August 16, 2024

It looks increasingly likely that the market jitters earlier in the month were temporary and caused by a few weak data points combined with the unwinding of the Japanese yen carry trade being used to finance bond purchases in the U.S. and elsewhere. In other words, it was much more a stock market event than an economic event. The scare began when the Bank of Japan raised its policy rate to 0.25% on Wednesday, July 31, and suggested that this was the beginning of a full-fledged rate hike cycle designed to lift Japanese interest rates back to a level deemed neutral for the economy.

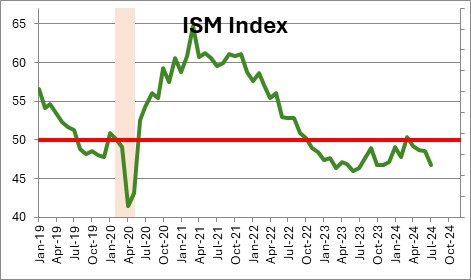

A day later on Thursday, August 1, the manufacturing purchasing managers’ index for August came in much weaker than expected.

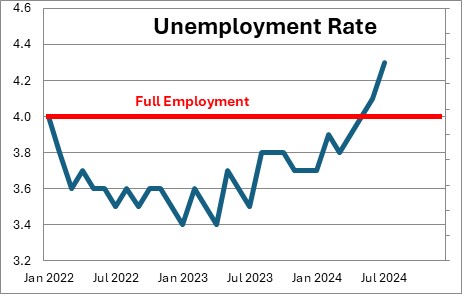

On Friday, August 2, a substantially smaller than expected increase in payroll employment for July, a decline in the workweek, and a surprise 0.2% increase in the unemployment rate to 4.3% spooked the markets. It appeared to many that the U.S. economy was on the cusp of or perhaps already in a recession.

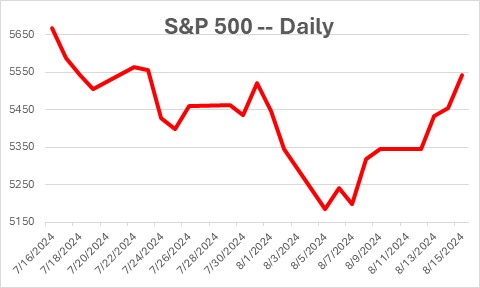

The markets began to expect rate cuts at every Fed meeting between September and yearend. There was even chatter about a 0.5% emergency rate cut prior to the next FOMC meeting. Suddenly rates in Japan were headed substantially higher. Rates in the U.S. were headed much lower. This combination of events destroyed the carry trade and leveraged traders were forced to unwind those money-losing trades and the U.S. stock market plunged.

The S&P 500 index fell 8.5% from a record high level of 5,667 on July 16 to 5,186 by August 5 which was a near correction.

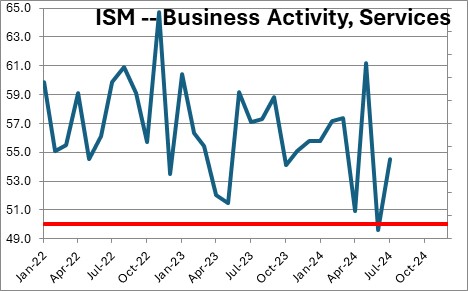

But then funny things started to happen. By Monday, August 5, the service sector purchasing managers index rose sharply and widely exceeded market expectations. This sector is important because the service sector of the economy at 83% is far larger than the goods-producing sector at 17%. Maybe the economy was not going over the edge after all.

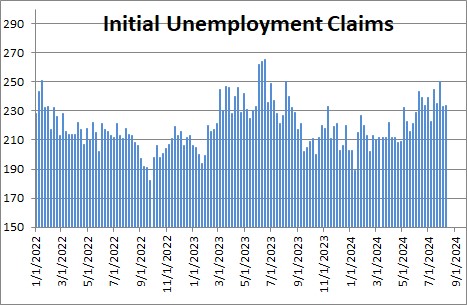

And then the weekly data on initial unemployment claims (a measure of layoffs) retreated in each of the next two weeks from the high level recorded in the week of July 27. Perhaps the labor market was not falling off a cliff either. Softened a bit perhaps, but hardly collapsing.

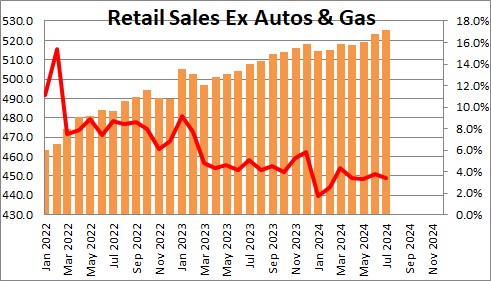

Then there were the retail sales data for July which jumped 1.0%, the biggest increase since January 2023. Admittedly, car sales accounted for a large portion of the gain, but even excluding autos and gasoline (the two most volatile categories) sales rose 0.4%. That category of sales has risen 3.4% in the past year, but at a 5.9% clip in the past three months. The consumer is supposed to be leading the charge in the alleged economic slowdown. So where’s the beef?

The bottom line is that upon further consideration economists concluded that the softness in the July data was probably caused primarily by Category 5 Hurricane Beryl which slammed into the Texas and Louisiana coast on July l 1. Another contributing factor may have been the cyberattack on computer software in late June that disrupted business operations for thousands of automobile dealerships for more than a week. As a result, economists decided that they might have overreacted and that the economy was not as weak as they thought initially. Given that change of heart, the stock market has rebounded, erased its earlier decline, and is basically one good day away from setting another record high level.

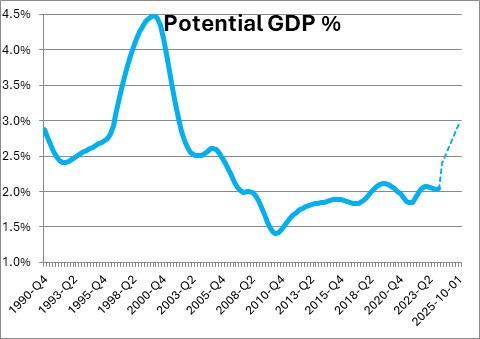

It is not yet clear what GDP growth will be for the third quarter. We expect GDP growth of 0.9%. But much of that anemic growth rate is attributable to a slower pace of inventory accumulation. Final sales growth, which strips out the change in inventories, is likely to be 2.2%. The widely followed Atlanta Fed GDPNow forecast is currently 2.4%. The Fed currently believes that potential GDP growth (the economy’s speed limit) is 1.8% but, like most economists, it is in the process of boosting that growth rate higher given what is expected to be a protracted series of productivity gains caused by AI and other productivity-enhancing technological developments. We suggest it may well now be somewhere in the range of 2.5-3.0%. Whatever the case, GDP growth of 2.2% or less in the third quarter is not going to be threatening.

With the increase in the unemployment rate to 4.3% (versus its presumed full employment level of 4.0%) the Fed is now also concerned about emerging softness in the labor market. But with most of the recent increase in the unemployment rate attributable to big increases in the labor force rather than layoffs, it should not be too concerned yet. Given that monthly changes in the labor force can be extremely volatile, we should not be too surprised if sometime in the next month or two the unemployment rate surprisingly declines 0.2% or so to 4.1%.

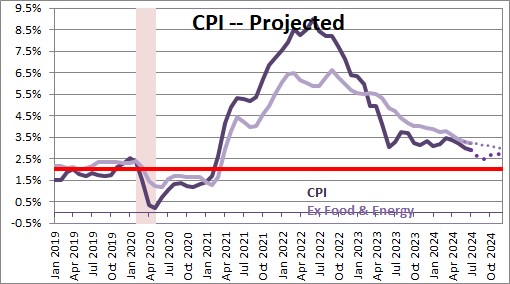

Meanwhile, the inflation data continue to surprise on the soft side. The year-over-year growth rate for the core CPI once again fell by 0.1% to 3.2% in July. It is still headed in the right direction, and the surprises have tended to be on the downside. Inflation is headed lower for the foreseeable future, even though the drop will almost certainly be slow but steady.

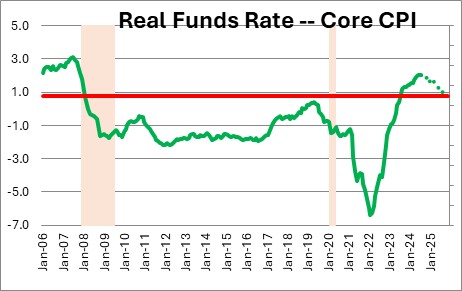

This leaves the Fed in an enviable position of being able to begin the long-anticipated series of rate cuts in September. The market is pricing in 75 bps of easing between now and yearend. We agree. That would lower the funds rate from 5.25% today to 4.5% by December.

As inflation continues to shrink to 2.6% by the end of 2025, the Fed can further reduce the funds rate to 3.5% by the end of that year. Given a 3.5% funds rate and a 2.6% rate of inflation, the real funds rate will have dropped from 2.1% currently to 0.9% by December 2025. Remember, the Fed thinks its policy is neutral when the funds rate is 0.8% higher than the inflation rate. By the end of next year Fed policy will have returned very gradually to a roughly neutral policy stance which should pave the way for steady growth for some time to come. By the end of 2025 the expansion will have lasted 69 months which means it is still in its infancy given that the average expansion since 1990 has lasted 103 months.

So far, so good.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me