May 30, 2025

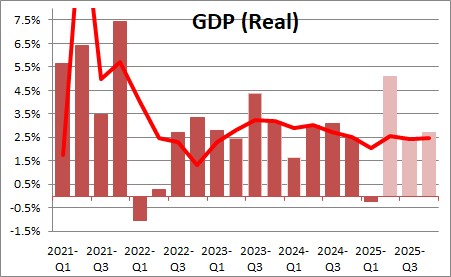

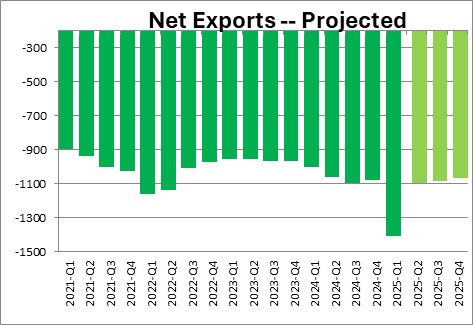

GDP forecasts for the second quarter got a significant boost this week as imports plunged in April. That drop made it clear that the import surge in the first three months of the year represented front-running by businesses as they tried to get goods into the country prior to the imposition of tariffs in early April. Because imports are a subtraction in the GDP calculation, first quarter GDP declined 0.2% and gave the impression that the economy was teetering on the brink of recession. The trade deficit subtracted 4.9% from that first quarter growth rate. The advance report on the exports and imports of goods for April indicated that imports plunged in that month. As a result, the reduction in the trade deficit is likely to add as much to GDP growth in the second quarter as it subtracted from the first quarter. We now estimate that we will see a 5.0% GDP growth rate in the second quarter. The trade component will likely add 4.9%. to growth in the second quarter which is exactly the amount it subtracted from first quarter growth. For what it is worth, the well-respected Atlanta Fed GDPNow forecast for the second quarter is 3.8%. Keep in mind that both estimates are based on the preliminary trade data for April as well as guesses about what will happen to trade in May and June. Thus, it is still early and there is plenty of room for revisions to growth in the months ahead. But the point should be that GDP will climb at a very rapid pace in the second quarter and that there is no hint of an economic slowdown in the first half of this year.

Trump’s ever-changing trade policy has significantly altered the pattern of GDP growth in the first two quarters of this year. In order to avoid tariffs, firms presumably estimated how many imported goods they would need for production for the next several months and got as many of those goods into the country in the first three months of the year to avoid the pending tariffs. But, if that is the case, they presumably need far fewer imported goods than normal in the spring because the goods are already in the country and stashed in a warehouse until needed.

If GDP jumps by 5.0% in the second quarter after having declined 0.2% in the first quarter, and both estimates were distorted by the imports data by roughly the same amount, then we would suggest the average 2.4% growth rate in the first half of the year is probably a fair estimate of the trend rate of growth during that period. Given that GDP grew at a 2.5% rate in 2024 it is suddenly quite clear that the economy has not slowed down at all in the first half of 2025.

That creates a dilemma for both the markets and the Federal Reserve. The markets anticipate two 0.25% rate cuts between now and yearend which would reduce the funds rate from 4.3% currently to 3.8%. Until this week the consensus was for GDP growth of 0.8% this year which would presumably have been soft enough to further reduce the inflation rate. Against that background, a couple of rate cuts by the Fed seemed like a plausible scenario.

But if GDP growth averages 2.4% in the first half of the year and 2.5% for the year as a whole, it is hard to make a case that growth has slowed and that the Fed can ease. The Fed thinks the economy’s potential growth rate, or economic speed limit, is 1.8%. It is impossible for the Fed to ease when growth is exceeding the speed limit by that amount.

On the inflation front, the personal consumption expenditures deflator rose 0.1% in both March and April. In the past year it has risen 2.5%. It is slowing down, but it is unlikely to register further improvement between now and the end of the year. We are estimating that the core PCE will rise 2.6% in 2025. This is the inflation measure that the Fed targets at 2.0%.

As economists digest this new trade data and revise upward their GDP growth rates for the second quarter, their enthusiasm for rate cuts by yearend should diminish.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me