September 1, 2017

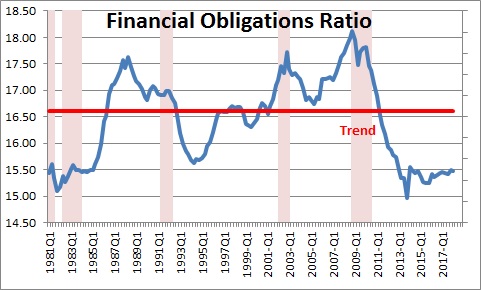

Consumers not only feel good they are increasing their appetite for debt. Much has been made of the fact that consumer debt outstanding has climbed to a record high level. Some economists view this as a danger signal. We do not. While debt outstanding has risen steadily, consumer income has also been growing. As a result, debt in relation to income remains close to a 30-year low. Rather than view this with alarm, we see it as a sign that consumers are finally shedding the fear caused by the recession and are, at long last, beginning to finance some of their spending with debt.

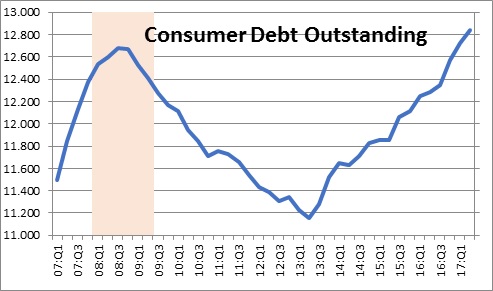

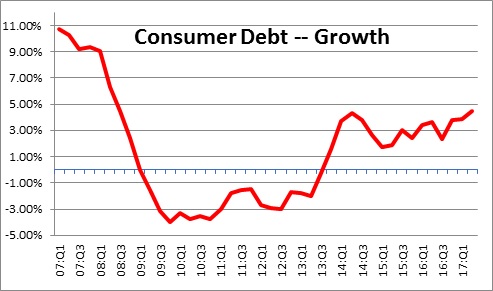

Consumers’ began to tack on some debt in mid-2013 and it has been rising steadily for the past four years. It gets a catchy headline when economists note that it has now surpassed its pre-recession high and risen to a record level. That sounds worrisome. It is not.

While the amount of debt outstanding has been growing steadily, its growth rate at 4.5% currently is modest. Growth of that magnitude is not a problem.

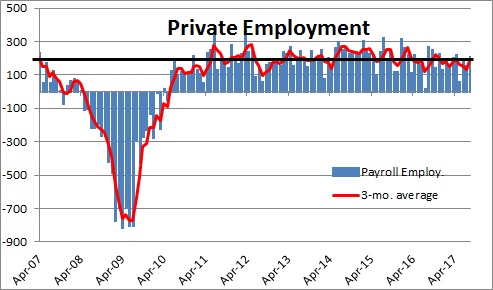

The reason consumers feel comfortable taking on more debt is because their income has been rising. The growth in income has been driven by extraordinarily steady gains in employment. In fact, payroll employment has climbed every month for the past seven years — since September 2010 to be exact. When employment rises more people receive a paycheck, and that generates growth in income.

Thus, consumers have become more willing to take on additional debt (and are easily able to do so) because their income has been rising. The financial obligations ratio measures aggregate consumer debt in relation to income. That ratio remains at essentially the lowest level since the early 1980’s.

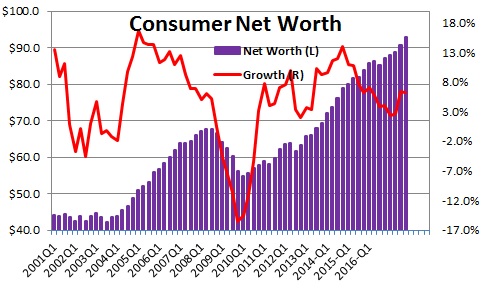

Keep in mind also that consumer net worth is at a record high level and continuing to climb at a solid 8.3% pace. That increase reflects the combination of the relentless upward movement in stock prices and 5.0% growth in home prices.

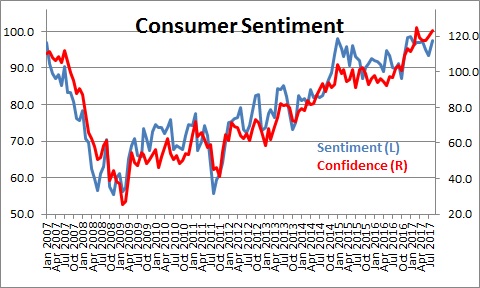

Given all of the above it is not surprising that the University of Michigan’s consumer sentiment index and the Conference Board’s measure of consumer confidence are both at their highest levels in more than a decade. With the unemployment rate at 4.4% consumers have little fear of losing their job and the monthly job gains show no sign of wavering. Thus, consumer income should continue to rise. The stock market and home price increases continue to boost the value of their assets. They have very little debt. Furthermore, there is still a reasonable chance that individual income tax rates will be cut by the end of this year. No wonder consumers are feeling good and willing to take on more debt.

Consumer’ willingness to incur debt is a good omen, not a cause for alarm. Clearly, consumers got whacked during the recession. Many lost their job – some for a very long time. Even if they found a job quickly the unemployment rate remained high for years and they worried about what might happen if they lost their new job. The value of their home fell 25%. Many could not sell even if they wanted to because they were underwater and owed more than their house was worth. Not surprisingly consumers – and business leaders – behaved cautiously. They refrained from unnecessary spending. They were unwilling to take on debt. Business people were reluctant to hire new bodies. The 2007-08 recession was the steepest drop in economic activity since the great depression seventy years earlier. Few people alive today have ever experienced anything quite like that. They were truly scared. But eventually time heals all wounds and the fear factor begins to recede into the background.

Renewed willingness to borrow is a healthy sign for the economy in the quarters ahead. If consumers become more willing to spend and take on debt, the animal spirits of business people will get a boost as well.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me