March 15, 2019

It is clear that first quarter GDP growth will be relatively anemic. We have reduced our forecast from 1.8% to 1.5%. Some economists anticipate even softer growth of perhaps 0.5%. However, the stock market selloff and the government shutdown have taken a toll on first quarter growth and it will certainly rebound. January was clearly a weak month and we are all guessing about February and March. Nobody knows exactly how vigorous the upswing will be.

As an example of the current confusion consider retail sales which fell 1.6% in December amidst the stock market debacle. That was perhaps no great surprise. Economists expected a relatively significant rebound in January but, instead, sales rose just 0.2% in that month. However, the January sales data were in the midst of the protracted federal government shutdown and followed the earlier sharp stock market decline which clearly biased the data downwards. Sales will continue to climb, but by exactly how much?

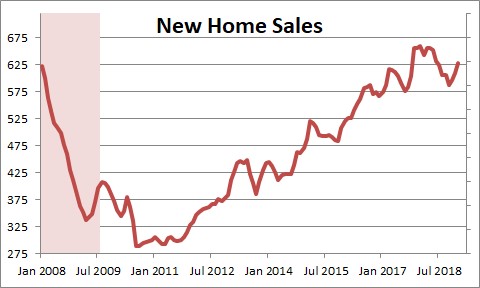

Home sales fell 6.2% in January. But, at the same time, Census revised upwards sharply the pace of sales for November and December. As a result, the 3-month average for sales appears to have hit bottom in October. Is the housing sector now on an upward trajectory?

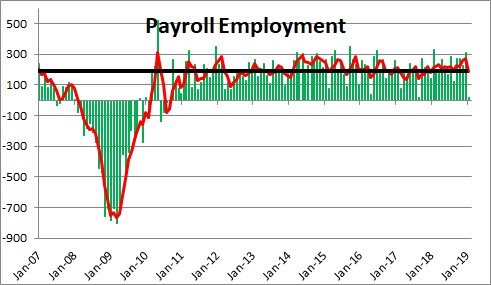

Payroll employment for February rose by an anemic-looking 20 thousand. But sales in the previous two months were surprisingly robust with gains of 227 thousand and 311 thousand, respectively. The 3-month average increase of 186 thousand is very much in line with the other recent months.

As we look at these data, we conclude that the trend rate has not changed a lot. However, the economic tea leaves indicate clearly that first quarter growth will be soft. Is our 1.5% projected growth rate accurate? Or could it be more like 0.5%. As additional data are received, we will get a better sense of what that growth rate will be. The combination of the stock market drop and the government shutdown have muddied the waters sufficiently that nobody can be certain exactly what the trend rate of GDP growth is at the moment.

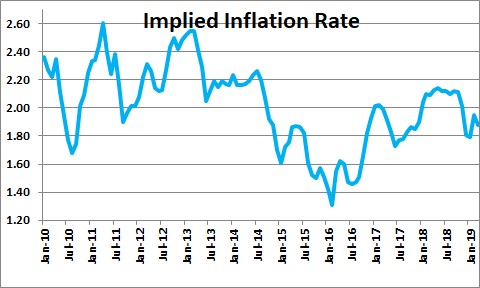

Meanwhile, both actual inflation readings and inflation expectations have been inching their way lower. For example, the core CPI for January rose 0.1% after having risen 0.2% in each of the previous five months. As a measure of inflation expectations, we look at the spread between the nominal yield on the 10-year note and the comparable inflation-adjusted yield. It has fallen in recent months from 2.1% to 1.9%. As a result, the Fed’s intent to raise rates twice in the second half of the year seems unlikely. It all depends on the magnitude of the rebound in growth, and whether that pushes inflation and inflation expectations higher. We will have to see.

While two second half rate hikes seem unlikely at the moment, the second half of the year is still months away. If the economy bounces back vigorously, actual inflation might inch its way higher and expectations might also climb. Given that scenario one or even two rate hikes could still be in the cards.

But if the rebound falls a bit short of what we are expecting and inflation expectations remain stable, the yield on the 10-year note might remain at its current level of 2.6%. If that is the case, there is absolutely no way the Fed would consider a rate hike at midyear. That is because the yield curve – the different between long-term and short-term interest rates — would be likely to invert. If the yield on the 10-year remains at 2.6% and the funds rate is 2.4% the yield curve would be 0.2%. A a rate hike or two by the Fed would push short rates higher, lift them above long rates, and cause the yield curve to invert. An inverted curve is a harbinger of an impending recession. The Fed will not do anything that could knowingly jeopardize the expansion. So, depending on the combination of GDP growth and inflation in the months ahead, it is possible that the Fed keeps rates on hold through yearend and perhaps beyond. We will have to wait and see how all this falls out.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me