December 15. 2017

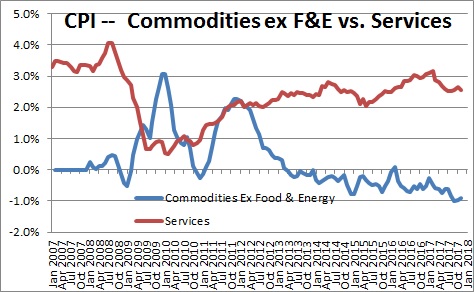

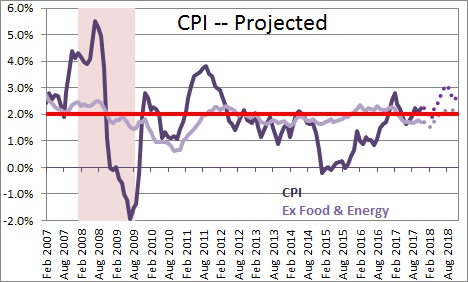

The “core” Consumer Price Index for November (excluding the volatile food and energy components) rose 0.1% which brings the year-over-year increase to 1.7% — somewhat below the Fed’s desired 2.0% pace. Special factors can explain some of the CPI softness in the past year, but it is increasingly clear that technology is the primary cause of consistently falling goods prices. In the past year goods prices have declined 0.9% while prices of services have risen 2.6%. What is causing these widely divergent price movements? Technology.

To be sure, special factors contributed to the overall softness of the core rate of inflation this year. For example, a price war amongst phone providers caused a double-digit drop in wireless phone prices. At the same time, prescription drugs prices have slowed from a 6.3% increase in 2016 to 2.2% this year following President Trump’s threat to the pharmaceutical industry. He wants to cut the prices of prescription drugs by allowing consumers to purchase such drugs overseas, and allow Medicare to negotiate prices directly with the insurance companies. The combination of these two factors appears to have shaved about 0.2% from the CPI this year but, in both cases, the downward bias to inflation has run its course.

With respect to goods, the internet has played a big role in reducing those prices by 0.9% in the past year, Shoppers can instantly use their iPhone to compare the store price to a wide array of prices available at other online and brick and mortar stores. If merchants do not price match, they risk losing the sale. Thus, all retail goods merchants are constantly competing with the lowest price available on the internet.

Looking at specific items in the CPI prices have fallen for almost every major category.

- New car and trucks — -1.1%

- Used cars and trucks — -2.1%

- Appliances — -1.9%

- Audio Equipment — -11.5%

- Sporting goods — -1.3%

- Toys — -9.0%

- Information Technology Commodities (PC’s, software, and phones) -3.3%

- Books — -3.6%

- Televisions — -7.5%.

Prices for these items are widely available on the internet and can be used as bargaining chips with traditional brick and mortar retailers.

The downtrend in these goods prices has been accelerating in the past five years as Google searches and price comparison apps have become more prevalent and easier for shoppers to use. Merchants increasingly need to price match to close the deal.

Prices for services, in contrast, have risen 2.6% in the past twelve months. Amongst services, there is an equally long list of prices that have been climbing.

- Rent — +3.2%

- Water, sewer, Trash Collection — +3.2%

- Medical Services — +1.6%

- Transportation Services (Car and Truck Rental, Auto Repair, Car Insurance) — +3.8%

- Public Transportation (Airfares, Bus and Train Fares) — -0.8%

- Recreation Services (Cable and Satellite TV Service, Pet Services, Admissions) — +3.5%

- Tuition — +2.4%

- Telephone Service (Wireless Telephone Service, Land-lines) –6.7%

- Miscellaneous Personal Services (Haircuts, Legal Services, Financial Services) — + 2.3%

Two comments about service sector prices. First, rents are, by far, the dominant category and account for more than one-half of the entire service sector. Given the on-going shortage of both homes available for sale and rental units, rents are destined to continue rising at a rate of 3.0-3.5%. Second, the only price declines in the list above were telephone services, which reflects the price war between wireless phone providers which has largely come to an end, and public transportation which includes airfares.

So, what is going to happen to the inflation rate in 2018 given the disparate movements between goods prices and services? The first thing that thing that should be noted is that goods represent about one-third of the entire CPI while services account for the remaining two-thirds. What happens to prices in the service sector is twice as important as changes in goods prices.

There can be little doubt that the downward pressure on goods prices will continue in 2018. However, with a very tight labor market and the rising cost of materials, goods prices may not match the 0.9% drop that occurred this year. In the service category, worker shortages may push prices upwards at a slightly faster rate in 2018 than they did this year, the price war between cell phone providers has come to an end, and rents should continue to climb at a rate between 3.0-3.5%.

Putting it all together, our expectation is that the core CPI should quicken somewhat from the 1.7% pace recorded this year to 2.2% in 2018. While some pickup in inflation should be expected, it is not going to explode to the upside because of the continuing downward pressure on goods prices as iPhones allow consumers to find the best available bargain.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me