the Fed funds rate is 5.5%. The year-over-year increase in the core CPI is 4.4%. Thus, the real funds rate is the difference between the two numbers or 1.1%. In prior business cycles the real funds rate peaked at about 3.0%, We suggest that by the end of the first quarter of 2024 the Fed will have raised the funds rate to 6.0%. Meanwhile, the core CPI will have slipped to 3.6%. Doing the subtraction implies a real funds rate at that time of 2.4% which seems more in keeping with history. Unfortunately, none of us can accurately determine the peak level for the real funds rate. In addition to Fed action, it depends in part on how quickly the inflation rate subsides. Prior to the Fed’s tightening initiative that began in March 2022 the Fed funds rate was 0.0% and the core CPI was 6.5% which meant that the real funds rate was negative 6.5%. Fed policy was wildly stimulative. But now with the real rate positive at 1.1% and likely to be 2.4% by March the Fed seems to be getting close to the peak and should proceed cautiously.

What seemed most problematical for the bond market was that the Fed said that it now expects only two 0.25% rate reductions in 2024 which would reduce the funds rate to 5.25% by yearend, versus four rate cuts that it anticipated in June.

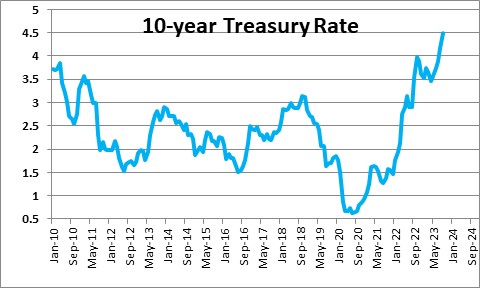

The higher outlook for interest rates was clearly bothersome for the bond market. The yield on the 10-year Treasury note rose 0.25% in just a few days and at 4.5% it is now the highest it has been since October 2007.

Meanwhile, the United Auto Workers Union has now escalated its strike against all of the so-called “Big Three” automobile manufacturers. Nobody knows how long the strike might continue, but it is clear that it will have a negative impact on the economy as long as it persists. Auto workers will get laid off. This will curtail their ability to spend. Fourth quarter GDP growth, which is already expected to slow from 3.5% in the third quarter to 1.7% in the fourth quarter, could be even softer.

At the end of this month student loan borrowers will have to resume monthly payments on their debt for the first time in three years. That means that $200-300 per month that had been available for spending will now get rerouted to the federal government. While mortgage debt outstanding is far and away the largest category of consumer debt (70%), student debt (at 9%) is now tied with auto loans as the second largest category. This hit on consumer spending should not be dismissed.

Finally, there is likely to be a government shutdown on October 1 if no budget legislation gets passed by the end of this month. Typically, this situation does not have a big impact on overall GDP growth, but it does suggest that important economic statistics for September like the employment report and the CPI will be delayed.

Markets do not like uncertainty. Between higher interest rates, still bloated inflation, strikes, student loans, and a government shutdown, the market has a lot on its plate.

But eventually strikes end and the economy rebounds, our legislators pass the bills required to get the government back in business, and growth will rebound. At this point we do not want to alter our longer-term outlook which calls for particularly soft 1.0% GDP growth in the first two quarter of next year — but no recession, a peak funds rate of 6.0% early next year eventually dropping to 4.75% by yearend, and inflation slowing from 4.4% currently to 3.0% by the end of 2024. If those forecasts are correct the Fed will have achieved the often elusive soft-landing. Kudos to the Fed if that happens. But, as always, we will see.

Stephen Slifer

NumberNomics

Charleston, S.C.

Like the real funds rate graphic, we always see the current rate and how “high” it is in relation to the last few years.

Hi David,

Higher for sure. But high enough???? Who knows.