January 24, 2025

.Trump is going to impose significant tariffs on all goods coming from Mexico, Canada, China, Europe, and Russia. He indicated that he intends to impose a 25% tariff on products imported from Mexico and Canada. Those are our biggest trading partners so tariffs on those two countries matter. While much of the sting for those two countries may be negotiated away, tariffs are going to be a factor those two countries will have to deal with for the next four years. For China and Europe tariffs will do serious damage because their respective economies are already anemic and tariffs will make them worse. The U.S. buys so little from Russian entities that a steep tariff would have little impact on that country.

It is hard to estimate the economic impact of the tariffs on Mexico and China at this point because it is clear that Trump intends to use them as a bargaining chip. In the case of Mexico he wants to halt the flow of illegal migrants into the U.S. In the case of Canada he wants to stem the flow of fentanyl from Canada into the U.S.. He also wants a significant increase in Canadian defense spending. But no matter how one slices it those two countries will see significant increase in tariffs as long as Trump remains in office. We will postpone a detailed discussion of the economic impact on these two countries until the situation becomes clearer.

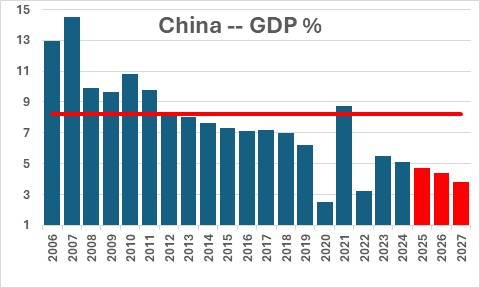

China’s GDP growth rate has slipped far below its historical average and is unlikely to rebound any time in the foreseeable future. In the past 20 years GDP growth in China has averaged 8.0%. But the IMF estimates GDP growth in China in 2024 was 4.8%. Worse yet it anticipates even slower GDP growth in each of the next three years. China’s problems are well known. It has an aging population which means that its workforce is shrinking. The prolonged problems in the housing sector are showing no sign of abating. A surge in residential housing developments boosted property values and lifted consumer spending for years. But the oversupply of homes eventually caused home prices to plunge. Many households now have negative equity. Consumers are overloaded with debt, wary of the future, and reluctant to spend. Meanwhile, many of the largest developers in the world have gone bankrupt. Investment will not rebound until home prices stabilize and housing inventories decline. Unfortunately, the drop in home prices continues.

Trump’s threat of imposing a 10% tariff on all goods coming from China would do serious damage to both economies, but with GDP growth currently averaging 2.5-3.0% in the U.S. the damage to the U.S. economy will be far less than it will be for China. With Chinese goods sold to U.S. customers averaging $40 billion per month, a 10% surcharge would do serious damage to already anemic GDP growth in China. And with consumer prices rising at only a 0.3% pace currently in China a significant drop in demand could result in a very damaging deflationary environment.

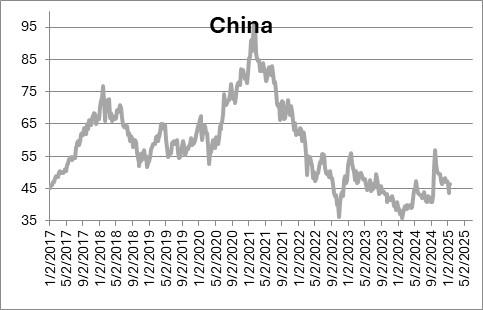

Given this bleak outlook for its economy the MCHI stock market index has been essentially unchanged for two years.

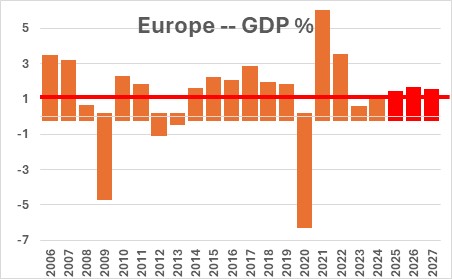

GDP growth in Europe is also anemic. The IMF believes growth in the Euro area was 0.8% in 2024 and it expects growth to be only marginally faster growth at about 1.3% in each of the next three years. But Trump has said that the European Union is” very, very bad to us., and so they are going to be in for tariffs”. That would be immensely damaging to a group of countries that collectively send $55 billion of merchandise to the U.S. every month and are already in a weakened state.

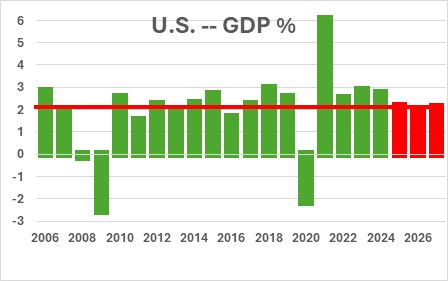

Contrast this situation to that of the U.S. where GDP growth remains robust. Growth in 2024 averaged 2.8%. It has been 0.5% faster than expected in each of the past couple of years. The IMF projects 2.1% GDP growth in 2025, 2026, and 2027 primarily because it believes that potential growth is still 2.1%. We believe potential growth is close to the 3.0% mark which suggests that GDP growth for the next couple of years could, once again, surprise on the high side.

If a tariffs war breaks out Mexico, Canada, China, and Europe are far more vulnerable than the United States. The strong economic performance of the U.S. economy has given Trump considerable leverage in negotiating trade deals.

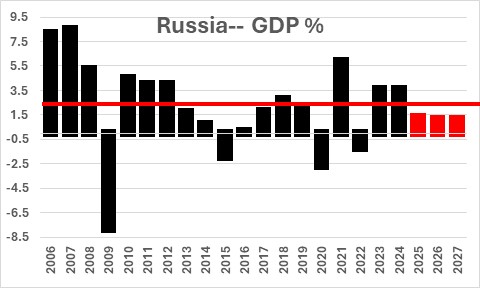

In the case of Russia, Trump has threatened taxes, tariffs, and sanctions on everything that Russia sells to the U.S. But that is a hollow threat. In the first 10 months of this year Russia’s exports to the U.S. were $3.0 billion or roughly 0.1% of total U.S. imports during that period of time. Trump’s intention is to provide an incentive for Putin to negotiate an end to its war with Ukraine, but this threat seems unlikely to do the trick. Putin wants a significant portion of Ukraine territory and is unlikely to end the war until he gets some concession.

It is true, that the Russian economy has been weakened significantly by its war in Ukraine, and the IMF is projecting 1.2% GDP growth in each of the next three years.

As a result of that dismal economic performance the Russian stock market remains about 30% below its pre-war peak.

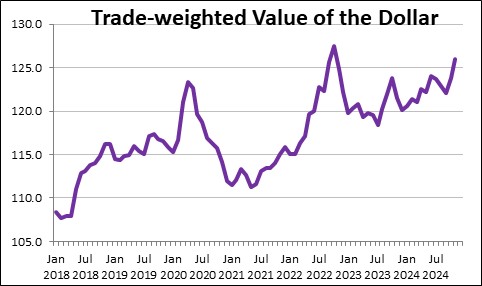

Disparate GDP growth between the U.S. and the rest of the world is causing the dollar to strengthen as investors seek dollar-denominated assets. It has risen about 6.5% in the past year largely as the result of significant gains against the Mexican peso and the Canadian dollar.

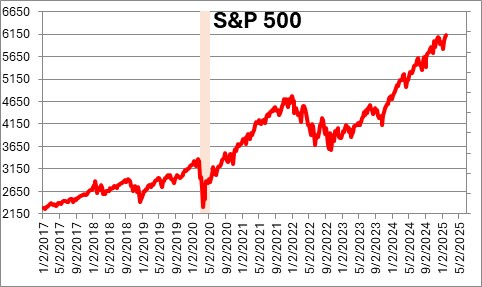

The steady, sustained rapid pace of GDP growth has pushed stock prices to yet another record high level.

Even though the economy still seems solid tariffs are coming. The exact amounts and products covered are still unclear but they are likely to begin February 1. Calculating their impact is difficult to assess in part because of uncertainty about the magnitude of the tariffs to be imposed by the U.S. and by the likely response by other countries.

Tariffs are not the only factor that can affect the pace of economic activity and/or inflation in the months ahead. The mass deportation of illegal immigrants and the extent and magnitude of tax cuts can also alter the otherwise optimistic outlook for the economy between now and the end of the year. Stay tuned, but for now the economic backdrop remains positive.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me