January 3, 2025

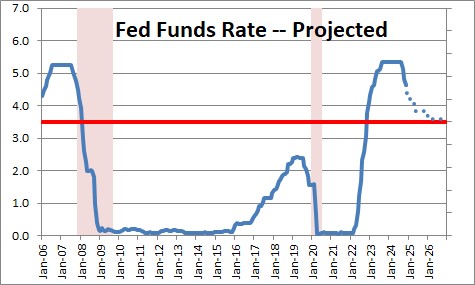

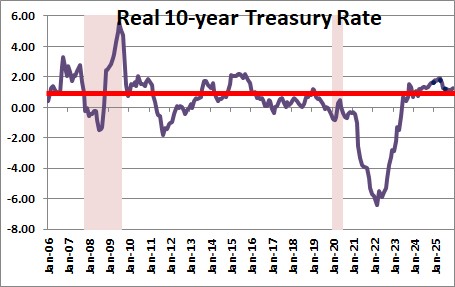

Throughout the summer the Federal Reserve suggested strongly that inflation had subsided sufficiently that it would soon begin to cut rates. In September the Fed finally reduced the funds rate 0.5% to 4.75-5.0%, suggested it would lower the funds rate two more times in the fourth quarter, and an additional four times in 2025. In total, it planned to cut the funds rate by two full percentage points from 5.5% to 3.5% within 15 months. That was a much more aggressive pace of easing than the bond market expected and rates declined sharply. The yield on the 10-year note, for example, fell from 4.5% in April to 3.7% by September. During the fourth quarter the inflation rate plateaued and the Fed had to walk back part of its planned easing initiative. It followed through with the two additional rate cuts in the fourth quarter, but now it anticipates just two rate cuts during 2025. The bond market did not like what it heard, and the 10-year note climbed from 3.7% in September to 4.5% today. Some economists fear that the current level of the 10-year could significantly slow growth late in 2025. We don’t buy it. The economy has a head of steam and is likely to surprise on the upside for GDP growth in 2025 rather than the other way around.

It is true that the backup in the yield on the 10-year note from 3.7% in September to 4.5% at the end of the year is impressive. But when the yield on the 10-year fell from 4.5% in April to 3.7% by September, the recent backup seems far less threatening. It is merely getting back to where it was in the spring of last year.

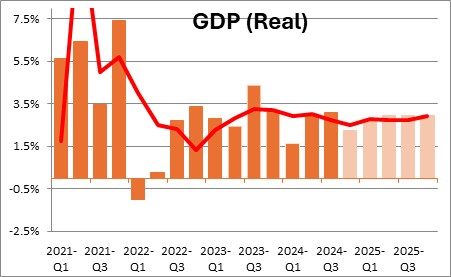

As it turns out GDP growth was 3.2% in 2023 and should register 2.5% in 2024. The economy came through a period when the funds rate was in a range from 5.25-5.5% for 13 months.

With the funds rate having fallen from 5.5% to 4.25-4.5% and likely to decline somewhat further in 2025, it is hard to imagine how lower rates will impede growth this year.

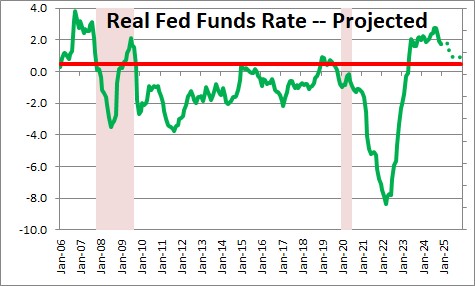

All economists are groping to find the so-called “neutral level” for the funds rate. The Fed currently thinks it is 2.9%, but that estimate has been steadily moving upwards. The Fed thought it was 2.5% in December 2023, but its estimate rose 0.1% each quarter last year to 2.9% by December 2024. For what it is worth we believe it is probably about 3.8%. But all these estimates are essentially guesses.The Fed thinks that the so-called “neutral” rate should be about 0.5% higher than the core CPI inflation rate. Currently with the midpoint of the funds rate range being 4.3% and the core CPI at 3.3% the real funds rate is + 1.0%. It would appear that the funds rate could still be slightly on the high side, but we should all remember that a neutral funds rate can never be observed. We do not know. We look at the level of the funds rate and what is happening to GDP growth, and adjust our estimates accordingly. We are still guessing.

As described earlier, long-rates have also climbed dramatically in the past three months. But are they “too high”? To answer that question we look at the real or inflation-adjusted 10-year. With the 10-year note at 4.5% and the core CPI at 3.3%, the real 10-year currently is +1.2%. But over the past 20 years or so the real 10-year has averaged about 1.0%. As we see it, real long rates are fairly close to where they ought to be. If the core CPI inflation rate continues to slow from 3.3% to 2.5% (or 2.0% for the core PCE deflator) then long rates can decline somewhat in both nominal and real terms roughly in line with the reduction in the inflation rate. But they cannot go far.

We will get a lot of information between now and the end of January. The purchasing managers’ index for the manufacturing sector was stronger-then-expected in December. The PMI for the services sector will be released on January 7. Then comes payroll employment for December on Friday, January 10. Retail sales for December on January 16. And at the end of the month we will get out first look at fourth quarter GDP which appears to be about 2.5%. The economy ended 2024 on a strong note. It does not appear to have lost any momentum but, as always we will see.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me