May 17, 2017

The latest round of tit-for-tat tariff increases by the U.S. and China has created a significant problem for the Chinese economy. The impact on the U.S. comes largely in the form of a pickup in inflation and higher long-term interest rates which can hardly be categorized as problems because the Fed would like both things to happen.

In 2018 the U.S. exported $120 billion of goods to China. Given nominal GDP of $20,494 billion that means that exports to China are 0.6% of U.S. GDP. Thus, a 20% drop in exports to China might shave U.S. GDP growth by 0.1%. Given projected GDP growth this year of 2.7%, the imposition of these tariffs might trim it to 2.6%. While this is not a big deal for the overall economy, it is little comfort to the industries that will be hit the hardest (think farmers, fishermen, and car makers).

Using the same arithmetic, Chinese exports to the U.S. last year were $540 billion in an economy of $13,407 billion. That means Chinese exports to the U.S. are 4.0% of its economy. A 20% drop in those exports would shave GDP growth by 0.8% from an already 30-year slow growth rate of 6.5% currently to 5.7%. The tit-for-tat increase in tariffs is going to do far more damage to the Chinese economy than it will to the U.S.

So how might the Chinese respond? One way would be to let the Chinese yuan depreciate. That would make Chinese goods cheaper for others to purchase. Reduced exports to the U.S. could be partially countered by higher exports elsewhere. But that is not going to happen.

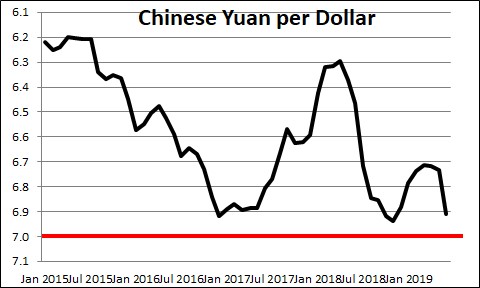

The Chinese yuan is at 6.91 per U.S. dollar. Government officials are determined not to let it fall beyond 7.0. A weaker yuan would encourage capital outflows which the Chinese can ill afford. Thus, Chinese leaders and have been intervening actively to ensure that does not happen.

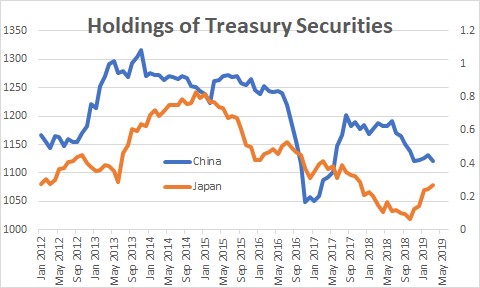

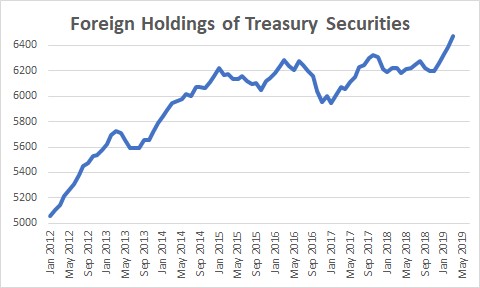

That raises a fear that the Chinese might have to sell U.S. Treasury securities to get the dollars required to sell in the foreign exchange market to stabilize the yuan. Chinese holdings of U.S. Treasury securities declined $62 billion or 5.0% last year and could fall further in the months ahead. Given that the Chinese still own $1.1 trillion of Treasury securities this development seems somewhat ominous – but also unlikely. If they choose to reduce their holdings of U.S. Treasury securities significantly, where are they going to re-deploy those assets? To Europe? The U.K.? Japan? Bitcoin? The alternatives are not enticing.

While Chinese holdings of Treasuries fell last year, total foreign ownership has climbed to a record high level. Some of the offsetting purchases have come from places like the U.K. and Ireland as they prepare for a possible unfriendly Brexit outcome. Thus, a significant drop in foreign holdings of U.S. Treasury securities as a result of the current trade difficulty with China seems unlikely.

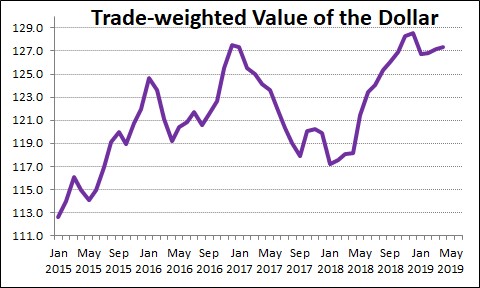

Suppose that the Chinese change their mind and decide to let the Chinese yuan decline. That would soften the blow of higher tariffs on the Chinese economy but would spread the impact throughout the entire community of emerging economies. Given their close trade ties to China a weaker Chinese yuan would weaken the currencies of every other country in Asia and significantly strengthen the value of the dollar as investors around the globe conclude that the country most insulated from the consequences of a trade war is the U.S. That is exactly what happened last year.

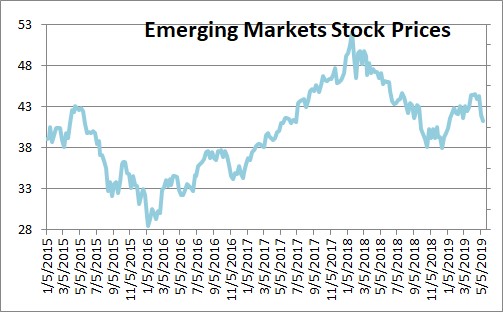

The dollar strengthened by 10% in 2018. Because commodities are priced in dollars, a stronger dollar meant that the raw materials every emerging economy requires to produce the goods that they manufacture became more expensive. With the higher cost of goods sold, they are less able to compete in the global marketplace. As a result, the IMF reduced projected GDP growth for all of these countries and their stock markets plunged.

While slower GDP growth around the globe is never a desirable scenario, the reality is that foreign capital outflows from China and elsewhere ended up in the U.S. and cushioned the blow on the U.S. economy. Foreign funds were used to start new businesses in the U.S., hire American workers, and invest in the U.S. stock and bond markets. Relative to the rest of the world the U.S. won, the rest of the world lost. Because the Chinese economy relies so heavily on foreign funds, a significant further weakening of the Chinese yuan is not a desirable outcome. For now Chinese leaders have chosen to stabilize the value of the yuan. But that means that the entire impact from the newly imposed U.S. tariffs will fall exclusively on China. Given that Chinese exports to the U.S. are 4% of Chinese economy, a significant drop would sharply reduce expected GDP growth which, at 6.5%, is already at its slowest pace since 1990. Not a good thing.

Any way you slice it, the Chinese have a problem.

In the U.S. the tariffs could slightly reduce GDP growth, but with the U.S. economy chugging along at an expected 2.7% pace this year the negative impact on growth would be negligible,

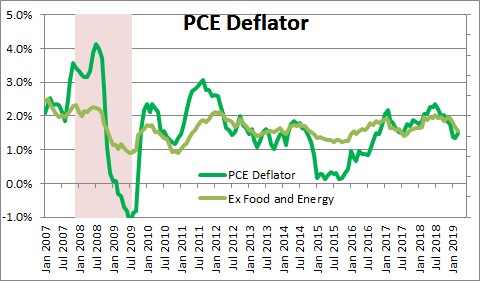

The impact on prices and the U.S. inflation rate will be more noticeable. As noted earlier, China exports $540 billion of goods to the United States. Given nominal GDP of $20,494 billion such goods represent 2.6% of GDP. A 20% increase in the price of those goods could boost the inflation rate by 0.5%. Higher prices for goods coming from China could entice some U.S. manufacturers to raise prices as well which could exacerbate the impact on inflation. With the core personal consumption expenditures deflator (the Fed’s preferred inflation gauge) currently at 1.6% an additional 0.5-0.7% jump in inflation to 2.1-2.3% would actually be a desirable outcome. The Fed has already told us that it is prepared to let inflation run slightly above target for a while to compensate for the fact that it was below target for so long.

A 0.5% increase in the inflation rate would boost the rate on the 10-year Treasury note by about 0.5% from 2.4% currently to perhaps 2.9%. With the funds rate likely to remain steady at 2.4%, that implies that the yield curve (the difference between long-term and short-term interest rates) could climb from roughly 0% today to 0.5%. Because an inverted curve can be an indicator of an impending recession, a significantly steeper curve would allow the Fed to breathe a collective sigh of relief.

All of this suggests that the pressure in squarely on the Chinese. They are in a box with no particularly desirable outcome. China needs trade with the U.S. to support the economy. Trade with the likes of Russia, Iran, Venezuela, and Cuba is no substitute. China needs to return to the bargaining table. While the possibility of a protracted trade war between the two countries is disquieting, it remains to be seen how long it will last.

Stephen Slifer

NumberNomics

Charleston, S.C.

Given nominal GDP of $20,494 billion such goods represent 2.6% of GDP.

Is the $20,494 really trillion?

Thanks. Great insight.