May 16, 2025

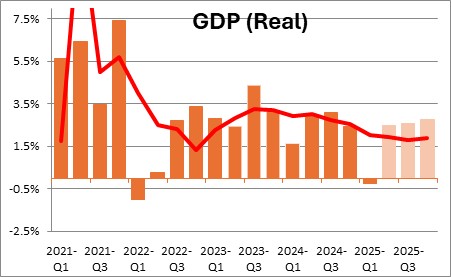

It appears that Trump’s recent tariff relief will continue for some time to come. While the reprieve is only guaranteed for 90 days, it is likely that upon expiration of the 90-day period the lower tariffs will be extended until such time as a permanent agreement can be made. Second guessing the president is always a tricky business and the uncertainty has not been removed entirely, but we believe that the global market turmoil caused by his initial announcement in early April which erased trillions of dollars of market value, heightened uncertainty by all players, and left firms stumped on how to plan for the future has caused a re-think on the part of the Administration. The worst seems to be over. Certainly stock investors appear to have reached that conclusion. We expect those abysmal readings for consumer, business, and builder confidence to climb in the months ahead and GDP growth in the final three quarters of the year to rebound to 2.5% or so.

Following the president’s reprieve on tariffs, all stock market indices have rallied vigorously. After briefly falling by 20% the S&P 500 index has soared and is now down just 3.5% from its mid-February peak. As consumers review the value of their stock holdings it is almost a sure bet that consumer sentiment will rebound.

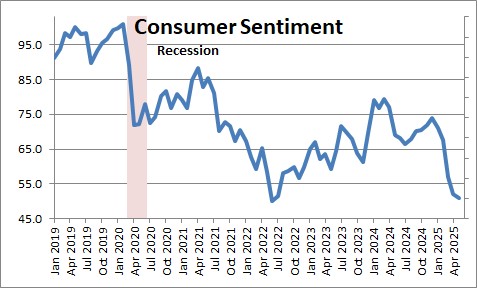

Consumer sentiment for May continued to decline and now stands at 50.8 which is lower than it was in 2020 and lower than it was at the bottom of the so-called “Great Recession” in 2008-2009. This makes no sense to us. The Surveys of Consumers Director Joanne Hsu pointed out that the vast majority of survey responses for May were received prior to the president’s change of heart about tariffs. That news combined with the stock market revival should bolster consumer spirits in the months ahead.

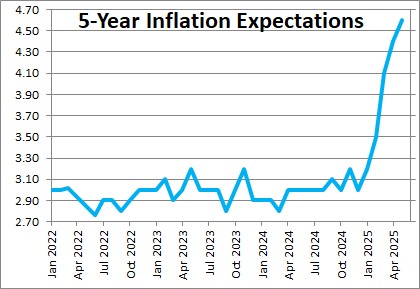

The University of Michigan’s survey of consumer sentiment indicated that consumer’s 5-year inflation expectations continued to climb to 4.6%, presumably as the result of tariffs. But that, too, makes little sense. It implies that the Fed will completely abandon its 2.0% inflation target. Not going to happen.

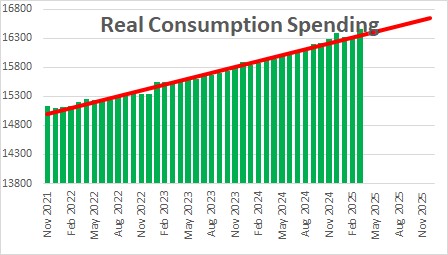

The good news is that the pace of consumer spending has not followed the extreme drop in sentiment. That link appears to have broken. When asked, consumers indicate clearly that they are nervous, but they are not yet prepared to significantly cut their pace of spending. While we would not necessarily expect a faster pace of spending in the months ahead, we clearly do not expect a pullback. We expect consumer expenditures to grow at a 2.0-2.5% pace for the balance of the year.

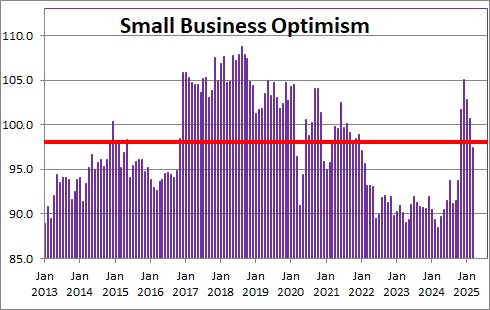

Small business owners have also become more cautious in recent months and sentiment has dropped from 105.1 at the end of last year to 95.8 in April. That is a steep decline but it is important to note that even at 95.8 small business optimism is significantly higher than at any time in the past three years during which the economy grew at a respectable pace. The revised tariff outlook and stock market rebound seems certain to have boosted the optimism of small business owners.

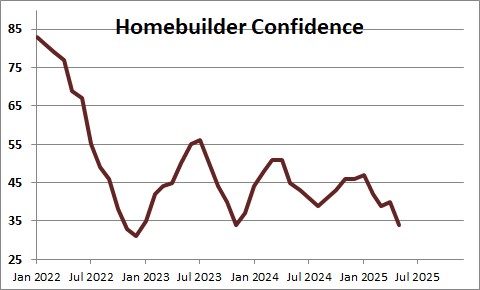

And, along the same lines, homebuilder sentiment has plunged and builders have become cautious as elevated interest rates, policy uncertainly, and the higher cost of building materials associated with the tariffs have taken their toll. But a reduction in the announced tariffs and stock rally should encourage builders to get back in the game. We expect the residential spending component of GDP to climb at a 5.0-6.0% pace in the final three quarters of the year.

We hoped all along that the initial 145% tariff on Chinese imports would prove to be a bargaining chip which would be negotiated lower via talks between the two countries. For that reason we never expected the initial tariff announcement to result in a recession in the U.S. Given recent developments we certainly do not now expect a recession in the U.S. later this year. Instead we anticipate GDP growth of 2.5%, 2.6%, and 2.7% in the final three quarters of this year.

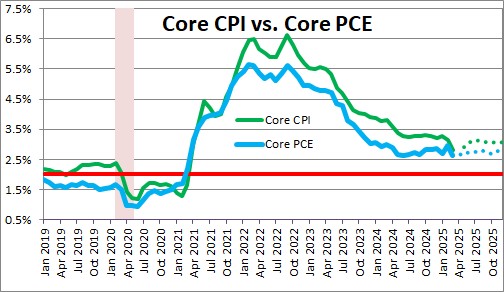

On the inflation front we do not expect tariffs to add significantly to the inflation rate this year, but it is almost certain to counter any further reduction. For what it is worth we expect the core CPI to rise 3.1% in 2025 and the core personal consumption expenditures deflator to rise 2.8%. The PCE deflator is the inflation gauge the Fed wants to see climb at a 2.0% pace. Inflation has clearly dropped from its peak levels in mid-2022, but its improvement has stalled for the past year.

So where does this leave the Fed? Probably on hold for the balance of the year. If we are right that GDP climbs at a fairly steady 2.5% pace, the unemployment rate remains at roughly its full-employment threshold of 4.2%, and the preferred inflation measure is stuck at 2.8% through yearend, it is hard to make a case for the Fed to ease. Nevertheless, the markets keep looking for two rate cuts between now and yearend. Maybe, but that is not our call.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, Since most consumers get their news from social media or national news, always doomsayers, it’s no wonder they have high inflation expectations. Bad news always sells. I get my economic news from Steve Slifer, an eternal optimist.