January 12, 2018

Solid economic data and a string of record high levels for the stock market are stoking fears that the economy may soon overheat which would boost the inflation rate and induce the Fed to accelerate the pace of rate hikes. Such fears have boosted long-term interest rates and encouraged investors to reallocate a portion of their investment portfolios from bonds into stocks. Expect more of the same. In the months ahead, bond rates and stock prices are headed higher.

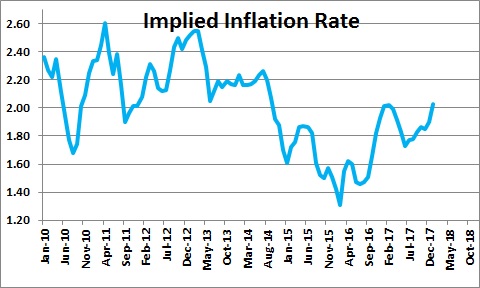

One gauge of the expected inflation rate is to compare the actual yield on the 10-year note to the comparable inflation-adjusted rate. The difference between the two is a measure of the bond market’s expected inflation rate during the next 10 years. It recently climbed above the 2.0% mark which is the highest it has been since mid-2014. Because we believe the overall CPI inflation rate in 2018 will climb to 2.4% and average 2.3% or so for the next decade, the expected inflation rate is probably headed higher.

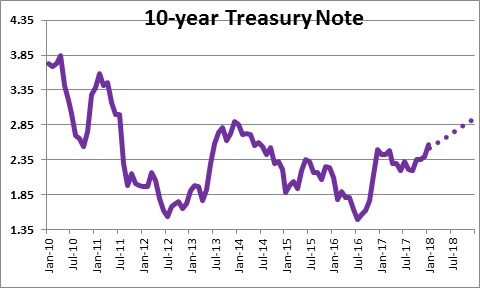

This combination of robust economic growth and higher inflation has boosted the yield on the 10-year note to 2.56% which is the highest rate since mid-2014. Three expected rate hikes by the Fed later this year and a gradual pickup in the inflation rate to 2.4% should boost the yield on the 10-year note to 2.9% by yearend.

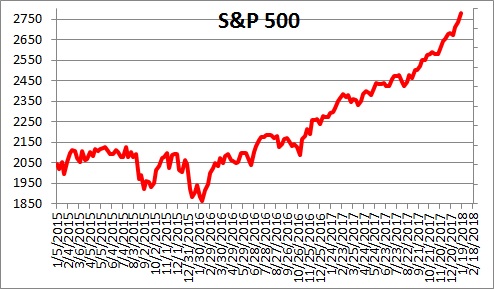

The market is suddenly awakening to the fact that inflation and long-term interest rates are going to rise in the months ahead. As a result, investors are likely to re-think their portfolio allocation between stocks and bonds. Their investment advisor is likely to recommend a shift out of bonds (the price of which declines as interest rates rise) into stocks. Indeed, portfolio reallocation may explain some of the stock market’s exuberance in the first two weeks of January.

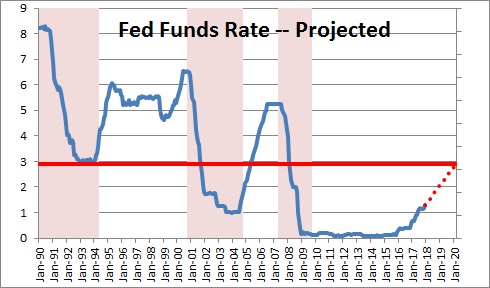

Does any of this change our view of the economy? Not at all. We continue to expect GDP growth to quicken from 2.7% in 2017 to 2.9% this year as investment spending accelerates. We expect the core CPI to rise from 1.8% in 2017 to 2.2% in 2018. And we think the Fed will raise rates three times as the year progresses. The reality is that interest rates – both short and long rates – remain low by any historical standard. For example, at its projected yearend 2018 level of 2.0% the federal funds rate is about one percentage point lower than the so-called “neutral”” rate of about 3.0%. Even though rates should continue to climb as the year progresses, they remain well below the level that could threaten the expansion. That point is unlikely to be reached until sometime in the early 2020’s.

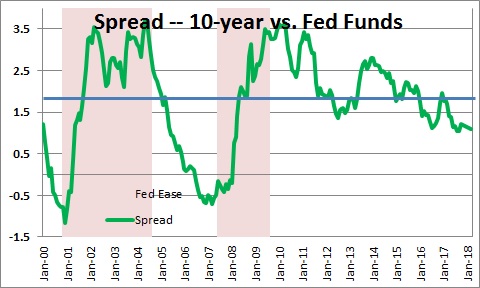

The other financial market indicator that would worry us is if the U.S. Treasury yield curve were to ”invert”, which means that short rates are higher than long rates. Such an event is frequently a precursor to recession because it means that the Fed is aggressively raising short rates (the federal funds rate) to slow down the pace of economic activity and short circuit a further pickup in the inflation rate. Note that prior to both the 2000 and 2008-09 recessions the Fed raised short-term rates to about 0.5% higher than long-rates, i.e., the yield curve was inverted. With the funds rate today at 1.3% and the yield on the 20-year note at 2.5% the yield curve has a positive slope of 1.2%. It has been getting steadily flatter for the past couple of years and some worry about a possible inversion later this year. That is not going to happen. Yes, the Fed will raise short-term interest rates by about 0.75% this year to 2.0%, but with the inflation rate climbing we expect the yield on the 10-year note to climb to 2.9%. So by yearend our expectation is that the curve will be 0.9% — somewhat flatter than it is currently, but in no danger of inverting.

So, all is well. The earlier anticipation and now the reality of tax cuts is having the desired effect of stimulating growth in the economy. Our first look at fourth quarter GDP growth will be on Friday morning, January 26 and it should be about 3.5%. If that forecast is accurate, it would be the third consecutive quarter with GDP growth above the 3.0% mark. There can no longer be any doubt that the economy has shifted onto a faster growth track.

Stephen Slifer

NumberNomics

Charleston, S.C.

Good to hear “all is well.” I was wondering about the overheating. I guess we just keep an eye on it. Thank you for your insights; I always appreciate them.

Darrel Staat