January 11, 2014

The Wall Street Journal recently published its monthly poll of economists with the headline, “Economists See Rising Risk of Downturn”. After getting off to a good start in the early part of the year the stock market turned south. This highlights the extent to which recession fears are ingrained in investors’ psyche, which probably means that the stock market recovery this year will be slow going. Ultimately, the economic data win and we expect the economy to rise 2.8% in 2019 and the stock market to achieve a new record high level later in the year.

The Journal noted that the surveyed economists saw a 25% chance of a recession in the next twelve months. While few could identify a specific trigger, the worries included the usual cast of characters — trade tensions with China, rising interest rates, and a sharp stock market selloff last year. But economists are always worrywarts. When asked if they see a recession in the next year they invariably say “no”, but then add that there is some non-zero chance of one occurring. Well, that about covers it. There is always a chance of bad things happening and the economy unexpectedly slipping into recession. Fair enough. But it seems to us that economists are simply hedging their bets. If the economy performs well, they can say that they were right. If the economy slips into recession, they can still say they were right because they highlighted a rising risk of recession in their forecasts. You can’t have it both ways. Either you expect a recession, or you don’t. For the record, we do not expect a recession in 2019. Nor do we expect one in 2020.

A chart accompanying the Journal’s article showed that economists’ recession fears spiked in 2011 to 33%, retreated briefly, jumped again in 2013, dropped back a second time, climbed again in 2016, fell a third time, and then jumped to 25% in the most recent survey. We are still waiting for that recession. So, rest easy. The economists’ recent renewal of anxiety is just economists being economists and envisioning doom and bloom around every corner.

We would have been happier if the surveyed economists had said that the previously-mentioned fears could result in a somewhat slower than anticipated rate of GDP growth in 2019. That seems possible, particularly early in the year if consumers become a bit more reluctant to spend and business leaders postpone their investment plans until some of the uncertainty disappears. That is a realistic alternative scenario. But to stop the economy dead in its tracks and push it over the cliff into recession has such a minuscule chance of occurring that it is not worth talking about.

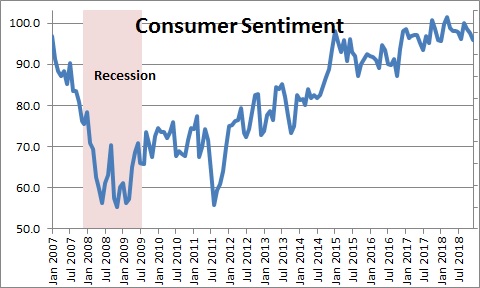

It has now been more than three months since the stock market swoon began and consumer sentiment has barely budged.

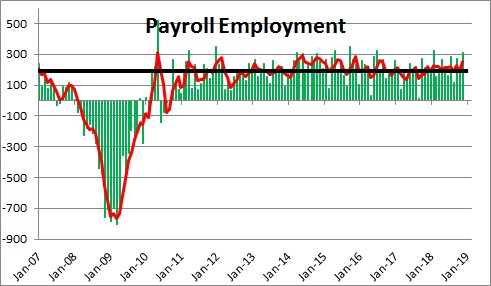

Confidence has most likely been supported by the robust, 200 thousand per month pace of jobs creation which is showing no sign of slowing down.

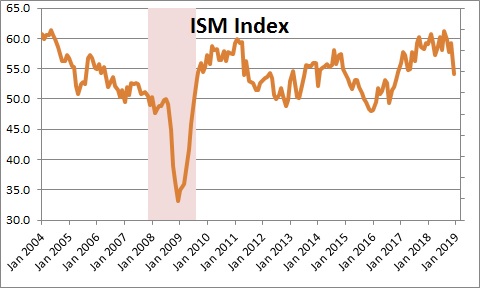

Business confidence has slipped a bit for both manufacturing and non-manufacturing firms as evidenced the the Institute for Supply Management’s monthly surveys. But, in both cases, the indexes are falling from very high levels and the ISM says that the December level for manufacturing firms is consistent with steamy GDP growth of 3.4% and for non-manufacturing firms it is 3.2%. Hardly worrisome.

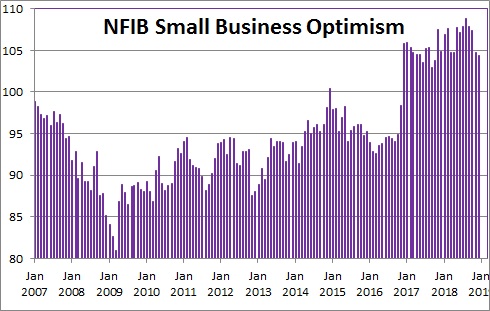

Small business confidence has edged lower in recent months but remains close to its recently-established 35-year high.

Fed Chair Powell and numerous other Fed officials have emphasized recently that they intend to refrain from further rate increases for some time, most likely at least until midyear.

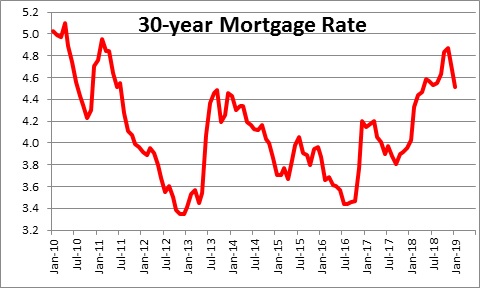

Meanwhile, long-term interest rates have declined in the past couple of months. The 30-year mortgage rate, for example, has fallen from 4.9% late last year, which was making potential home buyers nervous, to 4.5% which is where mortgage rates were a year ago. That will provide support to the housing sector.

We recognize that economists are nervous which has, in turn, made investors nervous. But we have seen no evidence from any recently-released economic data that the economy has softened. So, try to shake those lingering fears of recession. The worst that could happen would be a temporary slowdown in GDP growth and we see no evidence even that is about to occur.

Stephen Slifer

NumberNomics

Charleston, S.C.

Two jobs I want – weather reporter and economist. Both famous for being able to cover their behinds on just about every prediction they make.

Of course that excludes you.

But of course!

Weather reporters cheat. They have radar.