March 20, 2015

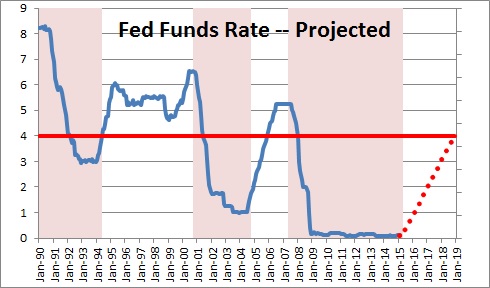

The increase in the value of the dollar will tend to slow GDP growth .this year. As a result, many now believe that the Fed will delay its mid-2015 rate hike. We doubt it. We expect the Fed to begin liftoff at its meeting in June, but it is likely to raise rates at a slower pace than normal. In the past the Fed would raise rates by 0.25% at each FOMC meeting. This time the Fed apparently intends to raise rates at every other meeting. The slower pace of rate hikes means that the Fed will not get rates back to a “neutral’ level of about 4.0% until the end of 2018. That, in turn, implies that the next downtown in the economy will not occur sooner than 2019.

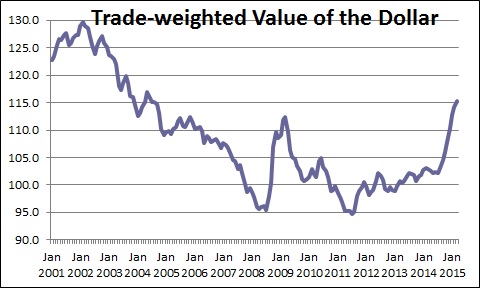

In the past twelve months the dollar has risen 12.0%, its highest level since 2004. The run-up has occurred against almost every currency – 24% against the Euro, 18% versus the yen, and 15% against the Canadian dollar, but only 1.5% against the Chinese yuan.

An increase in the value of the dollar makes U.S. goods more expensive for foreigners to purchase which implies slower growth in exports. At the same time imported goods will be cheaper for Americans to buy which implies faster growth in imports. Thus, a stronger dollar will widen the trade gap and reduce GDP growth.

But it is important to keep this in perspective. First of all, the 12% increase in the value of the dollar will not translate into 12% price changes for either exports or imports. Because profits remain strong some U.S. exporters may choose to cut prices to counter some of the impact of the stronger dollar and thereby maintain market share. Importers of goods into the U.S. may take the opportunity to fatten profit margins and not pass through to consumers the full amount of the appreciation of the dollar. Second, trade only represents about 10% of the U.S. economy. The bottom line is that the relatively sharp appreciation of the dollar may reduce GDP growth by only perhaps 0.5% most of which economists have already factored into their 3.0% GDP growth forecasts for the year. The economy is sufficiently robust to withstand any negative impact from trade because of surprisingly strong jobs growth and the likelihood of significant wage increases in the months ahead — both of which will accelerate consumer spending.

The flip side of a stronger dollar is a weaker Euro and yen which will presumably stimulate GDP growth in Europe and Japan. The IMF currently expects GDP growth in Europe this year of 1.3%. In Japan it anticipates growth of 0.8%. With sluggish projected growth in both regions any stimulus resulting from depreciation of the Euro and the yen should be regarded as a good thing.

As we see it, with GDP growth in the U.S. likely to be in excess of 3.0%, a modest negative impact on GDP growth caused by the appreciation of the dollar is not a bad thing. The U.S. economy can withstand the hit. Similarly, with GDP growth in Europe and Asia anemic, any stimulus caused by a weaker Euro and yen is a good thing. The best thing in the long run for the U.S., Europe, and Asia would be for Europe and Asia to soon emerge from their prolonged growth slump.

None of this dollar appreciation is going to deter the Fed from its midyear plan to raise interest rates. With nominal GDP growth of 4.0%, the funds rate should be at roughly 4.0%. It is at 0.0%. The days when the economy needed help from low interest rates is long past. The Fed should not delay its long-awaited move towards higher rates.

In the past the Fed would raise rates by 0.25% every time it met which is every six weeks. As a result, the funds rate would rise by about 2.0% per year. However, at its most recent FOMC meeting the suggested that it would raise rates every other time it meets which would boost the funds rate by about 1.0% per year. In this case, the funds rate will not reach the 4.0% mark until the end of 2018.

Given that the U.S. economy has never gone into recession until the Fed has pushed the funds rate above that so-called “neutral” rate, the soonest the U.S. economy could dip into recession would be 2019. Keep in mind that in June 2019 the current expansion will celebrate its 10-year anniversary — which would duplicate the longest expansion on record – the decade of the 1990’s. Everybody seems to find fault with the Fed, but the reality is that it is doing a good job of keeping the expansion on track.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me