January 4, 2019

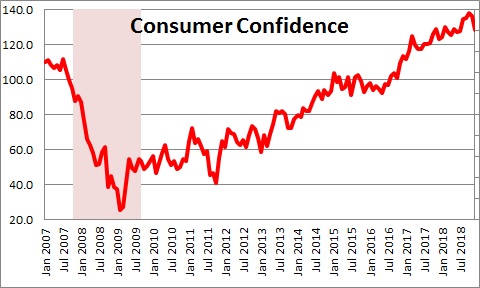

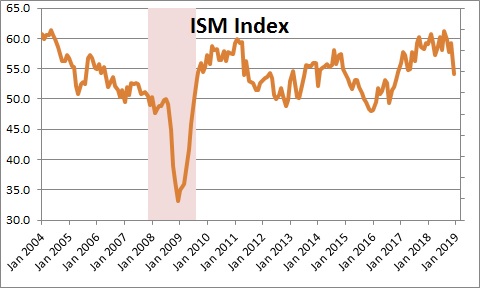

Stock market volatility is continuing in the early part of this year. Depending upon exactly when you look, you might conclude that a recession is in the cards by the end of this year or be reassured that the economic activity is on a relatively steady track. We remain in the latter camp. Having said that, consumer confidence edged lower in December while the manufacturing sector weakened notably. It could be that the combination of slower growth in China, the impact from tariffs on the economy, the continuing government shutdown, and gridlock in Washington will dent first quarter growth. But the government shutdown will soon end. Furthermore, pressure is on both the U.S. and China to strike a deal. As those events unfold in the months ahead consumers, businesses, and investors should conclude that there is no chance of a recession by yearend.

Consumer confidence fell eight points in December. That is the first drop since the stock market began its gyrations back in October. However, it fell from an 18-year high. The decline most likely does not mean much – but it was at least a noticeable drop.

Slightly more problematic is the decline in the purchasing managers index for December. It fell five points in that month to 54.1. The falloff was led by an 11-point drop in orders and a 6-point drop in production. These two categories tend to be more forward-looking and suggest that first quarter GDP growth could be weaker than the 2.7% pace we are projecting. Our sense is that an end to the government shutdown, reassuring economic data in the months ahead and, perhaps, some sort of a deal with China will allow this index to rebound.

When the stock market experiences a down day, the market concludes that the economy could enter a recession by the end of this year and that the Fed will lower rates by yearend. Forget it. Neither of those things are going to happen.

In mid-December the Fed suggested that the it would boost funds rate twice in 2019 from its current 2.25-2.5% target range to 2.9% by yearend. We still expect that to happen. However, in the near-term more and more Fed officials will advocate no additional rate hikes until some of the current uncertainty comes to an end. If that happens, which is what we expect, the Fed may well implement two additional rate hikes later this year.

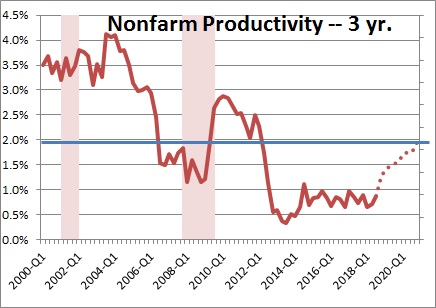

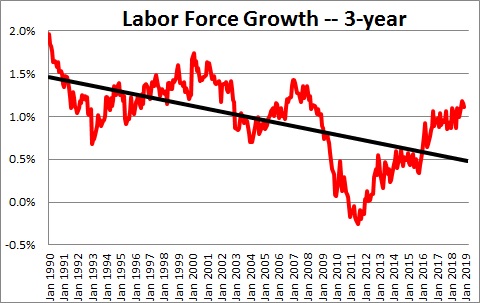

The Fed continues to believe that potential GDP growth is 1.9%. GDP growth last year was 3.1% and it expects 2.3% growth in 2019. Both growth rates exceed potential. Because the economy is at full employment the Fed worries that inflation could begin to climb. Potential growth measures how quickly the economy can grow over the longer-term when it is at full employment. It is interested in, say, a 3-year growth rate for the labor force and productivity. We take comfort from the fact that growth for both measures has accelerated in the past year and, most likely, potential GDP growth is on the rise.

Growth in the labor force has picked up considerably. At the end of 2017 the 3-year growth rate for the labor force was 0.9%. But the labor force increased 1.6% this year as rapid GDP growth lured some previously unemployed workers back into the labor force. The 3-year growth rate in the labor force has climbed to 1.1%, and if it climbs as rapidly this year as in 2018 the 3-year growth rate will continue to climb.

Productivity growth has quickened. The 3-year growth rate remains sluggish at 0.9% because of slow growth in earlier years. But growth this past year picked up to 1.5% and surpassed the 2.0% mark in the two most recent quarters. Like growth in the labor force, productivity seems to be gathering momentum.

This suggests that potential GDP growth is on the rise. The Fed’s 1.9% estimate probably consists of 0.9% growth in the labor force and 1.0% growth in productivity. But, as described above, growth in the labor force has picked up to at least 1.1%. Productivity growth has climbed to 1.5%. Thus, potential growth is no longer 1.9%. It is probably close to the 2.5% mark. If that is accurate, the economy can grow at a sustained 2.5% pace without generating inflation. If our forecast of GDP growth for 2018 of 2.8% is accurate the Fed has little reason to further raise rates.

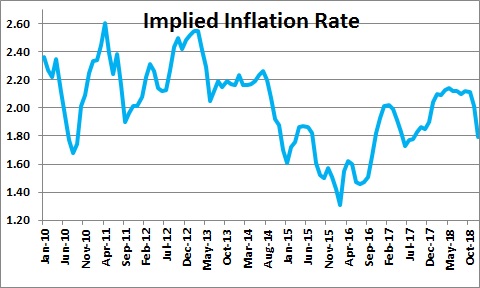

That is particularly true if inflation expectations remain in check. In the past couple of months inflation expectations have slipped from 2.1% to 1.8%.

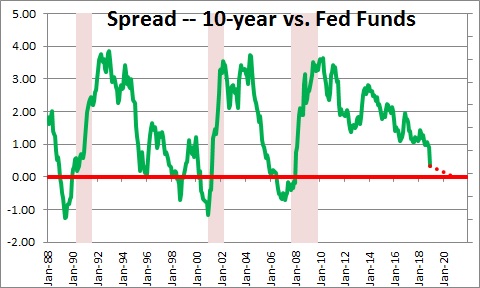

Also, keep in mind that the yield curve has flattened considerably in the recent months. With the yield on the 10-year note currently at 2.6% and the funds rate at 2.4%, the yield curve is positive by just 0.2%. The Fed does not want the yield curve to invert. It knows that an inverted curve is a warning sign that a recession is likely within the next year.

If potential growth is picking up to a pace roughly in line with projected GDP growth, inflation expectations are declining, and the yield curve is extremely flat, the Fed is not going to raise the funds rate any time soon.

While recession chatter has become more widespread in the past month or two there is no recession on the horizon for the foreseeable future.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me