April 5, 2024

The economy continues to be on a roll. The monthly employment gains are impressive. The workweek has rebounded. First quarter GDP growth keeps getting revised higher. We have raised our GDP estimates for both the first and second quarters from 2.2% to 2.5%. If those forecasts are accurate the Fed certainly does not need to be in a hurry to cut rates. The economy is doing fine. But the decision to ease or not will probably be determined more by the behavior of the inflation rate in the next few months than by the pace of economic activity. We continue to expect the first rate cut on July 31, which is still 3-1/2 months away. It is also important to note that with the economy doing as well as it is when the “real” funds rate is +1.7%, it seems increasingly likely that the “neutral” real funds rate in today’s world is not the +0.5% that the Fed expects currently but something higher. If it is +1.0% for example, then the neutral level for the nominal funds rate might be 3.0% (2.0% inflation + 1.0% real rate) rather than the 2.5% that the Fed believes currently.

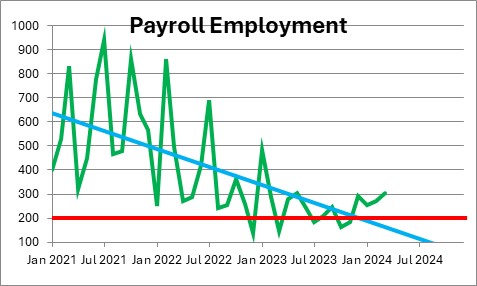

The labor market continues to impress with a jobs gain of 303 thousand in March. In fact, payroll employment has risen on average 244 thousand per month for the past year. This is surprising given that the population has presumably risen on average by 134 thousand during that period of time. Our sense is that the robust pace of hiring in the past year is related to the historic influx of illegal migrants crossing into the United States along our southern border. Almost all Americans are concerned about our largely open southern border and the potential inflow of drug dealers and Chinese spies amongst the entrants. That is not good. But it also appears that illegal immigration is the source of additional workers who are keeping the economy chugging along at an impressive pace at a time when most economists had expected a substantial growth slowdown and/or a recession.

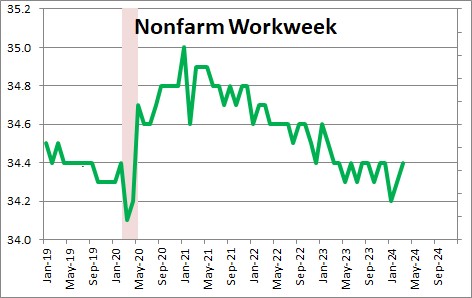

In March the economy added 303 thousand jobs. Each month employers can boost production either by hiring additional bodies or by lengthening the workweek of their existing workers. In March they did both.

In addition to the 303 thousand increase in employment, employers in March lengthened the workweek by 0.1 hour to 34.4 hours. That may not sound like a lot but it represents an increase of 0.29%. An increase in payroll employment of 0.29% represents a further increase of 461 thousand. In other words, had employers not lengthened the workweek they would have needed to hire 764 thousand workers to boost production by the same amount as the combination of a 0.1 hour increase in the workweek and an increase in payroll employment of 303 thousand. Needless to say, the labor market exploded in March. As a result, we have boosted our first quarter GDP estimate slightly from 2.2% to 2.5%. Because the pace of growth appears to have strengthened at the end of the first quarter, we have carried some of that additional strength into the second quarter and boosted our GDP outlook for that quarter from 2.2% to 2.5%.

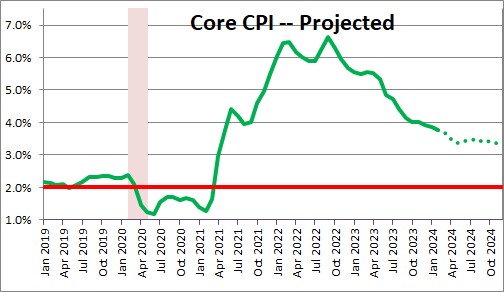

The market has concluded that the Fed will drag its feet and not be in any hurry to ease. As a result, the fed funds rate futures market now expects two rate cuts between now and yearend rather than three. That would trim the funds rate from 5.5% currently to 5.0% by yearend. That is not an unreasonable conclusion, but we continue to look for three rate cuts to 4.75% because we expect the inflation rate to continue its downtrend.

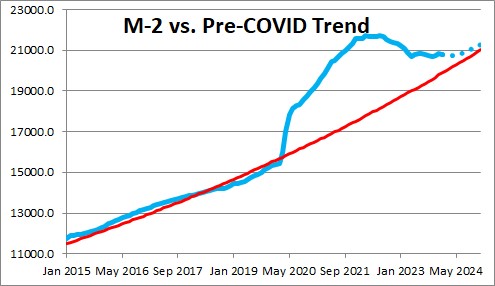

Our primary reason for expecting a steady slowdown in inflation is tied to growth in the money supply, which is simply a measure of liquidity. During, and for a long period of time after the end of the 2020 recession, the Fed was buying literally trillions of dollars of U.S. Treasury and mortgage-backed securities. In the process it flooded the economy with surplus liquidity as money supply growth exploded. Since March 2022 the Fed has been shrinking its balance sheet and withdrawing most of that surplus liquidity. In the process the money supply has been declining. While some surplus liquidity remains, if the Fed continues to shrink its balance sheet for the next several months the remaining surplus liquidity should disappear by midyear. That, in turn, should pave the way for a further slowdown in the inflation rate.

For what it is worth, we expect the core CPI to slow from 3.8% currently to 3.4% by the end of this year, and to 2.7% by the end of 2025.

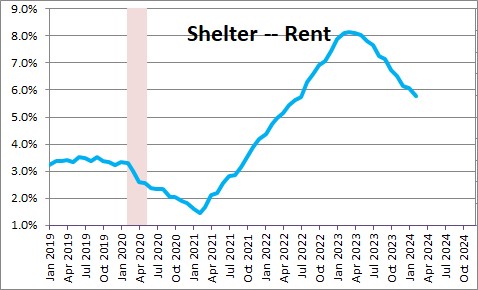

In addition to the money supply/liquidity argument we believe that the rent component will continue to slow gradually from 5.8% currently to about 5.0% by yearend as home prices level off or even decline in the months ahead as supply increases. Because rents represent one-third of the entire CPI such a slowdown would go a long ways to further moderating the inflation rate.

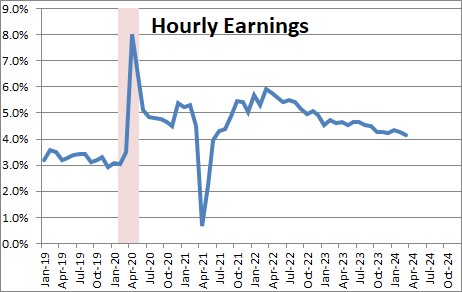

Also, it is worth noting that average hourly earnings (wages) have been slowing steadily throughout the past year. That is somewhat surprising given that the unemployment rate has consistently been below the full employment threshold of 4.0%.

It could be that illegal immigrants are filling many low-paying, entry level positions which is trimming the growth rate in average hourly earnings.

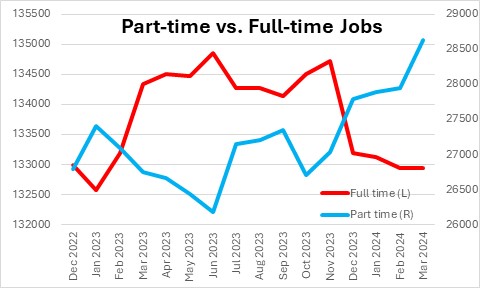

It may also be that they are accepting part-time employment rather than full-time positions. In the past several months the number of part-time workers has increased sharply while full-time employment has shrunk noticeably. The addition of a significant number of part-time positions is helping to keep the overall monthly increase in wages in check. Given that wages represent about two-thirds of a worker’s overall compensation, slower growth in wages should exert downward pressure on the inflation rate.

One final point. The funds rate today is 5.5%, the core CPI is 3.8%. Doing the subtraction implies that the real rate is +1.7%. At the same time, the economy is expanding nicely at roughly a 2.5% pace. Thus, it could be that a “neutral” real level of the funds rate may not be +0.5% (2.5% funds rate – 2.0% inflation) which is what the Fed expects currently. It may be significantly higher. If the neutral real funds rate is +1.0%, for example, then the neutral level for the funds rate might be 3.0% (2.0% inflation + 1.0% real rate). That means that, in turn, the funds rate might ultimately decline only to the 3.0% mark rather than 2.5% as the Fed expects at the moment.

On balance, recent data reinforce the notion that the economy continues to expand at an impressive pace while, at the same time, the inflation rate remains on track to steadily shrink. That is a great combo, if it lasts.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me