January 18, 2019

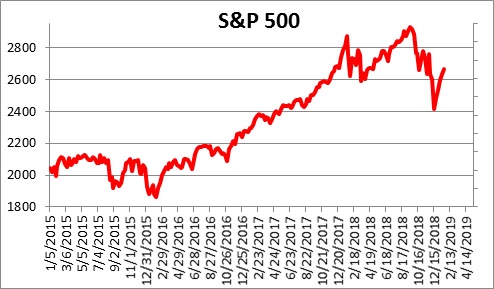

In the first three weeks of January the stock market recovered one-half of what it lost in the fourth quarter. Investors have found renewed optimism. The catalysts for the downturn included slower growth from China, a steady drumbeat of rate hikes by the Fed, weakness in the housing market, and concern about the impact of the government shutdown. Some pundits feared a recession as early as the end of this year. But in the past couple of weeks many of those fears have been reduced . While the government shutdown rolls on, it is important to remember that almost all of what is lost during the shutdown will be recovered in subsequent months.

The S&P 500 hit bottom on Christmas Eve and has been climbing slowly but steadily for three weeks. While the downslide was unnerving, we did not see corresponding weakness in the economic statistics, so we concluded that the drop was primarily attributable to exaggerated stock market volatility and, therefore, was not a harbinger of slower growth in the months ahead. We have no reason to change that view.

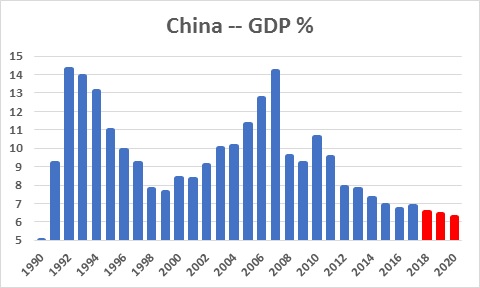

GDP growth in China is clearly slowing. The IMF currently estimates 2018 GDP growth for China of 6.5% with even slower growth expected in 2019 and 2020. For most countries 6.5% growth would be welcome news. But for China that would be the slowest rate of expansion since 1990. But two things are important.

First, much of China’s slower growth woes have been caused by the U.S.-imposed tariffs. With trade representing nearly one-half of the Chinese economy versus about 10% in the United States, China has much more to lose in a trade war. Since tariff talk began in the early part of last year, the Chinese yuan has declined almost 10%.

That, in turn, has caused the Shanghai Composite stock index to fall 23%. Slower growth in exports will negatively impact Chinese GDP growth for the foreseeable future.

The U.S. does not come out unscathed. Growth in the U.S. will be reduced as well. Both countries lose, but China loses far more than the U.S. Thus, the pressure is on both countries, the Chinese in particular, to reach a deal. The U.S. is not asking not just for a trade deal, it is asking China to completely alter its way of doing business. The U.S. wants China to recognize our patent and copyright laws. Quit stealing trade secrets. Stop forcing companies to share their technology as a prerequisite for permission to do business in China. Despite those harsh requests, we still expect some sort an agreement to be announced in the months ahead and recent talks are encouraging. Both countries can claim victory. Once that happens stock markets around the world will rebound as investors’ concerns about a significant slowdown in China’s GDP growth will be alleviated.

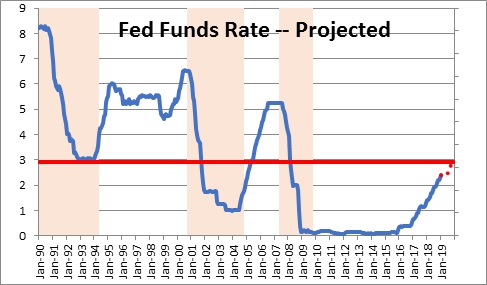

But there is more going on than just China and trade. Late last year the markets feared that the Fed would raise rates three times this year. In mid-December the Fed lowered its expectation of rate hikes this year from three to two. At the same time, it said that it would refrain from further rate hikes until some of the current economic uncertainty and market angst disappears, which probably means no further rate hikes until midyear. That is also good news.

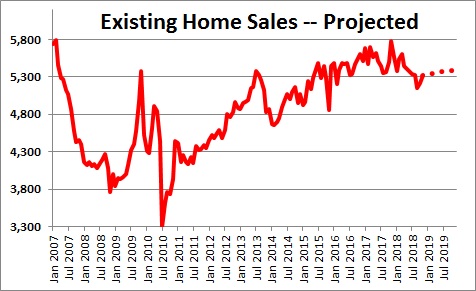

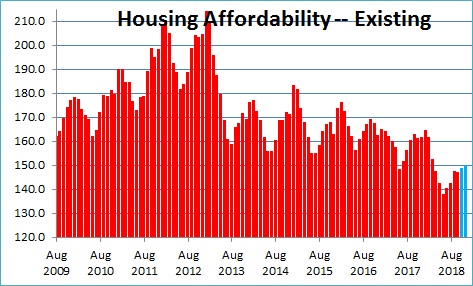

Finally, home sales took at big hit last year. Some believe that the combo of higher home prices and higher mortgage rates has made housing less affordable for many Americans. For those economists, recent developments should allay their concern.

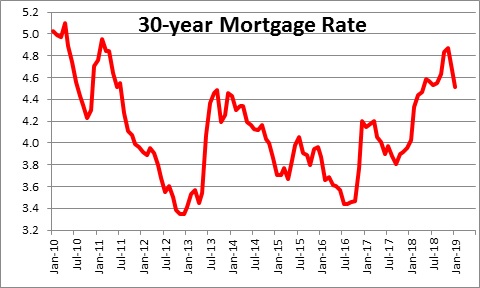

As the stock market swooned and a fear of slower growth materialized in the fourth quarter, mortgage rates fell from 5.0% to 4.5% which is where they were last summer.

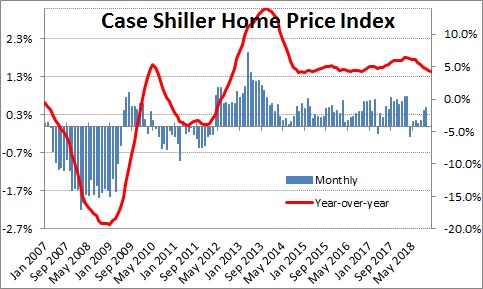

At the same time, the run-up in home prices has slowed dramatically. The year-over-year increase has ebbed from a peak of 6.4% at this time last year to 4.7%. And data for the last six months suggest a further slowdown to about 3.0%.

These developments mean that housing has become more affordable for the average American family. The National Association of Realtors series on housing affordability has climbed from 138 a few months ago to almost 150 currently. That means that a median-income family now has 50% more income than is required to purchase a median-priced home. Increased affordability should re-invigorate home sales in the months ahead.

These are all small, tentative developments but, collectively, they provide support for the notion that any slowdown in economic activity will be modest and perhaps short-lived.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me