March 3, 2017

Fed officials have hinted that the first of the Fed’s three expected rate hikes this year will occur on March 15. That will undoubtedly encourage speculation that the Fed will raise the funds rate more than three times this year. We are not yet prepared to go there. It appears to us that GDP growth will accelerate somewhat this year and inflation should rise gradually. If so, there is no compelling reason for the Fed to alter its basic game plan – three rate hikes this year followed by additional slow but steady increases in the funds rate in 2018 and 2019.

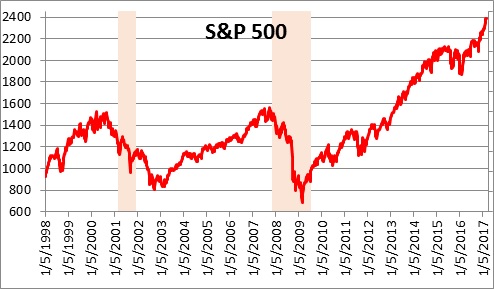

The sooner-than-expected rate hike has been influenced by a variety of factors. First is the stock market. It has risen 14% since the election. Some argue that the stock market is overvalued. But before one goes too far down that road keep in mind that the stock market reflects a discounted stream of future earnings. If one believes that tax cuts, regulatory relief, and a resurgence of infrastructure spending are forthcoming, corporate earnings are likely to grow at a double-digit rate this year. We believe that the S&P 500 index will continue to climb as the year progresses – but not necessarily in a straight line.

Second, President Trump’s speech to the joint session of Congress was the most presidential of his short tenure in office. The policies he advocates are the same ones he pushed during the campaign, but the tone was different. In contrast to his other speeches he urged the American people and members of both parties to come together for the good of the country. The possibility that our president can actually be presidential was highly encouraging. He still must get Republicans and Democrats on board to implement policy changes and that will not be easy, but the change in tone was encouraging.

Third, in his speech President Trump said, “Since my election, Ford, Fiat-Chrysler, General Motors, Spring, Softbank, Lockheed, Intel, Walmart and many others have announced that they will invest billions and billions of dollars in the United States, and will create tens of thousands of new American jobs.” Many of those pledges were almost certainly done to appease President Trump and ensure that he did not direct an angry tweet in their direction. And some of that spending and many jobs may never materialize. But it is hard to deny that something is happening that will boost investment spending, stimulate GDP growth, and create more jobs.

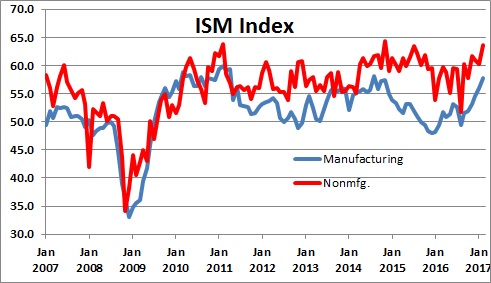

Fourth, business confidence is soaring The Institute for Supply Management (ISM) index for manufacturing firms has risen in each of the past six months and now stands at 57.7. That is the highest reading in more than two and one-half years. These firms are seeing their order books rise, they intend to keep hiring for the foreseeable future, the backlog of orders has begun to rise, and virtually every firm has seen prices rising. The index for non-manufacturing firms (which covers almost 90% of the economy) looks similar. The ISM indicates that current levels for these two indexes are consistent with GDP growth of 3.5-4.0%. Something is happening.

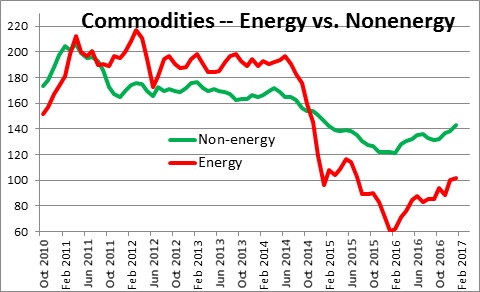

Fifth, respondents to the ISM survey report that prices have risen in recent months and it reflects increases in commodity prices across the board. Energy prices have climbed. But so have non-energy commodity prices including agricultural raw materials, food, industrial metals, and industrial materials. Something is happening.

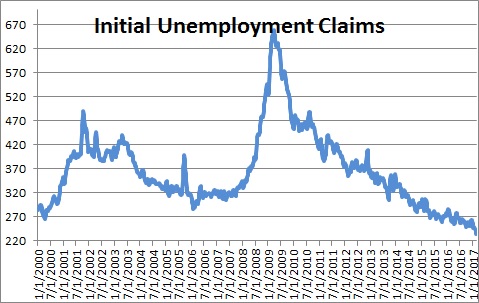

Sixth, the labor market continues to tighten. Initial unemployment claims – a measure of layoffs – has fallen to 223 thousand which is the lowest level since April 1973 — 44 years ago! Something is happening.

From the Fed’s viewpoint these developments provide assurance that the economy is truly gathering momentum. The days of anemic 2.0% GDP growth are over. The days when inflation was near 0% and a whiff of deflation was in the air are over. The downside risk to economic growth has largely disappeared. The time for 0% interest rates has come to an end. The Fed recognizes this and has announced its intention to gradually raise the funds rate until it eventually reaches its so-called “neutral” level of about 3% by 2020.

We expect GDP growth to pick up gradually this year to 2.4% from 2.0% in 2016 and the core CPI to increase to 2.5% this year from 1.9%. Those projections are roughly in line with what the Fed expects. But in view of the developments described above, it is possible that the economy could expand more rapidly this year and inflation could be higher than expected. If things turn out to be surprisingly strong it is prudent for the Fed to take advantage of the current positive economic environment and make its first rate hike of the year now.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me