July 3, 2020

Once the March and April data began to unfold it was clear that the economy had fallen into a deep recession. Who would have thought that by May the economy would be rebounding vigorously and that the recession would be over? But yet that is exactly what is happening. The data for May and June are undeniable. At the end of this month we will see a GDP decline of roughly 50%. But we will also see — eventually — a rebound in third quarter growth of roughly comparable magnitude. Some fear that the expansion will be short-circuited by the rapid spread of the corona virus. Undoubtedly, some bars and restaurants will be forced to close and some will go out of business. That could reduce GDP growth in the fourth quarter which we currently estimate at 7.0%. But make no mistake, the recession was not caused by the virus. It was caused by our government’s response to the virus, i.e., the nationwide stay-at-home order. That is not going to be repeated. Thus, the fear of a renewed dip into recession is misplaced.

As soon as the government announced its $2.5 trillion of fiscal stimulus, we became convinced that the recession would be short, perhaps lasting three or four months which is about one-half the length of an average recession. We were wrong. It lasted all of two months. We now know that the expansion ended in February and the recession began in March. But every economic indicator for May rebounded vigorously and the June data will be even more robust. There is no doubt that the recession ended in April and a renewed expansion began in May.

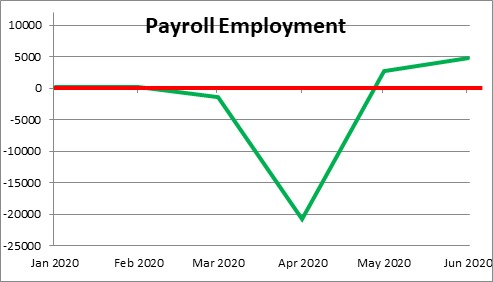

Following a decline of 1.4 million in March payroll employment plunged by 20.8 million in April. But it rebounded by 2.7 million in May and 4.8 million in June. Because the economy has recovered only one-third of the jobs lost during the recession, it still has plenty of room to grow in the summer months as the economy continues to re-open.

After stunning declines of 8.2% and 14.7% in March and April, retail sales surged by a record-breaking 17.7% in May. With far more consumers working in June than in May, and unit car sales climbing 5.7% in June, it is clear that yet another impressive gain in sales is in store for June.

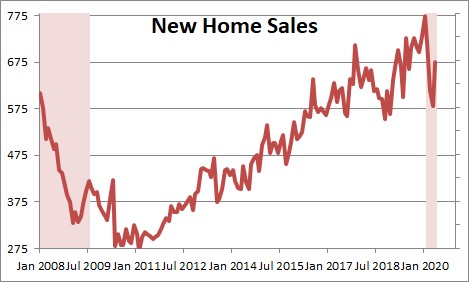

New home sales were dented during the recession as sales slipped from about 750 thousand in January and February to 580 thousand by April. But sales recovered about one-half of what they lost in May to a 675 thousand pace. A huge increase in consumer income in April (caused by the $1,200 refund checks), a shortage of available housing, and record low 3.0% mortgage rates have triggered an impressive snap-back in sales. That jump in demand is pushing home prices higher. The Case-Shiller index of home prices has risen 4.7% in the past year and at a 9.8% annual rate in the past three months. Either builders find a way to construct more houses, or home prices will continue to climb.

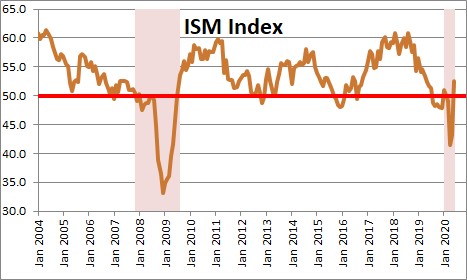

Even the beleaguered manufacturing sector is on the mend. Led by record setting increases in the forward-looking orders and production components, the purchasing managers increase climbed from a significant contraction in May (at 43.1) to expansion mode in June (52.6). That is largest single-month increase since August 1980 and the highest reading for this index since May of last year.

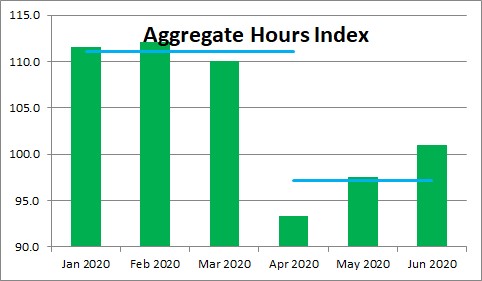

One way of putting all of this together is to look at aggregate hours worked in the economy. If we know how many people are working and how long they worked, we can get a sense for how many goods and services they produced. The Bureau of Labor series publishes an index of aggregate hours worked as part of the employment report. It is a gauge of the supply side of the economy. We now have data available through June and can calculate the average level of the index for both the first and second quarters. The annualized rate of decline between the two quarters is 50.3% which just happens to be our estimated rate of GDP contraction in the second quarter. The demand side data – consumer spending, housing, investment spending, etc. confirm a decline of roughly that magnitude.

We have made estimates of employment and hours worked for July, August, and September and the third quarter average appears to be 35% higher than the second quarter average. We will monitor this average as data become available during the summer months.

As noted earlier, the recession was not caused by the corona virus but by the government’s response to the virus which resulted in a record-breaking drop in economic activity. Similarly, the record-breaking rebound in May and June was triggered by $2.5 trillion of fiscal stimulus. The U.S. economy has never experienced such dramatic swings in economic activity in a matter of months. As the economy re-opens, the indomitable spirit of American citizens has reasserted itself. Growth will continue to climb and those currently without jobs will be steadily rehired. While GDP may reach its pre-recession high by early next year, it will take longer for the unemployment rate — currently at 11.1% — to shrink to its pre-recession low of 3.5%. That is unlikely to occur until 2022.

There is no doubt that the number of new corona virus cases has accelerated in the past couple of weeks. As a result, some states have paused the pace of reopening and six states – California, Arizona, Colorado, Texas, Florida, and Michigan – have partially reversed reopening. But the situation today is completely unlike what it was in mid-April when the virus was at its peak. Today 37,000 people are hospitalized; in mid-April that figure was 59,000. The number of people in ICU’s has dropped from 15,000 to 5,600. The number daily deaths has shrunk from 2,500 to 650. By almost any metric the situation has improved considerably. There is no case for the re-imposition of a nationwide stay-at-home order. Even if warranted, President Trump will not do it. To initiate another economic collapse right before the election is not going to happen.

Clearly, there will be some hospitals in a few cities that will get jammed to capacity, but do not let the press delude you into thinking this is a nationwide problem. And do not let the press scare you into worrying about a possible re-imposition of the nationwide shutdown. That is not going to happen.

The recession is over. The economy is rebounding and will continue to grow.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me