December 7, 2018

All eyes will turn to the Federal Reserve and its rate decision this coming week. The general expectation is that it will raise the funds rate by 0.25% to 2.25-2.5%. We are not as convinced and think they will leave it in its current range from 2.0-2.25%. Regardless of what they decide at this meeting it will be far more important to learn how they intend to carry out policy in the months and quarters ahead and learn their revised thinking about a neutral level of the funds rate. For the first time in years they are going to depart from autopilot when rate hikes were entirely predictable. Its future policy will become “data dependent”. That means that if the economy is showing signs of strengthening and/or inflation is beginning to accelerate, they will raise rates. But if economic activity continues to chug along at a moderate pace with no upward pressure on inflation, they will stand pat. But how to describe that new decision-making process to us novices? To complicate matters further the Fed and most economists have for some time believed that a “neutral” level of the funds rate is about 3.0%. But, judging from recent speeches, every Fed official is re-thinking that level and suggesting that it might be lower. How exactly do they figure out what a neutral rate might be?

Since December 2016 the Fed has talked about gradual increases in the funds rate but indicated that the funds rate would remain, for some time, below the level that should prevail in the longer run. That is Fed-speak for a desire to return gradually to a “neutral” funds rate. The Fed’s rate-determining body, the Federal Open Market Committee, or FOMC, meets eight times per year and they hold a press conference at every other meeting. It fell into a pattern whereby it would raise rates only at meetings after which it held a press conference. Thus, their policy became entirely predictable. But the funds rate is now 2.0-2.25%. Investors are worried that if the Fed remains on its current glide path it will eventually overdo it and the economy will slip into recession.

But Fed officials are not stupid. They knew when the funds rate was 0% it was an easy call to raise rates when the presumed objective was something around 3.0%. But with the funds rate 2.0-2.25% it is time to be more cautious. The current 3.0% estimate of the neutral level is the mid-point of the Fed’s likely range for that neutral rate which is anywhere from 2.5-3.5%, but most Fed officials are clustered together between 2.75-3.0%. The Fed is getting close.

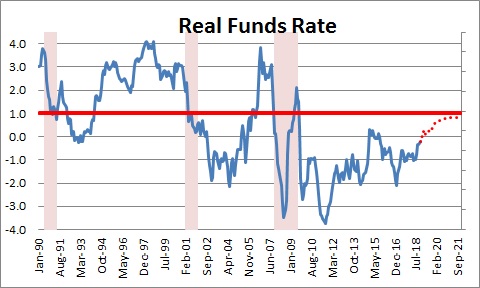

But there is nothing magic about 3.0%. Different economists use different methods to estimate it. We calculate it by looking at the relationship between the funds rate and the inflation rate or the so-called “real funds rate”. Over the past 50 years the real funds rate has averaged 1.0%. Sometimes the Fed will be tightening, other times it will be easing. If, through good times and bad, the funds rate averages 1.0% higher than the rate of inflation, it is reasonable to conclude that 1.0% should be a neutral level for the real funds rate. If the Fed has a 2.0% inflation target and a neutral rate is 1.0% higher than that, voila, a neutral funds rate level should be about 3.0%. That rate is probably in the ballpark of where it should be. But some economic studies suggest that the neutral rate may change over time. Just because the real funds rate averaged 1.0% during the past 50 years does not necessarily mean that it is still the appropriate level today.

Furthermore, other economists will estimate it in a different manner. For example, some think it should be roughly in line with nominal GDP growth. If the economy is growing at 2.0% and inflation is rising at 2.0%, nominal GDP growth would be about 4.0%. Their conclusion is that the funds rate should be at 4.0% to keep the economy and inflation on an even track.

All of this means that, going forward, the Fed needs to get off autopilot and begin to sniff the air. Its policy will be determined by looking at the entire spectrum of available economic indicators. From that data they will construct GDP forecasts, predict the future unemployment rate, and try to figure out the path of inflation. Just like the rest of us all 12 members of the FOMC may not agree. Fed Chairman Powell recently compared the Fed’s strategy as walking into a living room when the lights suddenly go out. “What do you do? You slow down, and you maybe go a little bit less quickly, and you feel your way more.” Great analogy.

We think that at its meeting this week the Fed will leave the funds rate in its current range from 2.0-2.25%. It can site slower GDP growth overseas, falling oil prices which will alleviate any upward pressure on the inflation rate for a while, and they can note financial market jitters in both the stock market and widening corporate bond spreads. We think it is entirely appropriate for them to leave rates where they are for a while and wait to see what happens. Whether the Fed raises rates or not at its meeting this week or not, pay attention to its estimate of the end point. Is their estimate of the neutral rate still 3.0%? Probably not. We think they might lower it to 2.75%.

At the very least the Fed’s rate decision will make it an interesting week.

Stephen Slifer

NumberNomics

Charleston, S.C.

Hi Stephen, thank you for another post on fed funds rate, your analyses are direct, succinct yet full of insights. Hope the conference went well! Wish I could attend one year, could you please send a copy of your slides?

Many people believe the rates need to go up a certain level to cushion the fall when next crisis is here; therefore, Trump is doing his best to prolong this duration for the rates to reach 3% (or 2.75% as you pointed out) in order to secure his re-election. In conjunction with ‘Will They, or Won’t They?’ from 23 Nov, is it plausible to assume that Trump’s remarks and anti-trade tactics serves to manipulate the stock market or economy by slowing down the growth or taming the stock market?