October 25, 2024

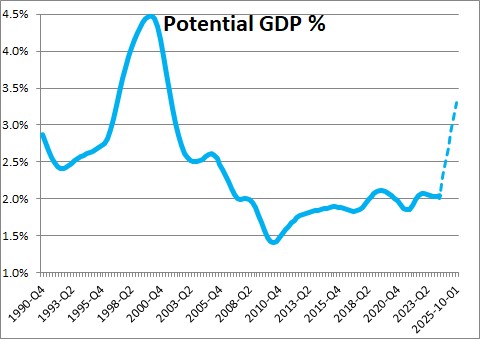

On Thursday we will get our first look at third quarter GDP growth. The Atlanta Fed’s GDPNow forecast suggests it will be 3.4%. But we know from the employment report that hours worked in the quarter edged up by just 0.2% which suggests that GDP growth should be soft. How can that be? The only way to reconcile those two numbers is if productivity in the third quarter climbed by the difference or 3.2%. While sizable, a productivity increase of that amount is no longer surprising. In fact, productivity growth in the past six quarters has averaged 2.9% which compares to a 1.2% pace in the 10 years prior to the 2020 recession. We believe that the acceleration in productivity has been caused by increased spending on technology. In the couple of years after the recession when qualified workers were extremely hard to find, businesses invested in technology to boost the productivity of their existing employees. Today tech spending is being enhanced by the adoption of artificial intelligence. This suggests that productivity growth will continue to climb rapidly for the foreseeable future. If that is the case then the economy’s potential growth rate has risen from 1.8% or so a couple of years ago to perhaps 3.2%. No longer is the maximum noninflationary economic growth rate constrained to 1.8%. Instead, potential growth today could easily be 3.2%. The acceleration in the potential growth rate not only allows the economy to grow more quickly, but it also keeps inflation in check and allows corporate earnings and the stock market to grow more rapidly. Given all that, we do not understand why so many economists and politicians remain fearful that a recession is looming.

Payroll employment rose 186 thousand per month in the third quarter. The average workweek declined slightly to 32.0 hours. Given the number of people working and how long they worked, we can estimate how many goods and services they produced. In the third quarter aggregate hours worked rose 0.2% which suggests that GDP growth in that quarter should be tepid.

But looking at GDP from the demand side by adding consumption, capital investment, housing, and trade, the Atlanta Fed estimates third quarter GDP growth at 3.4%.

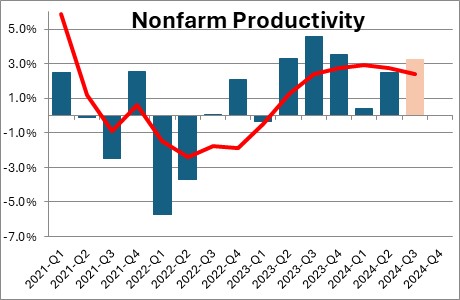

The only way aggregate hours can increase 0.2% and GDP grow by 3.4% is if productivity climbed by 3.2% in the third quarter. Its long-term average growth rate is 1.2%. Is it possible that productivity growth has accelerated so sharply? Yes. In fact, 3.4% productivity growth is no longer unusual. It has become the norm. In the past six quarters productivity growth has averaged 2.9%.

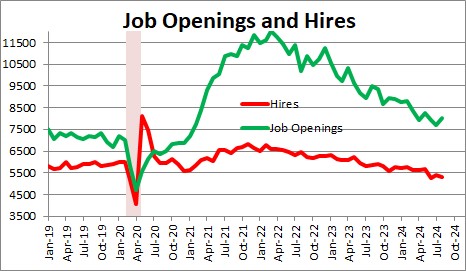

Why has productivity growth quickened? In a word, technology. Once the unemployment rate fell below the 4.0% mark and all workers who wanted a job had one, we began to see productivity accelerate. Given the tight labor market and job openings at a record high level, employers could not find enough qualified workers. But the economy was continuing to grow and businesses needed to boost output. As a result, they turned to technology and bought that latest piece of software that might help make their existing workers more efficient. That triggered the initial burst in productivity growth. Today, tech spending is being driven by the rapid adoption of artificial intelligence. We believe that productivity growth will continue at a rapid pace for the foreseeable future.

The economy’s potential growth rate is an estimate of how quickly the economy can grow without causing the inflation rate to rise. It is the sum of the growth rate in the labor force and the growth rate in productivity. In the past year the labor force has grown 0.5%. If going forward productivity growth averages 2.7% then potential growth is 3.2%. That seems almost unbelievably rapid. But in the mid-1990’s – when the internet was first introduced – potential growth soared. It peaked at 4.5%, and consistently grew at a rate in excess of 3.0% for six years. Given the quantum leap into the future provided by the introduction of artificial intelligence, the same thing could easily happen in the 2020’s.

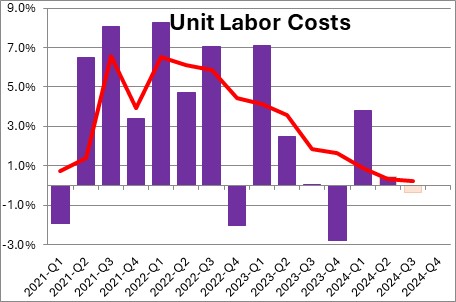

Faster growth in productivity will help to keep the inflation rate in check by reducing unit labor costs. Consider the following. If worker compensation rises by 3.0% and workers are no more productive, then the firms unit labor costs (labor cost per unit of output) have risen by 3.0%. But what if those workers are 3.0% more productive? The firm doesn’t care. They are paying workers 3.0% more money. but productivity has risen by 3.0% and they are getting 3.0% more output. Those workers have earned their fatter paycheck. In this case, the employer’s labor cost per unit of output has not increased at all which means that business leaders have absolutely no reason to raise prices. That is exactly what is happening currently. If our estimates of GDP growth and productivity for the third quarter are correct, then in the past year unit labor costs will have risen just 0.3%. As productivity growth has accelerated, unit labor costs have been falling from a peak of about 6.0% in mid-2022 to 0.3%. A 0.3% increase in unit labor costs is consistent with an increase in inflation considerably less than 2.0%.

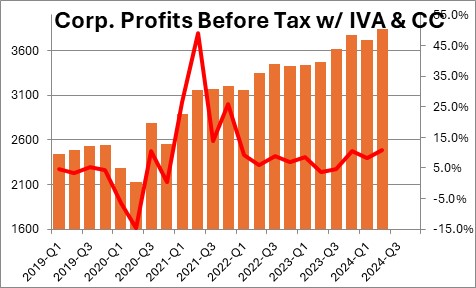

In 2022 and 2023 corporate earnings were climbing by about 6.0% or roughly in line with nominal GDP growth. But in the past year, with faster growth in productivity, corporate earnings have risen 10.8%. An accident? We don’t think so. With productivity rising rapidly and interest rates now falling, corporate earnings should continue to climb rapidly.

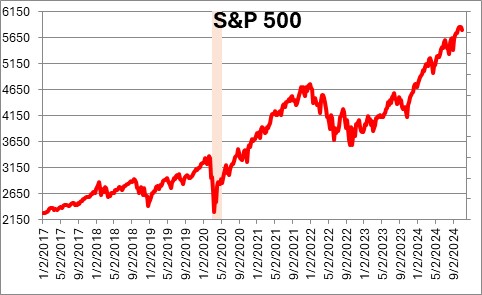

The stock market seems to have figured out that better times are ahead as each record high level is quickly surpassed by an even higher record. To be sure a 10% correction can occur at any time. But that does not negate the fact that the economic world seems to be changing in a very positive way.

Thus far we have heard little about the possibility of sustained rapid growth in productivity, a much faster potential growth rate, and the likelihood of surprisingly slow inflation. If our politicians can find a way to reduce the extreme polarization of views that divides Americans, and prevent the Ukraine/Russia and Mideast wars from spreading, the economic backdrop should keep the economy humming for years to come.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, you have found the “secret” to the growing economy, it is, TECHNOLOGY, or more accurately three of them. And, if you think the current impact of technology is only good on the short term, (I do not know if you think that to be true), then watch out for the impact of quantum computing. It will speed up everything phenomenally.

I retired from graduate school teaching last December. A huge part of my research in higher education showed that faculty in most universities were not interested in hearing about the impact that artificial intelligence, quantum computing, and nanotechnology would have on higher education. In presentations I made and books that I published on the topic of technology and higher education, I received minimal interest from the academic community.

The business community on the other hand seized on the potential of each of these three elephants in the room and incorporated as much of it that they could into their business practices. Why? Because they know, if they do not take these technologies seriously, their competition will, which could lead to destructive effects on their businesses or worse yet, bankruptcy.

Back to your commentary. Why are things now NOT happening according to the business rules of the 20th century? Because in the 21st century the role of workers has changed. As you point out, with little increase in worker numbers, financial gains are moving ahead at a previously unheard-of velocity, thanks to technology.

You, Stephen, are on the right track, technology will significantly revise the 20th century modes of business operations and success. Thank you for seeing the potential change through the windshield, and not waiting until your colleagues figure it out by looking the mirror.

Darrel Staat

It is interesting that after Covid our educators didn’t take more advantage of teaching through technology. Why not pay that teacher of the year a million dollars per year and let him teach the whole country? All teachers aren’t equal and certain ones are exceptional in getting kids to learn. sure not all subjects will apply but why not?

As to AI and productivity, I agree short-term things look rosy for the economy but long-term increased productivity means fewer jobs.

Hi Darrel,

I am not quite sure how I missed this comment from a couple of weeks ago, but I did. My apologies. Thank you for all your kind comments.

As I think you know, I do an annual economic conference in early December (December 3). This acceleration in productivity and potential GDP will be the major focus. It is a big deal and, as I pointed out in this article, I suggest that introduction of the internet in the mid-1990’s boosted potential GDP growth in excess of 3.0% for six years. These changes in technology should do the same thing. I have no idea why this has not been a more widely discussed topic. I would hazard a guess that everybody’s attention has been focused on analyzing the potential economic impact of the programs proposed by each of the two presidential candidates. I find such analysis kind of useless because we have no idea what will get actually get proposed passed. Lots of things get said during election campaigns and then get changed a lot once the new president actually takes office.

Best.

Steve

Hi Bill, I missed your comment. Sorry. While some jobs may get lost to AI, I suspect there will be lots of new ones of various types to take their place.

I like your discussion about good teachers and what perhaps should have happened during COVID.

Steve