October 18, 2023

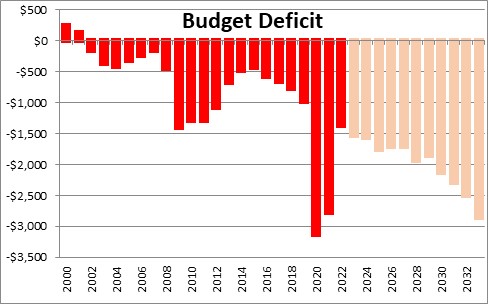

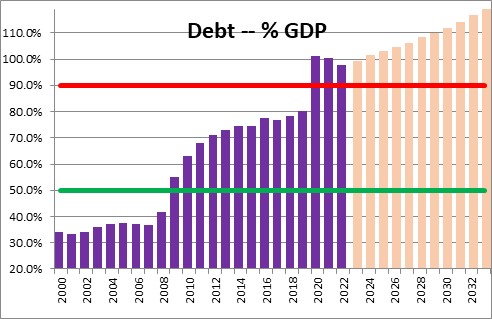

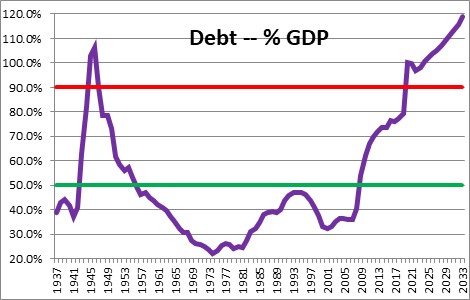

The budget problem has arrived. Budget deficits are averaging $2.0 trillion which means that the government must issue an equivalent amount of debt every year to pay its bills. As a result, debt in relation to GDP is expected to climb to 119% by 2033. The previous record was 106% following World War II. Politicians can no longer kick the can down the road. We must soon find a solution to the problem because Medicare will exhaust its reserves in 2031, Social Security will follow in 2033. Once its reserves are depleted Social Security benefits will be cut by an estimated 23%. Any candidate who says that they will not touch Social Security benefits is implicitly advocating a 23% cut in Social Security benefits for 70 million older Americans. Sorry, wrong answer!

Government spending has surged in the past two years as the government intervened in 2020 and 2021 to lessen the impact of the COVID pandemic. After a reprieve to “only” $1.4 trillion last year the budget deficit is poised to exceed $2.0 trillion once again in fiscal 2023 with a string of $2.0-3.0 trillion deficits looming every year for the foreseeable future. And if that is not bad enough, should a recession occur at any point in the upcoming decade the projected deficits will be even larger.

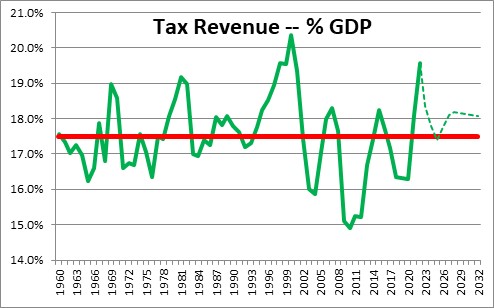

Make no mistake the deficit problem is not a shortfall of tax revenue. In fact, over the next decade those revenues are already projected to surpass their average over the past 50 years. There is not much room for tax increases to solve the deficit problem.

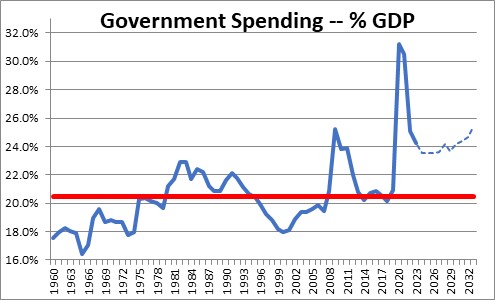

The problem is spending. Government expenditures will average about 24% of GDP compared to their historical average of 20.5%. The solution to the problem is to cut spending.

Given these bloated deficits, debt outstanding will increase by $2.0-3.0 trillion every single year because that is what the government must do to pay its bills. As a result debt in relation to GDP will climb from 100% this year to 119% by 2033.

To put this into perspective, the prior record debt to GDP ratio was 106% in 1946. But in the late 1940’s and 1950’s government spending plunged because wartime spending ended. That will not happen today because the bloated deficits are caused by excessive spending in general, ballooning entitlements in particular. What are entitlements? They are simply payments by the government directly to individuals to supplement income. The list includes such giants as Social Security, Medicare, and Medicaid, as well as veterans and unemployment benefits amongst others. In the 1960’s such benefits were roughly 25% of all government spending. Today they represent nearly two-thirds of the total. And, unfortunately, no politician ever wants to cut benefits. To do so will negatively impact the income stream for a large number of voters in their district. They regard a cut in Social Security benefits as the “third rail”. Cut them and your term in office will end at the next election. Like it or not, they will soon need to address the issue.

Why? Because the trust funds for many of these entitlements will soon exhaust their reserves. Medicare will be insolvent by 2031. Social Security will suffer the same fate in 2033. The Social Security Administration estimates that if that happens, 70 million retirees will see their monthly benefits shrink by 23%. While retiring baby boomers are a large part of the problem, the recent shrinkage of the labor force, declining birthrates, and increased life expectancy compound the problem.

The solutions are well known. Gradually raising the retirement age, trimming the annual cost-of-living adjustment, a reduction in payments to high income beneficiaries, and increasing the threshold for which benefits are taxed, will undoubtedly be parts of the ultimate solution. The problem is not how to solve the issue but, rather, finding the courage to act. With divided government, achieving the solution will be challenging but it must be done. Significantly cutting benefits for 70 million older Americans is unacceptable. Any politician who says he or she will not cut benefits for Social Security recipients should not be viewed as a serious candidate.

Stephen Slifer

NumberNomics

Charleston, S.C.

Fantastic analysis Steve!

Steve Can you put your comments in perspective with regard to how our debt to GDP ratio compares to other countries.

If they are doing better than we are, what is their secret? I suspect they are not financing other countries’ wars, defense, natural calamities, etc. as we do.

Regarding: “Any politician who says he or she will not cut benefits for Social Security recipients should not be viewed as a serious candidate.” – I wonder if any candidate would consider bringing this up as a topic much less even an option.

One more solution to SS solvency is raising the payuroll premium gradually as well as the employer contribution.

You are right, Pat. My list was never meant to be all-inconclusive. I picked off items agreed to by the Erskine-Bowles Commission back in 2010. 9 Republicans. 9 Democrats. Nobody ever expected them to come to any sort of an agreement. But they did. They came to an agreement on basically everything. Individual and corporate income taxes, tax brackets, shrinking the deficit, desired amount of debt outstanding, fixing Social Security and Medicare. But it cut entitlement spending too much and Obama pulled the plug on it. It was his Commission and he rejected its conclusions. One wonders how much different today’s world might look if we have accepted their conclusions.

Hi Dean. I can certainly understand why they don’t want to talk about it. Maybe we should hold their feet to the fire.

Not an easy question to answer in a short response. Every country is different. Here are results for some of the big countries + Greece.

Canada 14%

France 99%

Germany 47%

Italy 133%

Portugal 109%

Spain 97%

Greece 175%

Japan 162% (but the Japanese are big savers)

U.K. 92%

U.S. 95%

Economists generally believe that a debt/GDP ratio of 50% or so is sustainable over time. They regard 90% as a danger level.

As you can see all of southern Europe is in the danger category, as is the U.S (and its ratio is headed higher in a hurry — 119% by 2033).

Germany is the flip side of all that.

And, of course, Greece is probably the poster child of debt problems.

Hope this is helpful.

Thanks Barry. Now if we could only get Washington to actually do something. Remember the Erskine Bowles Commission in 2010 (see my comments to Pat Mason above)? We had the brass ring within our grasp and did not grab it. What a mess we have created!

If only just one of the Presidential hopefuls would read your commentary, especially concerning social security.

Even if they read it, would they really care? They won’t react, I don’t think, until you and I hollar enough to get their attention. Not too many voices out there at the moment.