June 7, 2010

May’s increase in private sector employment of 178 thousand was higher than expected and alleviates any fear that the economy may be slipping into a second quarter slump. However, it prolongs the debate about when the Fed will begin to taper off its purchases of long-dated Treasuries and mortgages. It is not sufficiently large to say they will have to begin soon. But it is also not small enough to conclude that they have the luxury of waiting until the end of the year – or beyond. Whenever the Fed chooses to make that announcement it will be a major negative for both the stock market and the bond market. Even now the Treasury bond market and the mortgage market have taken notice and rates are moving higher in anticipation of that action

As it stands currently the economy registered 2.4% GDP growth in the first quarter and we expect 2.5% growth in the second. Both rates are higher than the anemic 1.7% pace recorded during 2012. Keep in mind that the economy expanded at a moderate pace early this year despite the 2% increase in the Social Security tax at the beginning of the year, and the government sequester of funds that kicked in at the end of March. Now that the impact of those negative factors has largely run its course, we anticipate GDP growth in the second half of the year to quicken to 2.9% and 3.2% in 2014.

As growth accelerates and as we routinely see monthly employment gains of 200 thousand per month the Fed will , at some point, taper off its current pace of $85 billion of securities being purchased every month. It will no longer need to add reserves to the banking system at such a vigorous pace. While the exactly timing of that change in policy remains unknown, as does the speed with which they will moderate their purchases the markets know the change is coming – when, not if — and they have reacted accordingly.

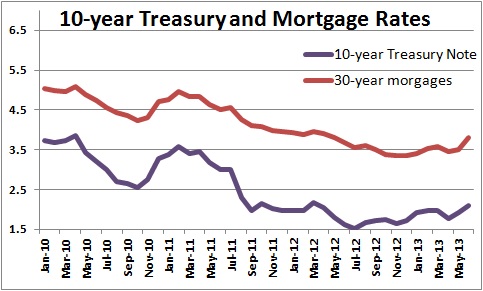

After reaching a low of 1.7% last year the yield on the 10-year note has backed up to 2.1%. Mortgage rates have risen from a low of 3.4% to about 3.8%. The moves are not dramatic, but they are pronounced. For the first time in six years the Fed will no longer be the friend of the markets to ensure that the stock market climbs steadily higher, and that long-term interest rates stay low. Our suggestion is that you have any borrowing need, now would be a good time to do it.

Make no mistake, the Fed is not trying to slow the pace of economic activity. Over the course of the past several years it has provided $1.7 trillion of surplus reserves to the banking system which are sitting around unused. That represents the supply of funds available to the banking system to lend, if you and I ever decide to borrow and, simultaneously, the banks decide to lend. The danger is that those surplus reserves could fuel a spending spree the likes of which we have never seen before and inflation would return with a vengeance. That is obviously not a sustainable situation. The Fed needs to gradually reduce the volume of excess reserves, first by slowing its pace of purchases, and eventually by actually selling securities. In that sense the upcoming action by the Fed should be viewed as a good thing and not something to be feared. It is a necessary first step in returning the markets to normalcy.

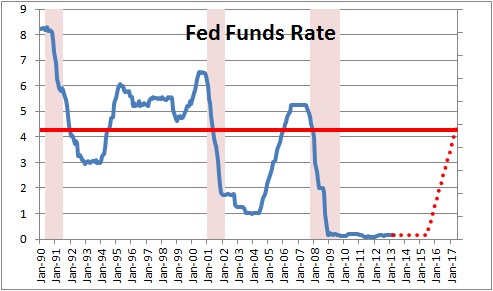

The more traditional type of Fed tightening will come when they begin raise the funds rate from its current level of 0.0% to a more neutral rate of about 4.25%. The Fed has given us some hint when that might occur. It said that it first wanted to see the unemployment rate decline to 6.5%. That is unlikely to occur until roughly early 2015. Furthermore, it will raise the funds rate slowly. It could take an additional two years—or until 2017 — for it to get back to the 4.25% level.

So, yes, the Fed is likely to make its first shift towards a less accommodative policy stance later this year. That is different from what it has been since the end of 2008. But the economy is not teetering on the brink of a depression like it was following the demise of Lehman Brothers. It is growing steadily, creating a reasonable number of new jobs, the housing sector is recovering quickly, the stock market is at a record high level, and consumers and business people are brimming with confidence. The economy no longer needs to remain on life support.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me