July 29, 2016

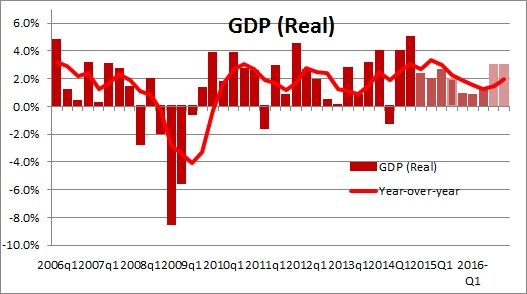

GDP growth in the second quarter came in at 1.2% which was far weaker than the 2.0% pace that had been anticipated. However, the smaller-than-expected increase in second quarter GDP growth understates the true degree of strength in the U.S. economy. That is because the second quarter GDP weakness occurred in the inventory component. In fact, inventory levels declined $8.1 billion. That rarely happens and when it does so it proves to be a short-lived event. Indeed, the last time that occurred was in the third quarter of 2011. In the subsequent quarter inventory levels surged by more than $80.0 billion. Thus, the second quarter drawdown of inventories will almost certainly prove to be temporary. As inventories return to a more normal level in relation to sales, we expect GDP growth of 3.0% in both the third and fourth quarters.

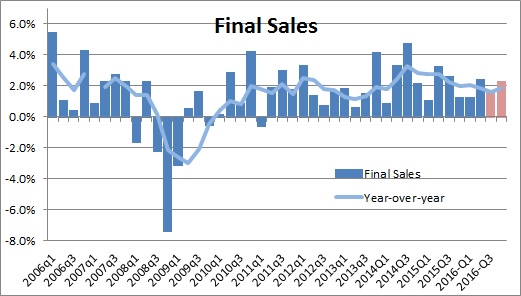

A more accurate reading of the economy is given by focusing on the 2.4% increase in final sales which was in line with other recent quarters and thereby not indicative of any economic slowdown. We expect final sales to grow at about a 2.0% pace in each of the final two quarters of 2016.

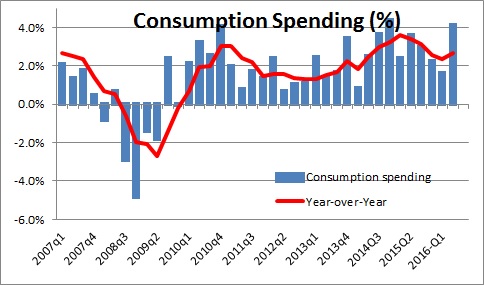

The increase in final sales included a 4.2% jump in consumer spending as job gains, rising income, the stock market at a record high level, and an unprecedented level of consumer net worth drove consumer spending upwards.

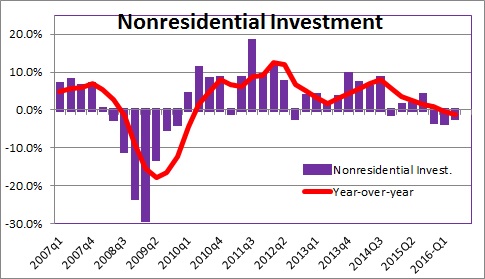

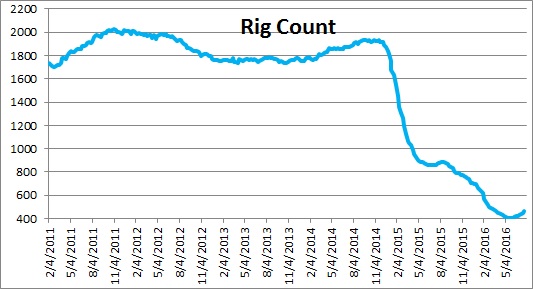

The continuing strength in consumer spending was largely offset by a 2.2% decline in nonresidential investment. One could argue that businessmen are being cautious given economic uncertainty, political angst as Election Day gets ever closer, and worries about the impact of Brexit on trade flows between the U.S. and Europe. All of those fears are legitimate, but given that the drop occurred largely in the structures category (which is where oil rigs in operation appear) and, to a lesser extent, equipment spending (which is where spending on oil drilling equipment is included), our sense is that the lingering softness in this category is oil related. If so, we know that the number of oil rigs in operation has actually increased somewhat in the past month or two. Hence, this category should level off in the final two quarters of the year. With the stock market close to a record high level, robust corporate earnings, and a record high level of corporate cash, it seems likely that while investment may not rebound in the quarters ahead, it should at least level off.

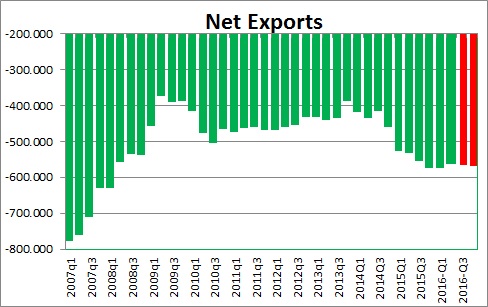

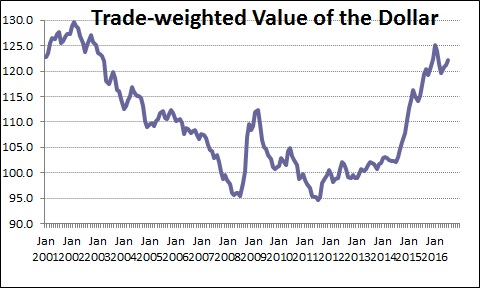

The trade component of GDP, the deficit for net exports, saw the deficit shrink $10.0 billion in the second quarter which actually added 0.3% to GDP growth. This is a big deal because last year the strength in the dollar caused U.S. exports to decline 7.2%. That increase in the value of the dollar began in October 2015 and continued through the end of last year. However, the dollar has declined about 4.0% since the beginning of this year which means that the drag on growth from reduced exports last year should gradually disappear in 2016. Indeed, the decline in the deficit for net exports in the second quarter is an indication that this process has begun.

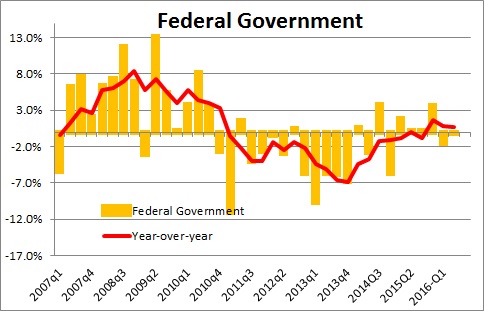

Government spending was essentially unchanged in the second quarter which was in line with expectations. After a long slide as the wars in Iraq and Afghanistan were being brought to a close, that process has largely come to a halt. That means that the drag on GDP growth that continued for several years has come to an end and we should expect Federal government spending to be essentially unchanged in the quarters ahead.

From our perspective the economy continues to chug along. Having said that, GDP growth has been somewhat softer than we anticipated. At the beginning of the year we expected 2016 GDP growth to be 2.5%. Now it appears that 2.0% growth is more likely. Consumer spending has held up well, but business people remain reluctant to invest. They have been able to boost output by hiring more bodies rather than by investing. If, as we expect, labor costs continue to climb, eventually firms are likely to reach the conclusion that it costs less to boost output via plant and equipment spending and experience the commensurate gains in productivity. But, thus far, that has not happened.

From the Fed’s viewpoint GDP growth roughly in line with its potential growth path will not generate any particular concern. It needs to raise rates to be in a position to be able to lower them at that point in time when the economy needs assistance. However, it apparently has the luxury of doing so at a slow gradual pace — which means the rate hikes will not endanger the pace of economic activity.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me