May 10, 2019

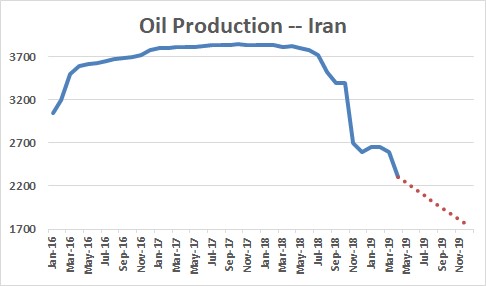

The waivers on U.S. sanctions for purchases of Iranian oil expired earlier this month. Oil exports from that country have plunged and the drop-off in economic activity in Iran has accelerated. But will this deteriorating economy result in the regime change that Trump desires, or merely heighten Iran’s resolve to retaliate?

Trump has raised tariffs from 10% to 25% on almost every Chinese export to the U.S. Unlike the earlier round which targeted goods used by businesses in the production process, this round will impact a broad array of consumer products and be far more visible. Not surprisingly, China has said it intends to retaliate but it has not yet provided details of what that might look like. Higher tariffs will adversely impact both countries, but they will hit the Chinese economy far harder than the U.S. Will this force the Chinese back to the bargaining table which is what Trump is trying to do? Or simply broaden the trade war and reduce global GDP growth for the second half of this year and 2020?

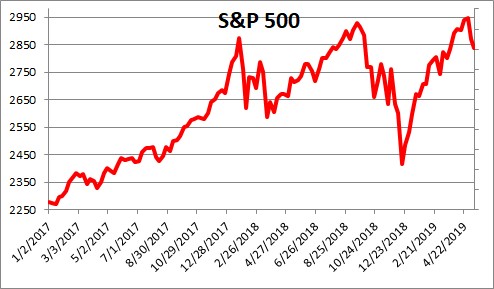

Finally, North Korea has resumed testing short-range missiles which heightens tensions in yet another corner of the world. The stock market has noticed all of these events but, thus far, the reaction has been muted.

Iran. The sanctions on Iranian oil exports have sharply curtailed oil production in that country which has been cut almost in half from what it was a year ago and it is expected to continue shrinking throughout the summer. The IMF expects that GDP growth in Iran will fall 6.0% in 2019 after having declined 3.9% last year. Highlighting the importance of oil production to the Iranian economy, the unemployment rate has risen from 11.9% in 2017 to an expected 15.4% this year. Inflation has accelerated from 9.6% in 2017 to more than 37% this year. No wonder Iran’s leaders are furious with the United States and have threatened to retaliate which often takes the form of heightened terrorist activity against the U.S. and its allies. While the negative impact of sanctions on the Iranian economy are obvious, they seem unlikely to result in the regime change that Trump would like. As long as strong dictators maintain the support of the military, they are likely to remain in power.

China. According to Trump the Chinese have reneged on parts of the trade agreement to which they had previously agreed in an effort to soften the blow on the Chinese economy. That is a typical Chinese bargaining tactic but, in this case, they have perhaps underestimated Trump’s resolve to force the Chinese to play by the rules and quit stealing technology from U.S. companies, eliminate the requirement for U.S. firms that would like to do business in China to share their technology, and respect intellectual property rights. But those are core principals of business for Chinese firms. Abandoning those methods of behavior as the result of U.S. pressure would represent a significant loss of face for Chinese leaders. They cannot accept such changes without some concessions from the U.S. Despite this recent controversy we continue to expect some sort of a U.S./Chinese trade agreement in the months ahead because it is in the best interest of both countries to do so. Tit-for-tat tariff escalation by the U.S. and China will hurt the Chinese economy far harder than the United States simply because trade is 10% of the U.S. economy but 50% of Chinese GDP. These increased tariffs could slice Chinese GDP by 1.3% while U.S. growth would be reduced by only about 0.3%. We currently anticipate U.S. GDP growth for both this year and next of 2.7%. The tariffs could chop those growth rates to 2.4% or so which is meaningful, but the U.S. economy would be in no danger of slipping into recession.

North Korea. Finally, relations between the U.S and North Korea continue to deteriorate. Thus far the renewed missile testing is only for short-range missiles which does not technically violate the agreement reached between Trump and Kim Jong Un to eliminate the Korean testing of long-range missiles. These heightened tensions are the direct result of Trump and the U.S. delegation abruptly walking out of the summit in Hanoi earlier this year due to disagreements about denuclearization and sanctions. This was a significant loss of face for Kim and he was duty bound to retaliate.

We do not know if, how, or when these global quarrels will be resolved. But in the absence of military action our sense is that the worst-case scenario would be the loss of perhaps 0.3% from U.S. GDP growth for both this year and 2020 from the tariffs imposed on China and their almost certain retaliation on the U.S. Having said that, heightened tensions make everybody nervous and increase the risk of a policy mistake. That is not our call, but obviously these situations bear watching.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me