August 4, 2023

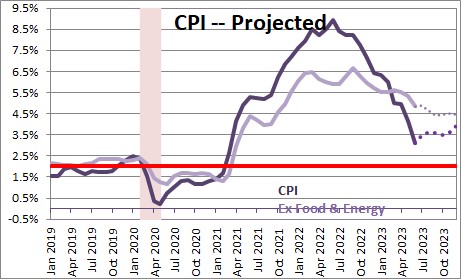

The economy may finally lose some momentum later this year as student loan debt repayment returns in October and as the recent sharp jump in interest rates should provide at least some further growth moderation later in the fourth quarter and the early part of 2024. But how much of a slowdown are we talking about? The economy currently seems to be cruising at about a 2.0% pace. Given that the economy’s potential growth rate or, or economic speed limit, is widely estimated to be about 1.8% it is hard to see how the core inflation rate can shrink from its current pace of 4.8% to anything close to the Fed’s desired 2.0% pace any time soon. Slower growth ahead may be in the cards, but will it slow enough to keep the inflation rate on a downward trajectory?

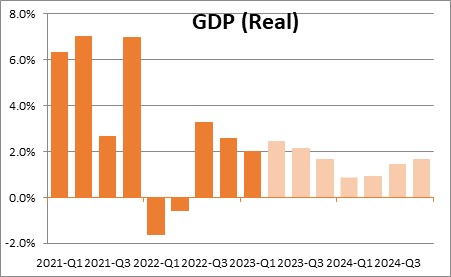

Last week we discovered that GDP growth in the third quarter remained rapid at 2.4%. This week we learned that payroll employment rose 187 thousand in July and the unemployment rate fell 0.1% to 3.5%. Given all of this, we anticipate GDP growth of 2.1% in the third quarter. However, growth may finally begin to moderate in the fourth quarter and beyond for several reasons. First, student loan debt payments will resume in October. Second, market interest rates have finally begun to rise sharply. For example, the interest rate on the 2-year note has climbed from 4.0% in April to 4.8%. The yield on the 10-year note has risen from 3.4% to 4.1%. Part of the rate upswing is attributable to the persistent steady growth in the economy. Just a few months ago economists widely expected a recession in the second half of 2023. That idea has disappeared. Another catalyst for the run-up in rates was the Fitch downgrade of U.S. Treasury debt from AAA to AA+. That action highlights the fact that debt outstanding is likely to reach a record high level as a percent of GDP in 2023, and surpass that record high level every year for the next decade. Following a 2.1% GDP growth rate in third quarter of 2023, we anticipate GDP growth to slip to 1.6% in the fourth quarter and 0.9% in each of the first two quarters of 2024.

While the pace of economic activity may gradually slow in the next several quarters, how much and how quickly will the inflation rate subside? We expect the core CPI to moderate from its current 4.8% pace to 4.4% by the end of this year, and slip to a 3.0% pace by the end of 2024. But even at the end of next year it will still be climbing 1.0% or so faster than the 2.0% Fed’s targeted rate of inflation. Given that situation it is hard to imagine that the Fed can keep the funds rate at its current 5.5% level.

Keep in mind that a month ago the Fed thought the unemployment rate at yearend would be 4.6%. In July it dipped to 3.5% — not the right direction and not even close to what the Fed expected. How can the inflation rate keep shrinking with the labor market as tight as it is and wages still rising?

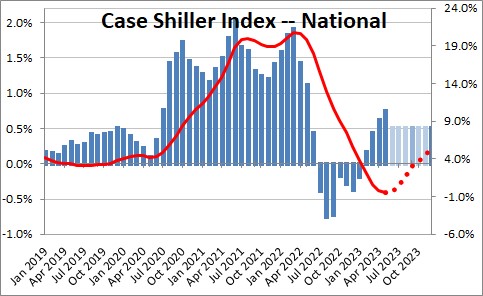

Furthermore, housing prices are starting to rise again. After falling for seven consecutive months, home prices have risen in each of the past four months as the record low level of homes available for sale is giving current owners leverage to raise prices. Multiple-bid situations are once again common. There is, quite simply, a shortage of both single-family homes and rental housing, and builders have been unable to crank up production quickly enough to satisfy the demand. Given that the rent component is one-third of the CPI index, it is hard to see how rents can slow very much.

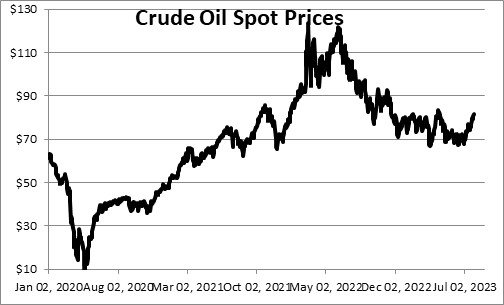

Finally, oil prices surged from $70 per barrel at the end of June to $81 at the end of July. That means that the year-over-year increase in the overall CPI index, which has fallen for twelve consecutive months, will actually increase from 3.1% in June to perhaps 3.7% in July. Oil prices are always volatile, but if the run-up in oil prices in July is sustained, it will make it hard for inflation to fall quickly.

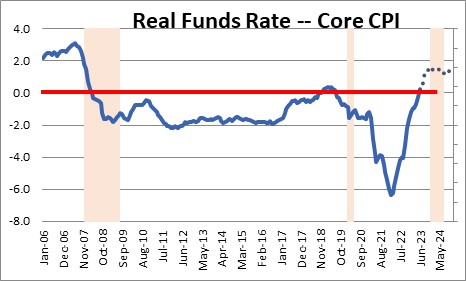

Given this background we believe that the Fed will need to raise rates further. The real funds rate is no longer 6.0% negative like it was last summer. With the funds rate today at 5.4% and the year-over-year increase in the core CPI of 4.8%, the real funds rate is positive by 0.6%. The Fed is at least close to where it should be. But until we see more convincing evidence that the economy is slowly sharply and the core inflation rate is shrinking quickly, we believe the Fed needs to keep going. It cannot sit idly by and do nothing. We expect the funds rate to peak at 6.0% or so by the end of this year. If the core inflation rate has slowed to 4.4% by yearend, then the real funds rate will be 1.6% which should, hopefully, be high enough to produce the desired growth and inflation slowdown.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me