December 9, 2016

A regime shift in Washington is under way. We expect a dizzying array of policy changes enacted in the first half of next year to restore corporate leaders’ confidence in the economy, unleash a wave of investment spending, and significantly boost productivity growth. A meaningful pickup in productivity growth will, in turn, enhance the outlook for a wide variety of economic indicators. It will raise the economic speed limit, accelerate growth in wages, keep the inflation rate in check, and ensure that the Fed maintains its previously described slow path towards higher interest rates. In short, Trump’s policy changes may be the most significant economic development in years,

In the past several years business leaders have been frustrated by the combination of high corporate tax rates, an inability to repatriate earnings from overseas affiliates back to the United States, a stifling regulatory environment, and a requirement to provide extremely expensive health care to its employees. President-elect Trump has promised significant changes on all four fronts.

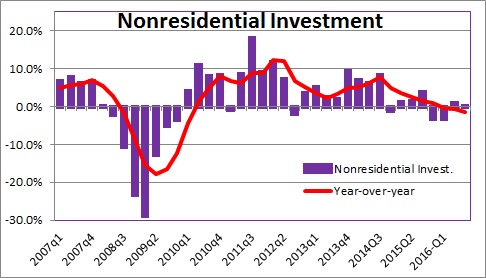

The lack of confidence by business leaders has shut off growth in investment spending for the past three years. But with many of their concerns likely to be addressed in the next six months we expect to see a wave of investment spending in the next couple of years — from no growth this year, to 2.5% next year, and 5.0% in 2018. If investment spending accelerates lots of good things happen.

Productivity growth is closely tied to the pace of investment spending. The more business leaders provide their workers with the latest technologically-advanced equipment, the faster productivity will grow.

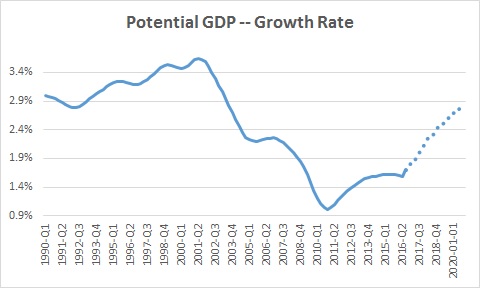

If productivity growth accelerates the economic speed limit of the U.S. will rise commensurately. That speed limit can be estimated by adding the growth rate of the labor force to the growth rate of productivity. Today the labor force is growing 0.8%, productivity growth is about 1.0%. Thus, the current economic speed is an anemic 1.8%. But if investment spending induces a quickening in productivity growth to 2.0%, then the speed limit will climb from 1.8% to 2.8% within a couple of years – the fastest growth rate for potential GDP since 2003.

Productivity gains help to keep the inflation rate in check. Consider the following: If firms pay their workers 3.0% higher wages and they are no more productive that firm’s labor costs have risen 3.0%. To offset the higher cost of labor that firm is likely to raise prices which means that the inflation rate will rise. But what if that same firm pays its workers 3.0% higher wages and its workers are 3.0% more productive? In this case, wages are rising 3.0% but the firm is getting 3.0% more output. Workers have earned the fatter paycheck. Thus, the best way to determine the impact on inflation caused by a tight labor market is to look at the increase in labor costs adjusted for the growth in productivity. Economists call this “unit labor costs”.

In 2016 worker compensation has risen 3.0%; productivity growth has been unchanged. Thus, unit labor costs have risen 3.0%. In 2017 we expect wages to rise 4.0% and we expect productivity to rise 1.0% which means that unit labor costs will, once again, increase 3.0% – exactly the same as in 2016. There will be no additional upward pressure on the inflation rate in 2017 caused by the tight labor market than there was this year despite a significantly larger increase in wages. There will, however, be upward pressure on inflation caused by the combination of rising rents and higher health care premiums, but no additional upward pressure on inflation caused by the tight labor market. Specifically, we expect the CPI (excluding the volatile food and energy components) to increase 2.3% this year and 2.7% in both 2017 and 2018. We would characterize this as a modest pickup in the inflation rate.

If the economy grows more quickly but gains in productivity help to keep the pickup in inflation to modest dimensions, the Fed has no reason to deviate from its previously described path towards higher interest rates. Specifically, we expect the funds rate to be 1.0% at the end of next year and 1.8% by the end of 2018.

If corporate leaders can regain their confidence and boost the pace of investment spending next year, the associated increase in productivity will boost the overall rate of economic activity, raise the standard of living, increase the size of worker paychecks, help to keep the inflation rate in check, and keep the Fed on track for very slow, measured increases in the funds rate. Not bad!

Faster productivity growth is the key.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me