October 12, 2018

A broad-based, dramatic decline in the stock market is always nerve-wracking. Most of the time it has little economic significance and reflects nothing more than normal stock market volatility. But when the end of an economic expansion is approaching, a similar-looking stock drop will be an early signal of trouble ahead. For this reason, we must always focus and try to determine the cause of the slide. In this case, we are firmly convinced that the recent decline falls into the “false signal” category.

The fundamentals are solid:

Consumer confidence is the highest it has been in 18 years.

Ditto for business confidence. Tax cuts and deregulation are working their magic.

Short- and long-term interest rates, while rising slowly, remain low by any historical standard or when looked at in inflation adjusted terms.

Housing has softened a bit, but the problem does not seem to reflect a drop-off in demand. Rather, it reflects an inability of builders to get enough workers to significantly boost the pace of production, and an unwillingness of existing homeowners to put their house on the market perhaps in anticipation of even higher prices down the road. Thus, we are apparently looking at a supply constraint rather than any significant weakening in demand.

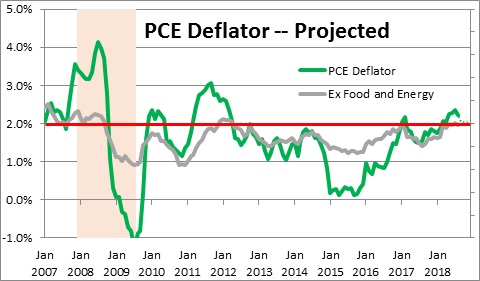

Inflation continues to be well contained. The CPI for September, released in the middle of the recent stock market rout, rose 0.1% both overall and excluding the volatile food and energy categories. The CPI core rate has risen 2.2% in the past year. But remember that the Fed’s 2.0% inflation target is not for the CPI, but the so-called personal consumption expenditures deflator. The 12-month increase in the core PCE deflator currently stands at 2.0% and has been steady at that pace for the past six months. While inflation is inching its way higher, the operative word is “inching”.

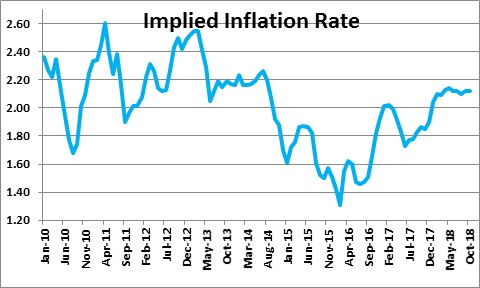

Inflation expectations (which are important to the Fed) have been steady at the 2.1% mark for almost a year.

None of these factors are going to cause the Fed to panic. The economy is showing no sign of overheating. The current rate of inflation as well as inflation expectations are steady at a rate close to the Fed’s target. But because the economy continues to expand at a solid pace, and because inflation seems to be inching its way higher, it is entirely appropriate for the Fed to continue its journey to bring rates back to “neutral”. The market’s fear that the Fed is going to accelerate its previously-announced pace of rate hikes seems unwarranted.

What about trade and an escalation of the trade war with China? Could that negatively impact GDP growth in the U.S. and elsewhere? Yes. We are happy that the trade skirmish now seems focused on China rather a more broad-based attack that included Mexico, Canada, Europe and Japan. The conflict with China is long overdue. The Chinese are notorious for not respecting copyrights and patents. They force U.S. tech companies to share their secrets in exchange for doing business in that country. We clearly support the notion of “free” trade, but it must also be “fair” trade and China fails that test. President Trump is right to curtail access to U.S. technology. U.S. security issues are involved, and they should supersede any free trade argument. Will that knock a couple of tenths off U.S. GDP growth? Probably. But it will curtail growth in China to an even greater extent which could provide some incentive for Chinese leaders to re-think their business practices. The good news is that this trade war comes at a time when the U.S. economy is strong and any modest drop-off in growth will go largely unnoticed.

In our view, the economic fundamentals are solid and seem to be pointing towards a surprisingly favorable combination of strong growth, contained inflation, and low interest rates for the foreseeable future.

As a result, we conclude that the stock market decline this past week has been largely technical and has little if any economic significance. We have noticed that the markets seem to become unglued late in the day and plunge several hundred points in a matter of moments. Perhaps the increased popularity of exchange-traded funds, which try to mimic the performance, of a particular stock index are contributing to the problem. Fund managers are required to keep their portfolios closely aligned with whatever index they track. They can most closely match that index by executing trades late in the day. We see the market collapsing and gasp, but the exaggerated slide largely reflects a very normal technical trading phenomenon.

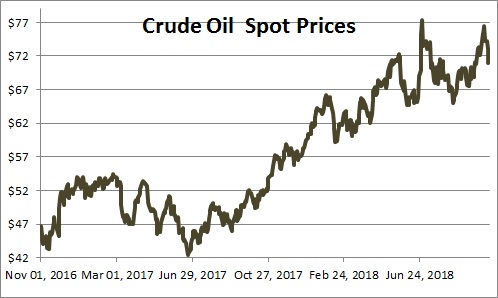

One other point worth noting. Oil prices in recent months climbed to about $75 per barrel before sliding late in the week to $71 as investors concluded that the stock decline might trim GDP growth around the globe and thereby curtail the demand for crude oil. However, we continue to worry about further reductions in the supply of oil in the months ahead which could once again push prices higher.

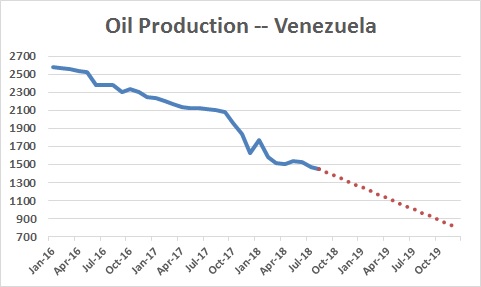

The rise in oil prices the past few months largely reflects curtailment in the supply of oil from Venezuela, and the fear of a sharp reduction of Iranian output once sanctions go into effect next month.

Oil production has collapsed in Venezuela as the country’s economy has sunk into depression. However, the drop-off has been gradual and other OPEC countries have been largely able to fill the gap.

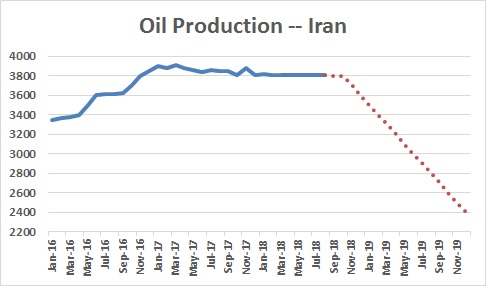

In Iran the decline in production in Iran thus far has been modest, but one wonders what will happen once the U.S.-imposed sanctions go into effect on November 4. The goal is to reduce Iran’s oil exports to zero. No one knows at this point how big the impact will be. India has joined South Korea and France in ceasing to buy Iranian oil. Other countries have sharply curtailed their purchases. OPEC has said it stands ready to counter any loss of oil from Iran and claims that its spare capacity is ample. However, those wells have been unused for some time and it is not clearly exactly how much can be tapped quickly. Thus, there is the potential for a further run-up in oil prices between now and yearend.

In conclusion, the October stock drop is disquieting, but there is no reason to believe it is a harbinger of slower growth ahead. As always, there are potential dangers lurking and we will continue to monitor them. For now, breathe easy.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me